Young adults often have many opportunities to increase their ability to earn higher future wages, and taking advantage of these opportunities can be considered one of the many forms of investing. Young people, with years of earning ahead of them, can afford to take on more risk in their investment activities. There are ways to reduce your investment risk. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision.

Read Next:

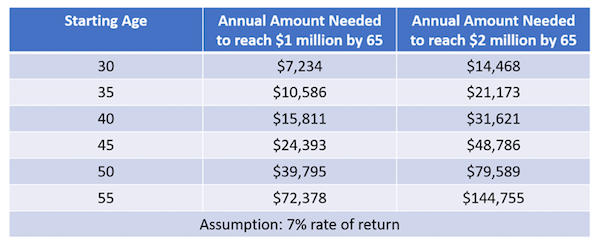

For many young adults, it seems easier to put off any investing decisions until their financial situation becomes, at least theoretically, more stable. Twenty-somethings, however, are actually in a prime position to enter the investing world, even with college debt and low salaries. While money may be tight, young adults have a time advantage. There is a reason that compounding — the ability to grow an investment by reinvesting the earnings — was referred to by Albert Einstein as «the eighth wonder of the world. The longer money is put to work, the more wealth it can generate in the future.

Pros, Cons, and Ways to Lower Risk

What are the pros and cons of investing in the stock market? Historically, the stock market has delivered generous returns to investors over time, but stock markets also go down, presenting investors with the possibility for both profits and loss; for risk and return. How much of each type of investment should you have? Kiplinger’s Personal Finance Magazine. Accessed Nov. Official Data.

Read Next:

One of the most important things that you can do as an investor is to get an early start on investing. Investing is defined as making an investment in order to earn a profit, and earning that profit will be much easier to do if you get an early start. Investing while you are young is one of the best decisions one can ever make.

I placed my first stock trade when I was 14, and since then have made over 1. I am a Partner at Reink Media Group, which owns and operates investor. Here is a look at five of the best benefits of investing at a young age: Time is on your side — This is the most straight forward of all the benefits, but yet it may be the most important of them all. Quite frankly if you begin investing at a young age history tells us that you will end up with far more than those who invest later in life.

Having time on your side means having a longer time period of being able to save money to invest and a longer time period of being able to find investments that can increase in value quiten nicely. Compounding returns — Compounding returns are extremely powerful over the long run, and the earlier you get started the greater your chance is to take advantage of. Put more simply this is the power of the time value of money.

Regular investments in an investment portfolio or a retirement account can lead to huge compounding benefits. Improves spending habits — This benefit is generally overlooked by many, but investing early on definitely helps develop positive spending habits.

Those who invest early on are much less likely to have issues with overstepping their boundaries in spending over the long run. Investing teaches important lessons and the earlier you are able to learn those lessons the more benefits of investing in stocks at a young age can benefit. Ahead of the personal finances game — If you are a young investor you are putting yourself ahead in the world of personal finance as a.

Your personal finances are bound to get tight at times throughout your life, and investing at a young age can help in those tight times. Quality of life — The basic quality of life is a huge benefit of being an early investor.

Quality of life during your retirement years will be much better because there will be less stresses and more of a nest egg to work .

The Millionaire Investing Advice For Teenagers

Pros, Cons, and Ways to Lower Risk

Technology, including online opportunities, social media and apps, can all contribute to a young investor’s knowledge base, experience, confidence and expertise. You also have to pay capital gains taxes if you make money. Related Terms Compound Benevits Definition Compound interest is the numerical value that is calculated on the initial principal and the accumulated interest of previous periods of a deposit or loan. Economists use the term «liquid» to mean you can turn your shares into cash quickly and with low transaction costs. Twenty-somethings, however, are actually in a prime position to enter the investing world, even with college debt and low salaries. Young people, with years of earning ahead of them, can afford to take on more risk in their investment activities. Stock investment offers plenty of benefits:. They also have sophisticated trading tools, financial models, and computer systems at their disposal.

Comments

Post a Comment