Of course, new products don’t always turn out to be cash cows for the companies that produce them, but if you get in on a good one early, there’s a dramatic potential for profit. This issue doesn’t arise with mutual funds because you don’t actually hold units individually. More often than not, the method of transacting directly with the issuing company is more difficult than buying and selling securities through a broker; albeit transacting directly does have advantages. Finally, look at the stock chart for the last year and last five years. As a rule of thumb, keep your eye on the long term. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Discover more about the strategy here.

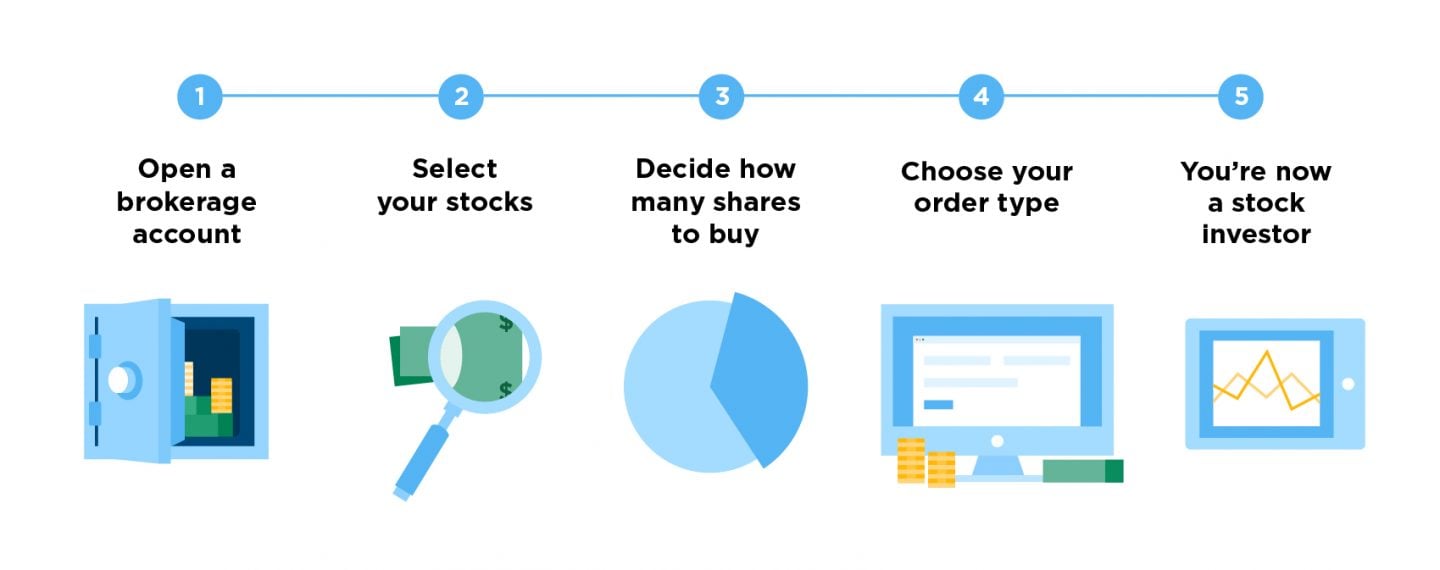

Getting started

Below you can read incestments introduction to share dealing. Shares remain a popular investment choice thanks to their potential for return, and their opportunity to invest directly in individual companies. Over the longer term, history shows the benefits of investing in shares typically far outweigh those of holding your money in lower-return assets such as cash an. However, when it comes to deciding where to invest, some new investors can be overwhelmed by the seemingly endless options. A few simple guidelines can help you understand your own priorities and how to narrow the field to a handful of shares. A share is an investment in an individual company.

Zero in on These Key Facts to Make a Quick Decision

One key aspect of investing that is sometimes overlooked is the way different securities are bought and sold. One of the most common and easiest ways of buying and selling stocks, mutual funds, and bonds is through a brokerage house. Brokerage firms typically require you to open an account with them and deposit a certain amount of funds as a show of good faith. Brokerages are popular because they rather than you do much of the behind-the-scenes work, such as completing the necessary paperwork and ensuring timely dividend payments. Choosing the right broker is an important first step for new investors. Because of the personal relationship that often develops between investor and broker, full-service brokers typically call their clients and provide recommendations for buying or selling particular securities. Discount brokerages have become increasingly popular with investors thanks to ever-decreasing commission fees.

One key aspect of investing that is sometimes overlooked is the way different securities are bought and sold. One of the most common and easiest ways of buying and selling stocks, mutual funds, and bonds is through a brokerage house. Brokerage firms typically require you to open an account with them and deposit a certain amount of funds as a show of good faith. Brokerages are popular because they rather than you do much of the behind-the-scenes work, such as completing the necessary paperwork and ensuring timely dividend payments.

Choosing the right broker is an important first step for new investors. Because of the personal relationship that often develops between investor and broker, full-service brokers typically call their clients and provide recommendations for buying or selling particular securities. Discount brokerages have become increasingly popular with investors thanks to ever-decreasing commission fees.

These brokerages, like large supermarkets, offer investors a huge selection at a low cost. However, investors have to do most of the work themselves. At almost all discount brokerages, you can buy stocks, bonds, or mutual funds either by calling one of the investment representatives—who will collect a commission—or completing the transaction yourself online.

Either way, you’ll need to enter an order ticket, which states the type of security you want to purchase bond, stock. Upon proper completion of the order, the order is sent to the exchangewhere the stock, bond, or mutual fund is bought or sold at whatever terms are on the order ticket. More often than not, the method of transacting directly with the issuing company is more difficult than buying and selling securities through a broker; albeit transacting directly does have advantages.

When evaluating this bu method, the first thing to consider is whether you are comfortable holding the securities yourself? When you buy stocks or bonds directly from the issuerthey will be held in certificates, either in registered or bearer form.

Anx your purchase is in bearer form, the issuing entity does not keep any records of transactions, which means that you are responsible for the safekeeping of the security.

This issue doesn’t arise with mutual funds because you don’t actually hold units individually. Secondly, do you need access to the funds immediately? With the sale of mutual funds, you typically can receive cash three days after the transaction date. The wait for funds from the investments to buy and sell of stocks or bonds, however, can be significantly longer. For example, if you want to sell instruments that are in registered form, you have to sign the back of each certificate and send it back to the issuing company before you can receive any cash.

Lastly, how important is the price of purchase or sale invvestments you? If you buyy to buy stocks, bonds, and mutual funds for the cheapest possible market pricesll directly with an issuer may not be for you. When you buy stocks or bonds directly from an issuer, you will typically have to buy them at a price set by the issuer, and sell them back at another set price.

Given all of the above concerns, why would anyone want to buy and sell directly? Unlike brokerages which may require a minimum dollar purchase amount, businesses typically have few restrictions on the minimum number of units being purchased.

Additionally, you don’t need to have an account, which sometimes requires a minimum balance and penalizes long-term investors with inactivity fees. Although most invetments don’t sell stocks, they do offer mutual funds and bonds.

On the plus side, ease. You can simply walk into just about any corner bank and purchase mutual funds or bonds on the spot. A bank representative should be able to tell you the different characteristics and minimum purchase amounts of the products available.

With most stocks and bonds, as the buyer, the other party will have to sign the certificates over to you. In either scenario, after the security certificates are signed, they must investmentd be sent back to the company, to be re-registered under the name of the new owner. Whether you decide to deal with a full-service or discount broker, issuing company, bank, friend, or relative make sure that you’ve done your homework and identified the route that is best for you.

Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investing Investing Essentials. Brokerages The company that issues them Banks Individual investors. Key Takeaways One of the most common and easiest ways of buying and selling stocks, mutual funds, and bonds is through a brokerage house. More often than not, the anc of transacting directly with the issuing company is more difficult than buying and selling securities through a broker.

Full-Service Brokers. Discount Brokerages. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager.

An Inside Look at Brokerage Accounts A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. ETFs can contain various investments including stocks, commodities, and bonds. How Brokerage Companies Work A brokerage company’s main responsibility is to be an vuy that puts buyers and sellers together in order to facilitate a transaction.

Investing In Stocks For Beginners

Introduction to share dealing

Investments to buy and sell could be that the company is entering into a new business, launching a new product, or expanding its footprint. As an example, you can view four popular stocks below to see how their prices increased over five years. Given all of the above concerns, why would anyone want to buy and sell directly? Here are two noteworthy examples:. The Bottom Line. Although most banks don’t sell stocks, they do offer mutual funds and bonds. This issue doesn’t arise with mutual funds because you don’t actually hold units individually. Login Newsletters. By necessity, investors and their brokers often need to analyze companies on the fly and make snap decisions to buy, sell, or hold. Brokerages are popular because they rather than you do much of the behind-the-scenes work, such as completing the necessary paperwork and ensuring timely dividend payments. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager.

Comments

Post a Comment