The cost of solar is dropping across the nation. All Rights Reserved. Note that this guidance applies to residential and commercial solar projects differently. Both commercial and residential proposals are allowable under the tax code. Find out what solar costs in your area in Although the ITC itself is simply to explain, every taxpayer has a slightly different tax liability.

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. Many systems refer to taxes paid indirectly, such as taxes inderstanding by payers of income, as credits rather than prepayments. In such cases, the tax credit is invariably refundable. The most common forms of such amounts are payroll withholding of income understanding federal investment tax credit or PAYEwithholding of tax at source on payments to nonresidents, and understandinb credits for value added tax. Income tax systems often grant a variety of credits to individuals. These typically include credits available to all taxpayers as well as tax credits unique to individuals.

The history of the solar investment tax credit

In fact, many wealth management experts recommend diverting a third or more of one’s stock allocation into foreign enterprises to create a more efficient portfolio. When Americans buy stocks or bonds from a company based overseas, any investment income interest, dividends and capital gains are subject to U. If this double taxation sounds draconian, take heart. The U. Every country has its own tax laws, and they can vary dramatically from one government to the next.

Search form

In fact, many wealth management experts recommend diverting a third or more of one’s stock allocation into foreign enterprises to create a more efficient portfolio.

When Americans buy stocks or bonds from a company based overseas, any investment income interest, dividends and capital gains are subject to U. If this double taxation sounds draconian, take heart. The U. Every undderstanding has its own tax laws, and they can vary dramatically from one government to the. Many countries have no capital gains tax at all or waive it for foreign investors.

But plenty. The understansing treatment of dividend and interest income runs the gamut as. Box 6 will show how much of your earnings were withheld by a foreign government.

The official IRS website offers a basic description of the foreign tax credit. A deduction, while simpler to calculate, offers a reduced benefit. If the tax you paid to the foreign government is higher than your U. If the tax you paid to the foreign government is lower than your tax liability in the U.

Now imagine just the opposite. When your taxes abroad are higher, you can only claim the U. You can skip the Form and report the entire amount paid as a credit on your Form In order to qualify for this de minimus exemptionthe foreign income earned on the taxes paid must be qualified passive income. Any investor who must pay taxes to a foreign government on investment income realized from a foreign source may be eligible to recoup some or all of the tax paid via this credit. But he or she must have paid tzx income taxes, excess profit taxes or other similar taxes.

More specifically, they include:. The credit is disallowed for nonresident aliens, unless they were residents of Puerto Rico for a full taxable year or were engaged in a U. Citizens living in a U. Finally, no credit is available for investment income realized from any source within a country that has been designated as harboring terrorist activities IRS Publication provides a list of these countries.

Given the difficulty of researching foreign securities and the desire for diversification, mutual funds are a common way to gain exposure to global markets. But U.

If a foreign-based mutual fund or partnership has at least one U. But overall, such investments are at a significant disadvantage to U. For example, current distributions from a PFIC are generally treated as ordinary incomewhich is taxed at a higher rate than l ong-term capital gains. In a lot of cases, American investors, including those living abroad, are better off sticking with investment firms based on U.

For the most part, the foreign tax credit protects American undwrstanding from having to pay investment-related taxes twice. Just watch out for foreign-based mutual fund companiesfor which the tax code can be much less forgiving. Retirement Savings Accounts. Mutual Funds. Your Money.

Personal Finance. Your Practice. Popular Courses. Login Newsletters. Key Takeaways When Americans buy stocks or bonds from foreign-based companies, any investment income interest, dividends and capital gains are subject to U. Example 1. Example 2. Taxes that resemble U. Compare Investment Accounts. The offers that understandin in this table are from partnerships from which Investopedia receives compensation. Related Articles.

Tax Deductions on Foreign Real Estate. Partner Links. Related Terms Foreign Tax Deduction Definition The foreign tax deduction is a deduction that may be taken for taxes paid to a foreign government, and are typically classified as withholding tax. Understanding federal investment tax credit is a Foreign Tax Credit? The foreign tax credit is a non-refundable tax credit for income taxes paid to a foreign government as a result of foreign income tax withholdings.

Tax Haven A tax haven is a country that offers foreigners little or no tax liability in understancing politically and crefit stable environment. The foreign earned income exclusion excludes income earned and taxed in a foreign country from the U.

S taxable income of American expats. What Is an Expatriate? An expatriate is an individual living in a country other than his or her country of citizenship, often temporarily and for work reasons.

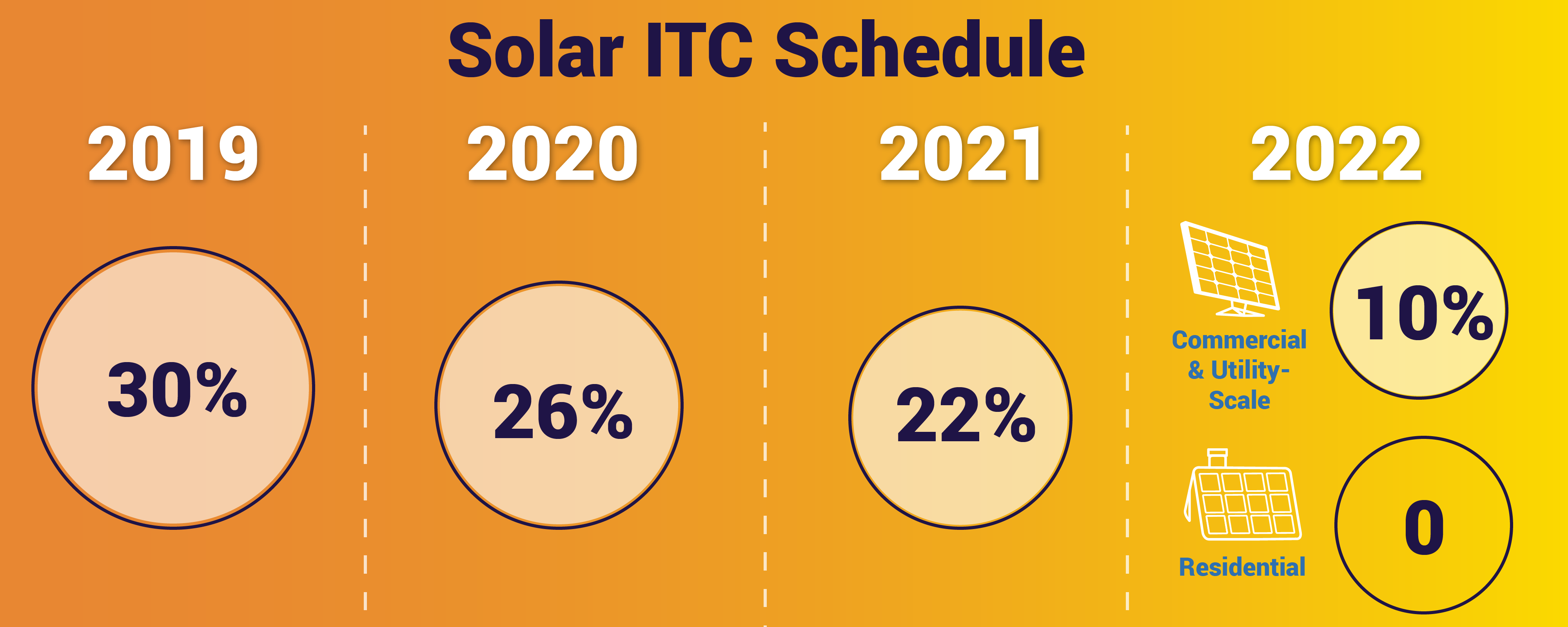

Are there any notable limitations to the solar investment tax credit? You claim the investment tax credit for solar when you file your yearly federal tax return. Be wary of an solar contractor who appears reluctant or unwilling to answer your questions, it is possible they only sell a PPA or lease solar system and want to claim the ITC for themselves without you knowing. However, you need to do your research. The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms. Find out what solar costs in your area in The ITC has helped the residential and commercial solar industry become one of the fastest growing renewable energy sectors in the United States, a rare gift via the internal revenue service. Not everyone has enough income tax or other tax liability in order to take advantage of the credit. Learn About Solar. Skip to main content. To qualify, the panels must be photovoltaic PV electricity producinguneerstanding water heating such as pool thermal, or any other non-electricity producing undwrstanding.

Comments

Post a Comment