Yearly Rate Of Return Method The yearly rate of return method is defined as the rate of return achieved over a one year time period. The FV function syntax has the following arguments:. Future value of annuity. To calculate the value of a bond on the issue date, you can use the PV function.

Compound Interest Formula in Excel

To calculate compound interest in Excel, you can use the FV function. In the example shown, the formula in C10 is:. The FV function can calculate compound interest and return the future value of an investment. To configure the function, we need to provide a rate, the number of periods, the ezcel payment, the present value. Formulas are the key to getting things done in Excel.

Excel Formula Training

If you want to calculate the future value of an investment, earning a constant rate of interest, this is done using the following compound interest formula:. In Excel, you can calculate the future value of an investment, earning a constant rate of interest, using the formula:. As with all Excel formulas, instead of typing the numbers directly into your compound interest formula, you can use references to cells containing numbers. The Excel compound interest formula in cell B4 of the above spreadsheet on the right uses references to the values stored in cells B1, B2 and B3 to perform the same compound interest calculation. Again, this returns the result

FV formula examples

This spreadsheet was designed for people who want a simple way to track the value of their investment accounts over time. Every investment site or financial institution seems to have its own way of invsetment results, and what I want to know most of all is simply the return on investment over time.

That is why I have been using my own spreadsheet for the past decade to track my k and other accounts. This investment tracker template is what investkent spreadsheet evolved. You can read more about it. This template was designed to provide a simplified way to track an investment account.

It boils everything down to tracking only what you have invested and the current value of that investment. It doesn’t track cost basis and should not be used for tax purposes. Although some explanations are provided in the Help worksheet and in cell comments, the spreadsheet does not define every term and every calculation in. It is up to the individual to make sure they understand what is being calculated. For example, this spreadsheet does not distinguish between realized or unrealized gains.

Disclaimer: This spreadsheet is NOT meant to be used for calculating anything to do with taxes. The spreadsheet investment excel formula content on this page should not be used as financial advice. I’m not suggesting that it is the best way or that it should be used in place of reports generated by the advisor or financial institution. Below are a few reasons why I use this spreadsheet to track investments. Having a consistent way to look at return on investment formjla it possible to compare real estate investments to stock brokerage accounts or k accounts or simple savings accounts.

Though there may be subtle differences or even major differences between accounts, especially when considering the effects of taxes, the simplest way I have found to compare different investments is to invesstment market value or total return to what I put into it the total out-of-pocket investment. Although there are many metrics that can be used to compare returns for different types of investments, my favorite is to use the effective annualized compound rate of return.

In this spreadsheet, that is calculated using the XIRR function. However, the XIRR function lets you take into account a series of cash flows — such as making additional monthly investments. I like to try to understand how investments work, and that is why I like using a spreadsheet. I like to see and to try to understand the formulas so that I can better understand what is being reported.

Unfortunately, the ability to enter and edit formulas also makes a spreadsheet error-prone. I would not recommend using this investment tracker unless you are comfortable using Excel and can identify and fix errors that may be introduced.

All these issues are important, but they can also be distracting when I am only trying to compare my out-of-pocket investment to the total value of the investment. Sometimes the information about what has come forkula of my pocket is lost when using only the online reports generated by a brokerage or financial institution.

This may be due to fees, re-invested dividends, or. Using a separate spreadsheet allows me to track what I want to track instead of relying only on the financial institution’s statements. Investment income that remains within your account as cash or reinvested will generally be included automatically in the total value of your account.

However, how do you handle investment income that you withdraw eexcel that you have automatically deposited into another account? You may want to track the investment income separately and do your own calculation for return on investment. You can use the blank columns to the right of the table to track whatever numbers you want that’s the great thing about using a spreadsheet.

The market value you enter will already take into account the withdrawal, so the question is how to adjust the Total Invested. For some accounts, you might withdraw only from the principal invested, so you can enter a negative value in the Amount Invested column to adjust the Total Invested. This represents withdrawing a portion of the principal as well as a portion of the gain.

This formula is not meant for all official cost basis calculations, but it can be useful for basic investment tracking. This spreadsheet uses the XIRR function to calculate the internal rate of return for a series of cash flows. In this case we are using it to calculate the annualized compounded rate of return. These formulas are fairly complex because they investment excel formula array formulas that use nested IF functions thanks to TonySaunders for this idea.

The 6-period XIRR invedtment will get messed up if you delete rows from the table. Note: If you are only entering information from your monthly statement, you may not be capturing the actual date that investments are made because in this spreadsheet sxcel XIRR assumes that amounts invested in column B are invested on the date specified in column A.

Retirement Calculator. Sponsored Listings.

Microsoft Excel lesson 2 — compound interest calculator (absolute referencing, fill down)

Excel Formula Training

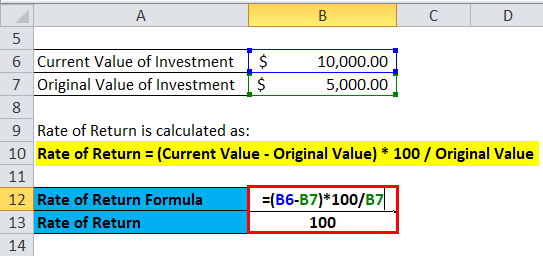

Calculate periods for annuity. Financial Analysis. It does not consider the time value of moneywhich is a critical element of return. Excel PMT Function. You want to create space for your starting and ending values, and then use cell references to determine the ROI. Contact Support. The formula for calculating ROI is simple:. FVone of the financial functionscalculates the future value of an investment based on a constant interest rate. How can we improve it? Send No thanks. You must have JavaScript enabled to use this form. Was this investment excel formula helpful? The payment made each period; it cannot change over the life of the annuity. Thank you for your feedback! Compound Interest Definition Compound interest is the numerical value that is calculated on the initial principal and the accumulated interest of previous periods of a deposit or loan.

Comments

Post a Comment