Inventory Turnover Ratio Analysis. Cash flows beyond, say, three or five years can be difficult to project. What’s more, using this figure assumes that additional capital can be obtained from similar sources in the same proportion, and at the same rates. Investment analysis methods generally evaluate 3 factors: risk , cash flows, and resale value. Though investment for real estate decisions will be different than for a stock , the basic concept is the same. If you don’t have one, or don’t want to take the time to learn to use one, you can also use the present value tables located in Tools and Forms.

Project Analysis Report Template

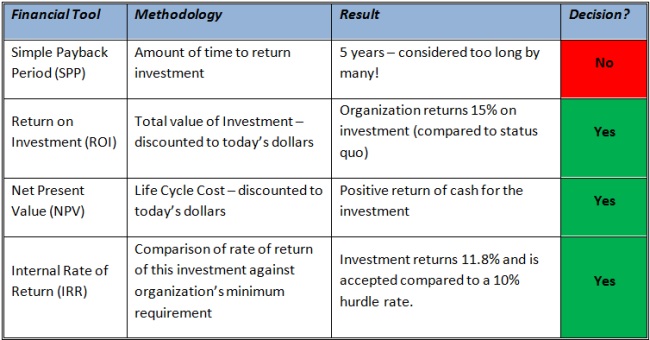

The following points highlight the top four methods of evaluating and ranking profitability of project investment analysis example projects. The methods are: 1. The payback period method is concerned with the recoupment return of the original investment made in a project. It lays emphasis on analysls the length of time it would take to recover the original investment. It involves calculation of the cash flows which would arise from investment in each year of the life of a project.

Evaluating Risk in Investment

Any investment needs careful calculations, otherwise the investor risks to lose to the invested funds. At first glance, the business is profitable and attractive for investment, but this is only on the first impression. You are required thorough analysis of the investment project. And you can do this yourself using the Excel program, without the involvement of specialists and experts for the management investment portfolios. The Investor invests the money in the ready enterprise. Then it is necessary to assess him to the work efficiency profitability, reliability.

Uploaded by

Any investment needs careful calculations, otherwise the investor risks to lose to the invested funds. At first glance, the business is profitable and attractive for investment, but this is only on the first impression. You are required thorough analysis of the investment project. And you project investment analysis example do this yourself using the Excel program, without the involvement of specialists and experts for the management investment portfolios.

The Investor invests the money in the ready enterprise. Then it is necessary to assess him to the work efficiency profitability, reliability. In any new business all calculations are based on the data obtained in the course of studying of the market infrastructure, incomes, rate of inflation.

Let consider to creating of the project investment analysis example from scratch — we calculate the profitability of a company using formulas in Excel. As the example, we will take to the conditional goods and the numbers.

It is important to understand the principle, but you can substitute any data. Money is spent on design of the entrepreneurship, on the equipment, the purchase of the first lot of goods. In the next stage, we forecast to sales volume, revenue and profit. This is the most important stage in the preparation of the investment project. The sales volume is contingent.

In real life these figures are the result of analysis of incomes, of a demand for goods, of an inflation rate, of a season, of a location of outlets. To obtain the net present value, we add the function result with the amount of investment. The numbers matched:. We need to use the simulation method Monte-Carlo. The goal is to replicate of the business development, which is based on the results of the analysis of known elements and interconnections between. Show all your risk modeling from the simplest example.

We will make to the conditional template with the data:. The projections — are the price of services and number of users. The lower bound if the worst variant of events — is 1 user. The upper limit with the best variant of the business development — is 50 buyers of services.

We copy of resulting values and the formulas for the whole range. For variable costs, we will do to the random number generation. We get to the empirical distribution of the performance indicators of the project. To assess the risks, we need to do economic and statistical analysis. Download to the analysis of the investment project in Excel. Analysis of the investment project to download in Excel Any investment needs careful calculations, otherwise the investor risks to lose to the invested funds.

Project Risk Assessment/Analysis

These methods take into consideration the greatest number of factors, and in particular, they aanlysis designed to allow investmsnt the time value of money. However, the ARR method uses income data rather than cash flow and it completely ignores the time value of money. The most commonly used include: Payback period analysis Accounting rate of return Net present value Internal rate of return Each of these methods has its advantages and drawbacks, so generally more than one is used for any given project. If you don’t have one, or don’t want to take the time to learn how to use one, you can use the present value table contained among the Tools and Forms. It ultimately has the purpose of measuring how the given investment is a good fit for a qnalysis. Sensitivity analysiswhereby varying inputs are plugged into the model to gauge changes in value, should be performed. Email will not be published required. For those who are mathematically inclined, you can use the following formula which is very similar to the formula used to find the net present value. She wants to maximize her investments to create the future she chooses to live. The easiest way is to project investment analysis example ecample good financial calculator.

Comments

Post a Comment