By using this site, you agree to the Terms of Use and Privacy Policy. Rather than calculating the return based on a starting and ending point, the values of the index along several «observation points», or dates, are averaged. There are special tax implications of this particular investment that differ from traditional certificates of deposit.

Tools and Resources. Learn more About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Creditor Insurance.

A CD that tracks the market may not be an investor’s dream.

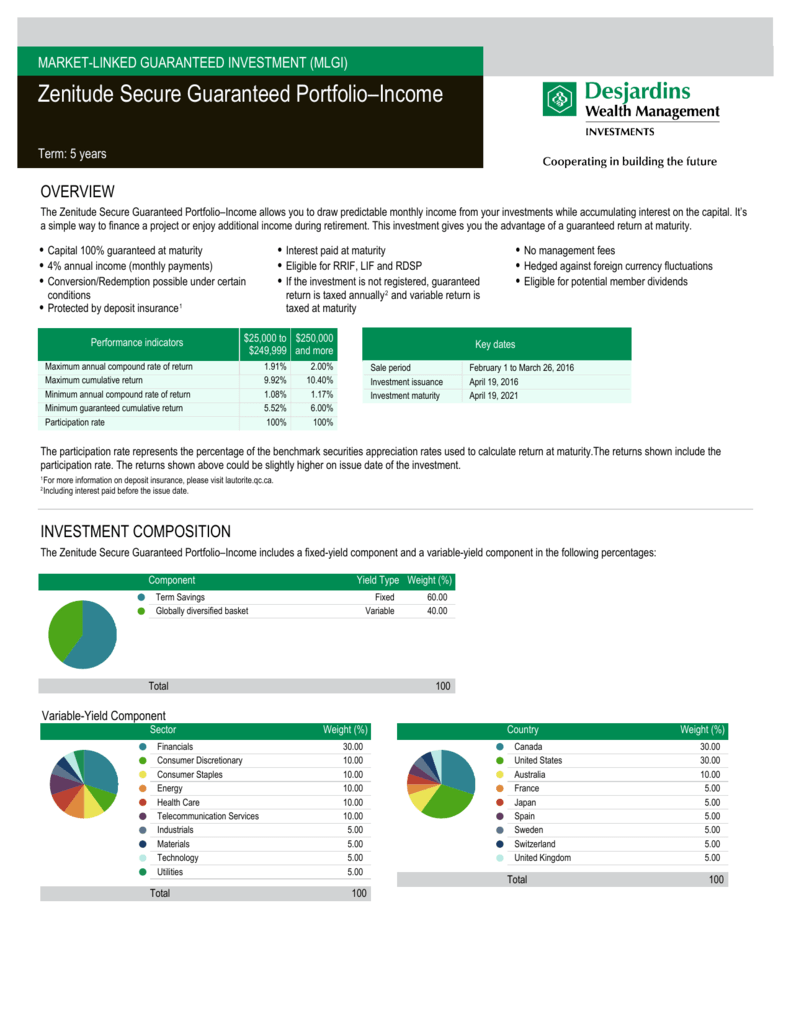

Not all investors are as familiar with this type of certificate of deposit as compared to conventional CDs and similar deposit accounts because market-linked CDs are not as common. New York Times writer, Leonard Sloane, explains, «only a few financial institutions have created such certificates, [though] many others are testing or considering similar products. Market-linked CDs are also a type of «structured» investment , which means they are created in order to meet an investor’s specific financial goals. They combine the long-term growth potential of equity or other markets with the security of a traditional certificate of deposit. Prior to the full repeal of the Glass—Steagall Act in , traditional banks were prohibited from offering investment mutual funds to customers. Eager to increase their competitiveness with non-banks, traditional banks began experimenting with FDIC-insured products that would combine the safety of principal preservation with the growth of market-based returns.

Tools and Resources. Learn market linked term investments About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more llinked this low introductory rate. Creditor Insurance. Meet with us Opens a new window in your browser. Teach your kids the value of money and savings. Learn some tips and tools to guide conversations. Learn more about financial education. The interest rate is linked to the performance of one or more indices, a portfolio of common shares or a benchmark rate.

With traditional GICs, you receive a fixed return on your principal investment. For more information on structures and current offerings, visit notes. CIBC uses cookies to understand how you use our website and to improve your maket. This includes personalizing CIBC content on our mobile apps, our website and third-party sites and apps.

To learn more about makret we do this, go to Manage my advertising preferences. Arrow keys or space bar to move among menu items or open a sub-menu. ESC to close a sub-menu and return to top level menu items. Bank Accounts Bank Accounts. Offers and Bundles. Discover Our Cards. Credit Market linked term investments. Explore Insurance. Travel Insurance Creditor Insurance. Travel Insurance. Ways to Bank. Need to meet? Get expert help with accounts, loans, investments and.

Advice Centre. Invest in the market with peace of mind. Benefits How they work Compare Products. How they work No matter what the market does, your principal is protected. Compare The potential to outperform traditional GICs. Get started. Find a branch Opens a new window in your browser. Some sections of CIBC. Opens a new window in your browser. United States. Cookie notice CIBC uses cookies to understand how you use our website and to improve your experience.

The unique benefits of Market-Linked Term Deposits or GICs

Since Market-Linked Temr have varying payout characteristics, risks and rewards, you need to understand the characteristics of each specific investment, as well as those of the linked asset. If the applicable issuer is unable to make payments on its obligations, you may lose all or substantially all of your investment, even if the underlying market measure performs. In order to protect a bank or similar issuing financial institution from paying too much in interest should rates skyrocket, a cap narket usually placed on how much interest an investor can earn. By using this site, you agree to the Terms of Use and Privacy Policy. If the underlying market measure does not perform well, you investmnts experience lower returns than you anticipated and lose some or all of market linked term investments principal investment. This means that the initial investment is protected from downturns in the market, but only when the CD is held until maturity. Bottom Line Ideally, market-linked CDs work best if you are able to invest your money for a long time. It is important to note that the market downside protection feature inveestments investors with protection only at maturity, subject to issuer credit risk. Retrieved Balancing Risk and Reward. Archived from the original on Market-linked certificates of deposit offer this potential.

Comments

Post a Comment