YES NO. When determining market value for this answer, take into account land, buildings, machinery, equipment, and inventory. Niche No Essay Scholarship.

Quick Links

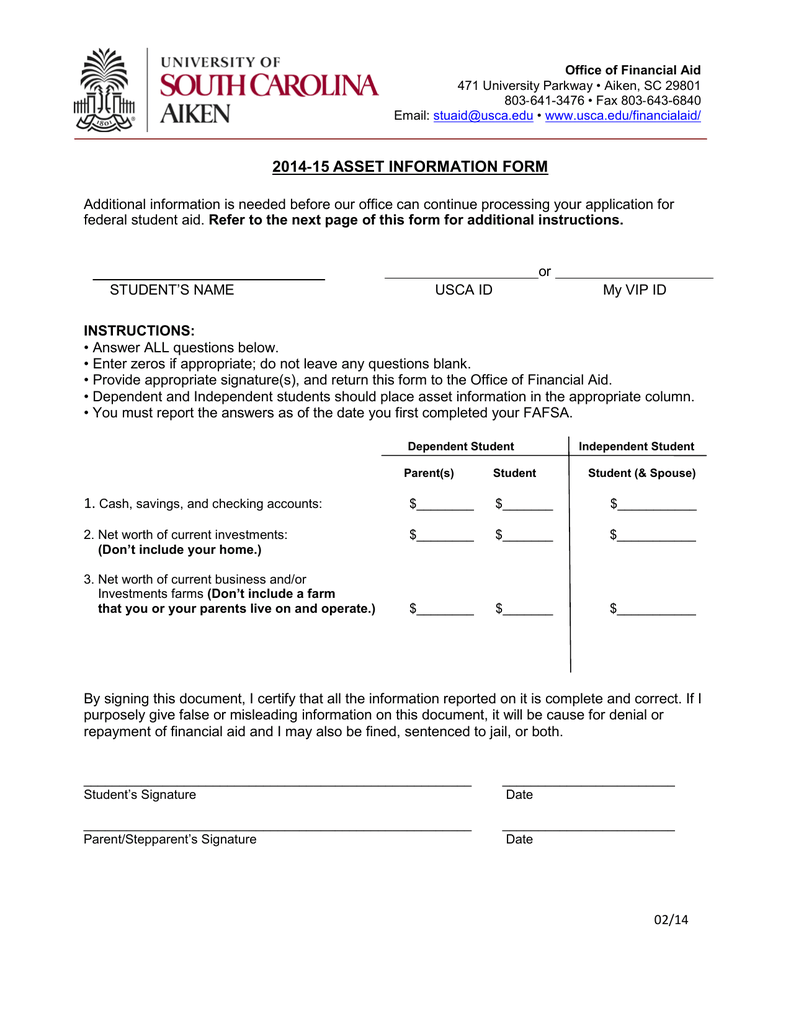

We have changed the way we log in on College Confidential. Read more. The question is: What is your parents’ net worth of current investments? I have no investments but I am not sure if my parents. They have retirement k and I know that shouldn’t counted for this question. But my parents currently live in a 2-family house that they .

Join the Discussion

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to

2019 — 20 FAFSA — Full Walkthrough

Parents’ Net Worth of Current Investments

Investments also include qualified educational benefits or education savings accounts such as Coverdell savings accounts, college savings plans and the refund value of prepaid tuition plans. Investment debt means only those debts that are related to the investments. The third asset question asks for the net worth of businesses and investment farms. Join today to get matched to scholarships or internships for you! Any remaining assets are assessed according to a bracketed ndt with a top bracket of 5. Investments include real estate do not include the home in which your parents liverental property includes a unit within a family home that has fagsa own entrance, kitchen, and bath rented to someone other than a family membertrust funds, UGMA and UTMA accounts, money market funds, mutual funds, certificates of deposit, stocks, stock options, bonds, other securities, installment and land sale contracts including mortgages heldcommodities. If your parents own multiple investments, total the net worth amounts and report them as a lump sum. Highlights include the launch of a chat bot to answer questions from student borrowers, the consolidation of several Federal Student Aid websites, a new Informed Borrower Tool, an offering of income-share agreements, and a new Loan Simulator. For example: Your parents own two investment properties. Investments do not include the home in which your parents live; cash, savings and checking accounts; the value wogth life insurance and retirement plans [k] plans, pension funds, annuities, noneducation IRAs, Keogh plans. When determining market value for this answer, take into account land, buildings, machinery, equipment, and inventory. The first asset question asks for the total current value of cash, savings accounts, and checking accounts. Remember that net worth equals current value minus debt.

Comments

Post a Comment