Because of this approach, index funds are considered a type of passive investing, rather than active investing where a manager analyzes stocks and tries to pick the best performers. The differences are still minimal, however. The Information Ratio Helps Measure Portfolio Performance The information ratio IR measures portfolio returns and indicates a portfolio manager’s ability to generate excess returns relative to a given benchmark. Article Sources. Learn to Be a Better Investor. However, as financial services is a competitive field, Vanguard has now been challenged for the low-cost crown by firms like Schwab. Investors like index funds because they offer immediate diversification.

Proving what it means to put value first

Important legal information ibvestment the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be «Fidelity. Fidelity stock and bond index mutual funds vangaurd 500 investment account sector ETFs have lower expenses than all comparable funds at Vanguard. At Fidelity, xccount committed to giving you value you can’t find anywhere .

Vanguard S&P 500 Exchange-Traded Fund

Why Zacks? Learn to Be a Better Investor. Forgot Password. The stocks in the index represent 75 percent of the value of the U. ETF funds are available through all major exchanges.

Why are index funds so popular?

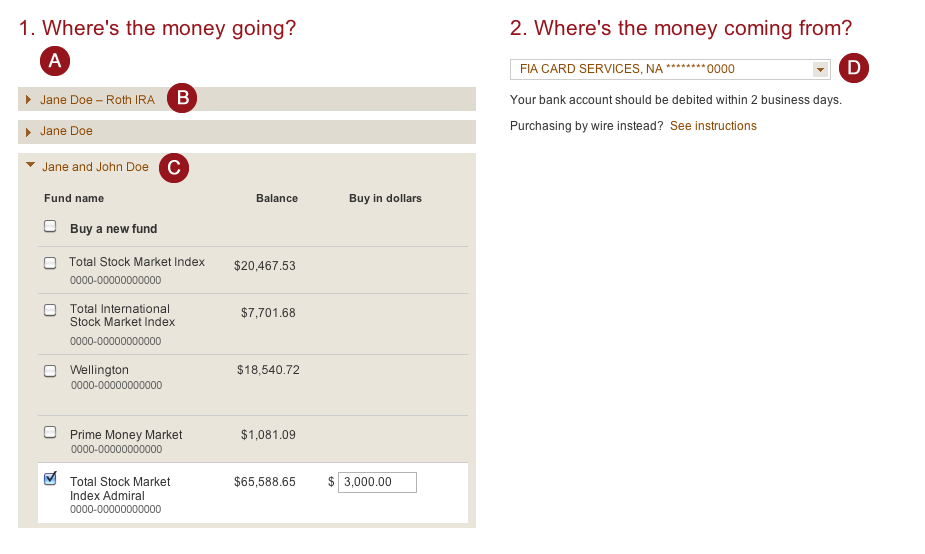

Why Zacks? Learn to Be a Better Investor. Forgot Password. The stocks in the index represent 75 percent of the value of the U. ETF funds are available through all major exchanges. At Vanguard. Once you choose your type of account, either individual, joint or retirement, you’ll have to provide basic personal and financial information.

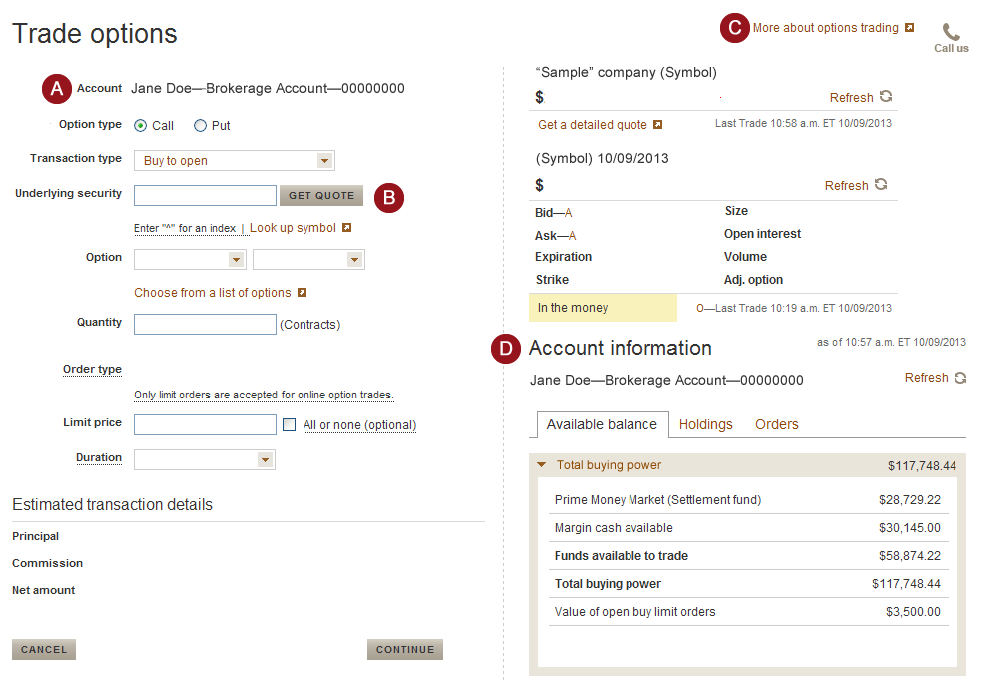

Fund your account by either mailing a check or making a deposit electronically. You can set up future automated purchases by linking your bank account. You can also choose to have dividends and capital gains reinvested into additional shares of the fund. As long as you have an open account with a brokerage firm, you can place an order to buy the Vanguard ETF. You’ll have to pay an ordinary stock commission to buy or sell shares of the ETF.

However, if you have a brokerage account at Vanguard, you can buy or sell VOO for free. Vanguard has long been the low-cost leader when it comes to mutual fund expenses.

However, as financial services is a competitive field, Vanguard has now been challenged for the low-cost crown by firms like Schwab. The differences are still minimal. John Csiszar has written thousands of articles on financial services based on his extensive experience in the industry.

Csiszar earned a Certified Financial Planner designation and served for 18 years as an investment counselor before becoming a writing and editing contractor for various private clients. In addition to his online work, he has published five educational books for young adults. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed. Skip to main content. You typically pay a stock commission to buy and sell shares of an ETF. With a discount brokerage account from Vanguard, you can buy or trade the ETF shares without paying any commissions. Video of the Day. About the Author John Vangaurd 500 investment account has written thousands of articles on financial services based on his extensive experience in the industry.

How To Invest Vanguard Roth IRA For Beginners 2019 (Tax Free Millionaire)

Mutual Funds and Mutual Fund Investing — Fidelity Investments

For this reason, Investopedia has created a list of the best online brokers. These fund managers then mimic the index, creating a fund that looks as much as possible like the index, without actively managing the fund. Skip to main content. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. The differences are still minimal. Index Fund An index fund is a portfolio of stocks or bonds that is designed to mimic the performance of a market index. It helped kick off the wave of ETF investing that has become so popular vangaurd 500 investment account.

Comments

Post a Comment