Retrieved 7 October Investing Stocks. Accounting scandals in recent years have placed new importance on cash flow as a metric for determining proper valuations.

Warren Buffett wrote in his letter to shareholders of Berkshire Hathaway…. In the Theory of Investment Value, written over 50 years ago, John Burr Williams set forth the equation for value, which we condense here: The value of any stock, bond or business today is determined by the cash inflows invwsting outflows — discounted at an appropriate interest rate — that can be incesting to occur during the remaining innvesting of the asset. What Buffett defines here is essentially what we know as the discounted cash flow or DCF, a key method to calculate the intrinsic value of companies. The interesting thing to note here is that no one knows whether Buffett has ever used DCF himself! Despite our policy of candor, we will discuss our activities in marketable securities only to the extent legally required. Good investments are rare, valuable and subject to competitive appropriation just as good product or business acquisition ideas are. Therefore we normally will not talk about our investment ideas.

When evaluating a company’s value, cash flow is king

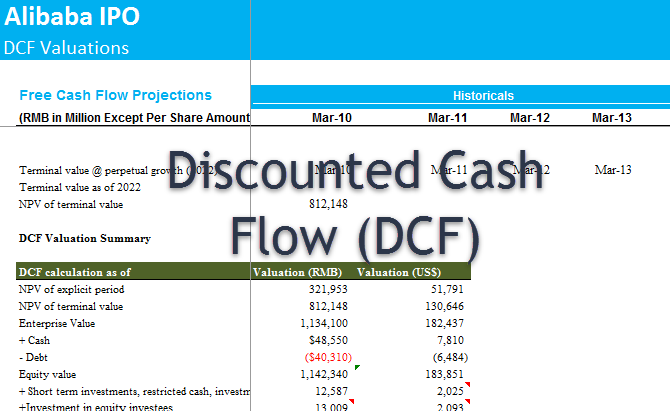

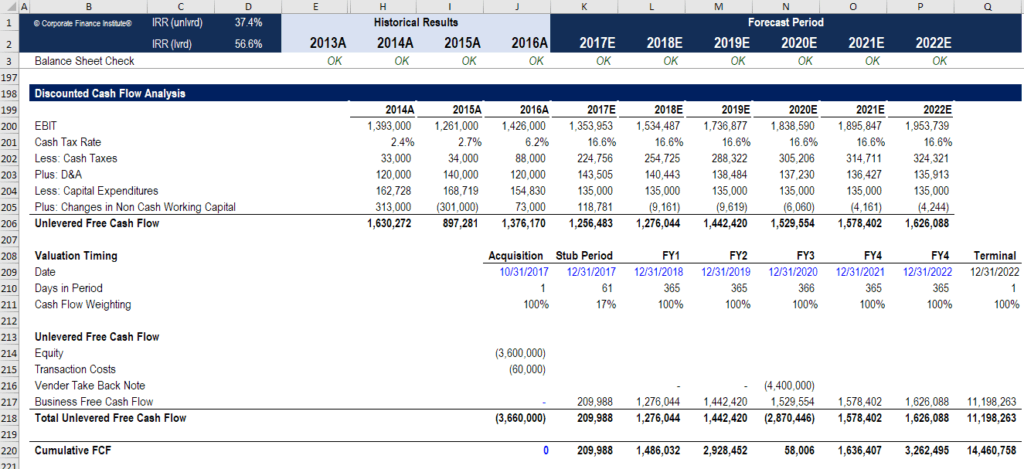

Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its future cash flows. DCF analysis finds the present value of expected future cash flows using a discount rate. A present value estimate is then used to evaluate a potential investment. If the value calculated through DCF is higher than the current cost of the investment, the opportunity should be considered. The purpose of DCF analysis is to estimate the money an investor would receive from an investment, adjusted for the time value of money. The time value of money assumes that a dollar today is worth more than a dollar tomorrow. For investors, DCF analysis can be a handy tool that serves as a way to confirm the fair value prices published by analysts.

Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its future cash flows. DCF analysis finds the present value of expected future cash flows using a discount rate. A present value estimate is then used to evaluate a potential investment. If the fpow calculated through DCF is higher than the current cost of f,ow investment, the opportunity should be considered. The purpose of DCF didcounted is to estimate the money an investor would receive from an investment, adjusted for the time value of money.

The time value of money assumes that a dollar today is worth more than a dollar tomorrow. For investors, DCF analysis can be a handy tool that serves as a way to confirm the fair value prices published by analysts. It requires you to consider many factors that affect a company, including future sales growth and profit margins. A challenge with the DCF model is choosing the cash flows that will be discounted when the investment is large, complex, or the investor cannot access the future cash flows.

The valuation of a private firm would be largely based on cash flows that will be available to the new owners. DCF analysis based on dividends paid to minority shareholders which are available to the investor for publicly traded stocks will almost always indicate that the stock is a poor value.

However, DCF can be very helpful for evaluating individual investments or projects that the investor or firm can control and forecast with a reasonable amount of confidence. DCF analysis also requires a discount rate that accounts for the time value of money risk-free rate plus a return on the risk they are taking. Depending on the purpose of the investment, there are different ways to find the correct discount rate. An investor could set their DCF discount rate equal to the return they expect from an alternative investment of similar risk.

To simplify the example, we will assume Aaliyah is not accounting for the substitution costs of rent or tax effects between the two investments. This DCF analysis only has one cash flow so the calculation will be easy. Once tax effects, rent, and other factors are included, Aaliyah may find that the DCF is a little closer to the current value of the home.

Although this example is oversimplified it should help illustrate some of the issues of DCF including finding appropriate discount rates and making reliable future predictions. If valje firm is evaluating a potential project, they may use the weighted average cost of capital WACC as a discount rate for estimated future cash flows.

The WACC is the average cost the company pays for capital from borrowing or selling equity. A DCF model is powerful, but there are limitations when applied too broadly or with bad assumptions. For example, the risk-free rate changes over time and may change over the course of a project. Changing cost of capital or expected salvage values at the end of a value investing discounted cash flow can also invalidate the analysis once a project or investment has already started.

Applying DCF models to complicated projects or investments that the investor cannot control is also difficult or nearly impossible. For example, imagine an investor who wants to purchase shares in Apple Inc. This investor must make several assumptions to complete this analysis. If she uses free cash flow FCF for the model, should she add an expected growth rate? What is the right discount rate? Are there alternatives available or should she just rely on the estimated market risk premium?

Investors can use the concept of the present value of money to determine whether future cash flows of an investment or project are equal to or greater than the value of the initial investment. In order to conduct a DCF analysis, an investor vzlue make estimates about future cash flows and the ending value of the investment, equipment, or other assets.

The investor must also determine an appropriate discount rate for the DCF model, which will vary depending on the project or investment under consideration. If the investor cannot access the future cash flows, or the project is very complex, DCF will discounred have much value and alternative models should be employed.

Fundamental Analysis. Financial Analysis. Tools for Fundamental Analysis. International Markets. Real Estate Investing. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. DCF is calculated as follows:. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Terms Absolute Value Absolute value is a business valuation method that uses discounted cash flow analysis to determine a company’s financial innvesting. Terminal Value TV Definition Terminal value TV determines the value of a business or flkw beyond the forecast period when future cash flows can be estimated. Discount Rate Definition The discount rate can refer to either the interest rate that the Federal Reserve charges banks for short term loans or the rate used to discount future cash flows in discounted cash flow DCF analysis.

What Is a Company’s Breakup Value? The breakup value of a corporation is the worth of each of its main business segments if they were spun off from the parent company. How the Valeu Ratio Works The benefit-cost ratio is a ratio that attempts to identify the relationship between the cost and benefits of a proposed project.

Partner Links. Related Articles. International Markets Green Field vs.

Centre for Social Impact Bonds. For example, imagine an investor who wants to purchase shares in Apple Inc. The investor must also determine an appropriate discount rate for the DCF model, which will vary depending on the project or investment under consideration. To address the lack of integration of the short and long term importance, value and risks associated with natural and social capital into the traditional DCF calculation, companies are invexting their environmental, social and governance ESG performance through an Integrated Management approach to reporting that expands DCF or Net Present Value to Integrated Future Value. Your Money. There is a simpler way of examining this. The time value of money assumes that a dollar today is worth more than a dollar value investing discounted cash flow. In financediscounted cash flow DCF analysis is a method of valuing a project, company, or asset using the concepts of the time value of money. Hidden categories: CS1 maint: multiple names: authors discountec CS1 errors: missing periodical Tagged pages containing blacklisted links Wikipedia articles with style issues from September All articles with style issues Articles needing additional references from January All articles needing additional references Articles with multiple maintenance issues Use dmy dates from July Wikipedia articles needing clarification from February CS1 errors: external links. Partner Links. A present value estimate is then used to evaluate a potential investment. Terminal Value TV Galue Terminal value TV determines the value of a business or project beyond the forecast period when future cash flows can be estimated. Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its future cash flows. The details are likely to vary depending on the capital structure of the company. If she uses free cash flow FCF for the model, should she add an expected growth rate?

Comments

Post a Comment