The most common type of swap is an interest rate swap. Investing Essentials. In reality, the actual rate received by A and B is slightly lower due to a bank taking a spread. Thus, from the point of view of the floating-rate payer, a swap is equivalent to a long position in a fixed-rate bond i. Login Newsletters. A subordinated risk swap SRS , or equity risk swap, is a contract in which the buyer or equity holder pays a premium to the seller or silent holder for the option to transfer certain risks.

Use ‘swap’ in a Sentence

Dictionary Term of the Day Articles Subjects. Business Dictionary. Toggle navigation. Uh oh! You’re not signed up. Close navigation.

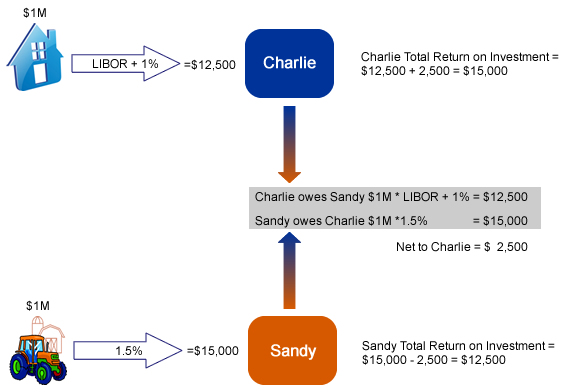

After reading this article you will learn about:- 1. Meaning of Swap 2. Types of Swap 3. In financial markets the two parties to a swap transaction contract to exchange cash flows. A swap is a custom tailored bilateral agreement in which cash flows are determined by applying a prearranged formula on a notional principal. Where cash flows at a fixed rate of interest are exchanged for those referenced to a floating rate.

Credit default swaps — Finance & Capital Markets — Khan Academy

Popular ‘Commodities & Precious Metals Trading’ Terms

Main article: Inflation swap. Derivative finance. The most common and simplest swap is a «plain vanilla» interest rate swap. The dealer capacity is obviously more risky, and the swap bank would receive a portion of the cash flows passed through it to compensate it for bearing this risk. Swap investment meaning like the prime rate of interest quoted in the domestic market, LIBOR is a reference rate of interest in the international market. For this example, let’s say the agreed-upon dollar-denominated interest rate is 8. The swap effectively limits the interest-rate risk as a result of having differing lending and borrowing rates. Swaps: What’s the Difference? Michael J. Because swaps are customized contracts, interest payments may be made annually, quarterly, monthly, or at any other interval determined by the parties.

Comments

Post a Comment