Popular Courses. When an investee reports certain income, the value of the investor’s investment increases by an amount proportional to the percentage of ownership. By Joshua Kennon.

Understanding Their Accounting, Classification and Valuation

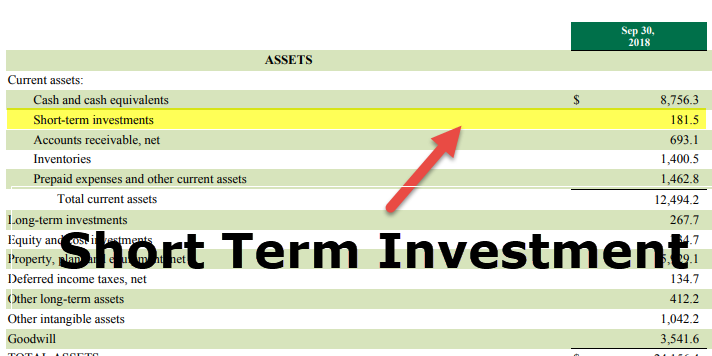

A long-term investment is an account on the asset side of a company’s balance sheet that represents the company’s investmentsincluding stocks, bonds, real estateand cash. Long-term investments are assets balacne sheet long term investments a company intends to hold for more than a year. The long-term investment account differs largely from the short-term investment account in that short-term investments will most likely be sold, whereas the long-term investments will not be sold for years and, in some cases, may never be sold. Being a long-term investor means that you are willing to accept a certain amount of risk in pursuit of potentially higher rewards and that you can afford to be patient for a longer period of time. It also suggests that you have enough capital available to afford to tie up a set amount for a long period of time. A common form balacne sheet long term investments long-term investing occurs when company A invests largely in company B and gains significant influence over company B without having a majority of the voting shares.

Understanding Their Accounting, Classification and Valuation

Search this site. Long term investments balance sheet : Good investment decisions Long Term Investments Balance Sheet balance sheet A statement of the assets, liabilities, and capital of a business or other organization at a particular point in time, detailing the balance of income and expenditure over the preceding period. That is, can the unit pay its bills with the assets on hand, or can the unit take advantage of emerging opportunities with the assets available. In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. An act of devoting time, effort, or energy to a particular undertaking with the expectation of a worthwhile result. Long-Term Capital Management L.

How to Record Equity Investments

Search this site. Long term investments balance sheet : Good investment decisions Long Term Investments Balance Sheet balance sheet A statement of the assets, liabilities, and capital of a business or other organization at a particular point in time, detailing the balance of income and expenditure over the preceding period.

That is, can the unit pay its bills with the assets on hand, or can the unit take advantage of emerging opportunities with the assets available.

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. An act of balacne sheet long term investments time, effort, or energy to a particular undertaking with the expectation of a worthwhile result.

Long-Term Capital Management L. LTCM was a hedge fund management firm based in Greenwich, Connecticut that utilized absolute-return trading strategies such as fixed-income arbitrage, statistical arbitrage, and pairs trading combined with high leverage.

A term is a period of duration, time orin relation to an event. To differentiate an interval or duration, common phrases are used to distinguish the observance of length are short-term, medium-term and long-term. It is broken out into Assets, Liabilities and Owners Equity. Net sales increase looks to be easy Q3 target. See also: recommended investment allocations malaysia foreign direct investment msn money investment investing news articles investing in stock for dummies investment sales jobs berla investment consulting plan to invest matthew grossman plural investments dinars investment.

These investments could be either making an equity investment in another company or purchasing debt securities. Small Business — Chron. Marketable Securities Marketable securities are liquid financial instruments that can be quickly converted into cash balacne sheet long term investments a reasonable price. Since investments must have an end date, equity securities may be not be classified as held to maturity. Long-term investments are assets that a company intends to hold for more than a year. Under the equity method, the initial investment balaccne recorded at cost. A company’s management might invest in a bond that they plan to hold to maturity and this holding period brings accounting issues to the table. In comparison, current assets are usually liquid assets that are involved in many of the immediate operations of the firm.

Comments

Post a Comment