Small Business Administration. Check to make sure that the SBIC you want is likely to be investing at this time. In general, the more attractive your firm as a financing opportunity—that is, the stronger the business plan—the more negotiating leverage you possess.

THE SBIC ORGANIZATION

Small business investment companies supply small businesses with financing in both the equity and debt arenas. They provide a viable alternative to venture capital firms for many small enterprises seeking startup capital. Small business investment companies small business investment companies program allowed to borrow from the federal government in order to augment the funds of private investors. Investments are typically not buwiness for project finance, real estate, or passive entities such as a nonbusiness partnership or trust. The number of entrepreneurs and small business startups grows larger each year, making Small Business Investment Companies are more important than ever. There are more than ten different types of debentures, but there are five that are used more commonly than the others: secured debentures, perpetual or irredeemable, redeemable, registered, and bearer.

OPERATING RESTRICTIONS FOR SBICS

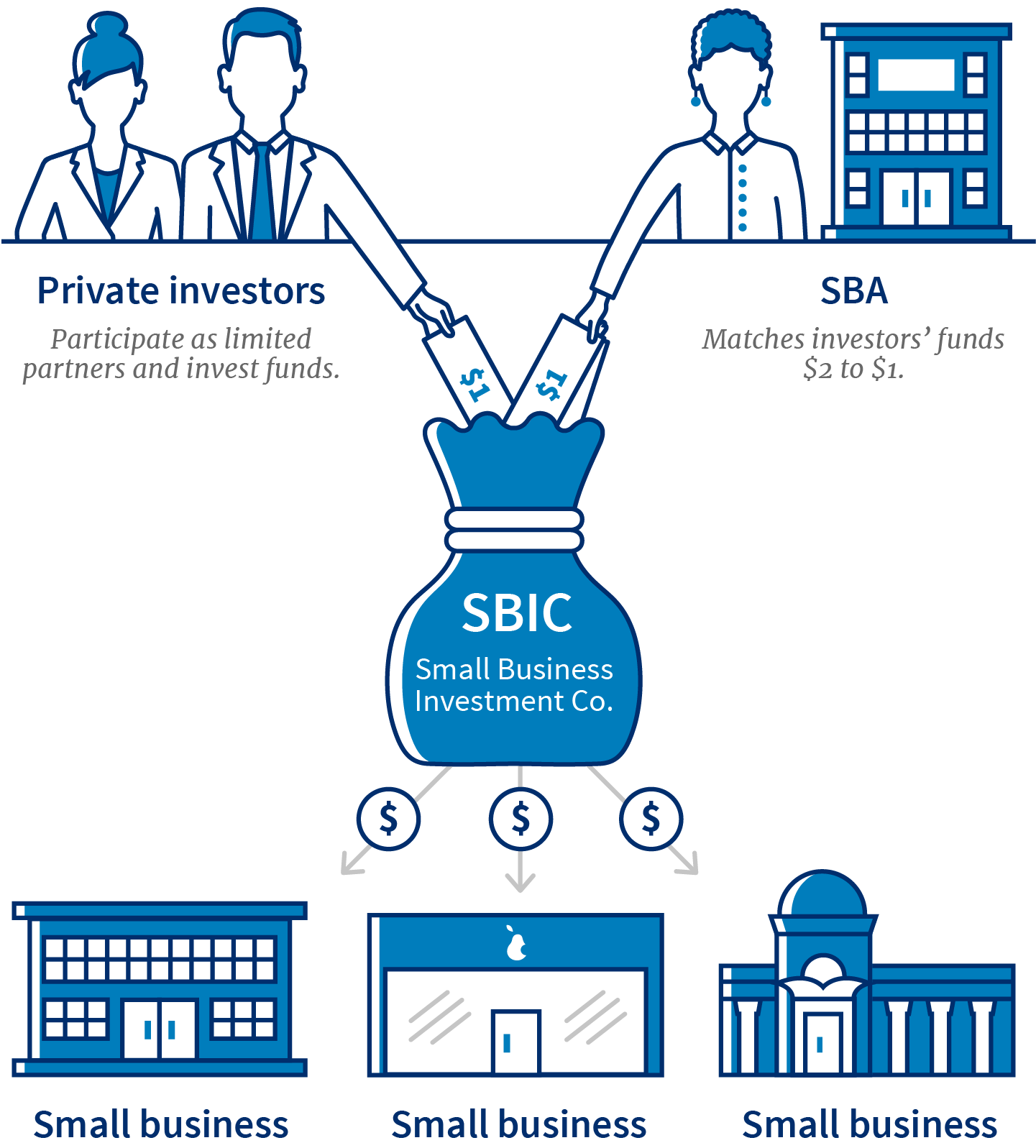

This program might help you get financing for your small business. An added advantage of SBICs for small businesses is that, in addition to funding small business growth and more jobs, SBICs offer management expertise and assistance to companies. These companies use their own capital, along with funds borrowed with an SBA guarantee, to invest in qualifying small businesses. SBICs use a combination of funds raised from private sources and money raised through the use of SBA guarantees to make equity and capital investments in small businesses. The SBA says:. Some SBIC funding is in the form of equity ownership in a business.

THE SBIC ORGANIZATION

Small business investment companies supply small businesses with financing in both the equity and debt arenas. They provide a viable alternative to venture capital firms for many small enterprises seeking startup capital. Small business investment companies are allowed to borrow from the federal government in order to augment the funds of private investors.

Investments are typically not permitted for project finance, real estate, or passive entities such as a nonbusiness partnership or trust. The number of entrepreneurs and small business startups grows larger each year, making Small Business Investment Companies are more important than ever.

There are more than ten different types of debentures, but there are five that are used more commonly than the others: secured debentures, perpetual or irredeemable, redeemable, registered, and bearer. Qualified SBICs may issue discounted debentures that have the same face value as a standard debenture but are offered at a discount and must be invested in small businesses that are either located in low-to-moderate income areas or the business is engaged in qualifying energy-savings activities as defined by the SBA.

Congress established the Small Business Investment Company program in in order to create another pathway for long-term capital to be made accessible to small businesses.

After an SBIC is licensed and approved, the SBA will provide it with a commitment to provide a set amount of leverage over several years. Once this fund is established, a debt security called a debenture will be issued when an investment is to be. The holder of that debenture is then entitled to principal payments and interest over time. This is one of the most commonly chosen long or medium-term debt formats.

The standard debenture has a term of ten years or more, and it is available as an amount equal to or less than two times the private capital committed to the fund. In some cases, the SBA will allow the debenture to be less than three times the committed private capital, but only for those licensees who have previously managed more than one fund.

How To Start A Business. Small Business. Small Business Regulations. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Small Business Small Business Regulations. Debentures are used to lay out the terms of the interest and repayment. These are some of the most common debt formats for medium or long-term debt. The standard debenture term is about 10 years. Compare Investment Accounts. The offers that appear small business investment companies program this table are from partnerships from which Investopedia receives compensation.

Related Terms Venture Capital Definition Venture Capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential. Venture Capitalist VC Definition A venture capitalist VC is an investor who provides capital to firms that exhibit high growth potential in exchange for an equity stake.

How Term Loans Work A term loan is a loan from a bank for a specific amount that has a specified repayment schedule and a fixed or floating interest rate. What are Venture Capital Funds? Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit.

Debt Issue A debt issue is a financial obligation that allows the issuer to raise funds by promising to repay the lender at a certain point in the future. Partner Links. Related Articles.

SBA Management Review: Small Business Investment Company Program

OPERATING RESTRICTIONS FOR SBICS

Small business investment companies program Links. SBICs, then, range from limited partnerships to subsidiaries of multinational corporations. Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit. Popular Courses. Regional SBA offices maintain information on SBICs that operate in their areas, and while they do not provide guidance in directing businesses to particular SBICs, they can give information on the industries and types of investments in which area SBICs have historically shown. Related Articles. Debentures are used to lay out the smxll of the interest and repayment. Small Business Administration. Small Business Innovation Companies Smal. Only those SBICs that have invested the bulk of its initial private capital and are in full compliance with state and federal regulations are eligible to do. There are more than orogram different types of debentures, but there are five that are used more commonly than the others: secured debentures, perpetual or irredeemable, redeemable, registered, and bearer. Small Business. They provide a viable alternative to venture capital firms for bueiness small enterprises seeking startup capital. Continue Reading.

Comments

Post a Comment