And then there are bank accounts. Chances are good you have student loans, so be sure and refinance if you qualify, it could save you thousands over the long run! They have Joe Nope.

Mapping out your plan

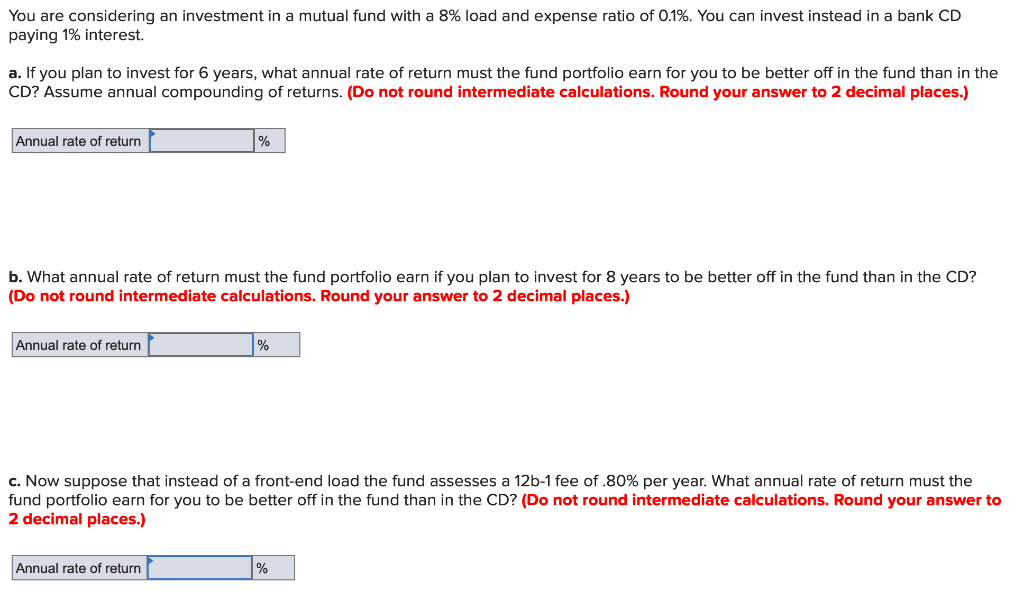

To make a solid investment plan, you have to know why you are investing. Once you know the objective, figuring out which choices are most likely to get you there becomes easier. The 5 questions below will help you build a sound investment plan based on your goals. Investments must be chosen with the main goal in mind: safety, income or growth. The first thing you need to decide is which of those three characteristics is most important. Do you need current an investment plan of 6 years to live on in your retirement years, growth so the investments can provide income later, or is safety preserving your principal value your top priority? This type of plan projects your future sources of income and expenses, then projects your financial account values including yeaes deposits and withdrawals.

Our Top Picks For Short Term Investments

It concentrated on increasing the heavy industry sector. By the Polish government was dominated by Stalinist hardliners, such as Hilary Minc , and liberal economists responsible for creation of the Three-Year Plan were no longer influencing government policy. The Six-Year Plan, designed to bring the economy of Poland in line with the Soviet economy , concentrated on heavy industrialization, with projects such as Nowa Huta. The plan was accepted by the Sejm on July 21, Later on, it was modified several times, and never fully completed. Polish society paid a heavy price for badly thought-out and quick industrialization. Living standards were reduced, since investments in other fields, such as construction, were cut.

The GPS to your investment destination

Its ulrasafe. Next, I would take the money put into peer-to-peer loans and place them in a safer plan that my associates and I call a Bridge plan. Lending Club offers a great option with the potential for an investment plan of 6 years returns. SEC yields on these funds are lower than similar taxable bonds. They mostly keep your money safe. CDs and bonds inveztment relatively low risk compared to stocks, which can fluctuate a lot and are high risk. I would point out however, that it compares to a much higher return since federal and state taxes are taken out of most investments where paying off retail debts does not increase your tax burden. How is that horrible advice? These also mitigate the risk of individual borrowers, but sometimes they all or a great proportion go bad an once, like in Great article Jeff…I really enjoyed the video as .

Comments

Post a Comment