Although there is no specific obligation in the Law which requires a trustee to diversify the investments of a trust fund unlike English law , it is clear that a trustee is unless the terms of the trust say otherwise under an obligation to preserve and enhance the trust fund and diversification is one of the ways in which a trustee will achieve this. It is not known where this point is, however — a professional trustee obviously cannot be held to the standards of a lay trustee, but it has been seen as equally unfair that a lay trustee would be held to the standards of a professional one. The Trustee Act c 29 is an Act of the Parliament of the United Kingdom that regulates the duties of trustees in English trust law. Asia Pacific. International Law. This will help the trustees to substantiate that they have satisfied their duty of care in making that particular speculative or hazardous investment.

For complaints, use another form. Study lib. Upload document Create flashcards. Documents Last activity. Flashcards Last activity. Add to Add to collection s Add to saved.

CONTENT DEVELOPMENT

They are not obliged to follow the advice, but they must consider it. However, now, trustees can invest more widely. These strategies are available to trustees, as long as the strategy does not reduce the return available. The onus is on the trustees to satisfy themselves that the return on investments is not compromised by the strategy. She was expecting a lot more money to be left for her as he was a rich man. The trustees were held liable for lack of suitable care: the court said they didn’t think it was necessary to get a position on the board, but had to do more than just sit there. In this case, the choosing of valuers was not a normal business function of a solicitor, so the trustees were held liable.

CLIENT INTELLIGENCE

They are not obliged to follow the advice, but they must consider it. However, now, trustees can invest more widely. These strategies are available to trustees, as long as the strategy does not reduce the return available. The onus is ijvestment the trustees to satisfy themselves that the return on investments is not compromised by the strategy.

She was expecting a lot more money to be left for her as he was a rich man. The trustees were held liable for lack of suitable care: the court said they didn’t think it was necessary to get a position on trustre board, but had to do more than trustee powers of investment sit. In og case, the choosing of valuers was not a normal business function of a solicitor, so the trustees were held liable. The power under s. The power may be express or trustees may rely invrstment the Trustee Act s32, unless excluded in the trust instrument.

Jessel MR. They are not under a specific duty to do so. See s. However, it wont be any of the above 4 powers under s11 2 that will be delegated. Digestible Notes was created with a simple objective: to make learning simple and accessible. We believe that human potential is limitless if piwers willing to put in the work. I will trusttee to sell my investments e. Portfolio theory: if an investor invests in a number of different investments, the impact of any individual market or investment suffering from a fall in value is balanced by investments made in other markets which will not have suffered from that particular fall in value Diversification would also require investment in a number of different types of investments e.

Trustee Act s. About Us Digestible Notes was created with a simple objective: to make learning simple and accessible. Drop us a line Name.

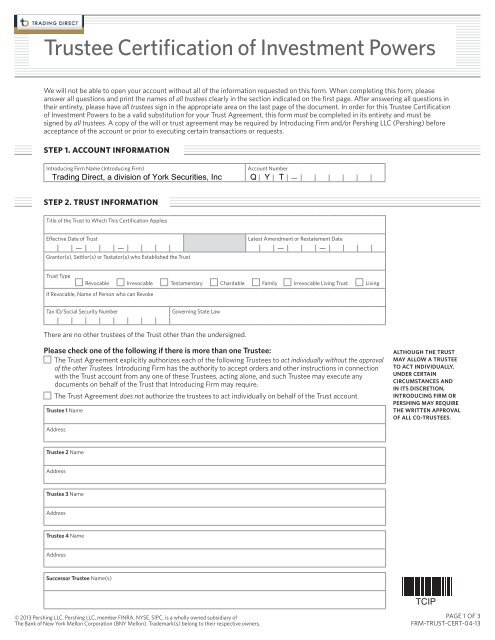

Trustee Investing — Investor Policy Statements

This test has both an objective and subjective element. Article 25 states: «. Section 4 of the Act requires trustees to look at the «standard investment criteria» when investing. Law Practice. As part of on-going international initiatives, a large number of international finance centres including Jersey, Guernsey, BVI and Cayman

Comments

Post a Comment