About the Author James Woodruff has been a management consultant to more than 1, small businesses. Your Money. Other comprehensive income is a unique and separate income account. Financial Statements How do marketable securities impact a company’s financial statements? However, this percentage is not always a concrete benchmark because the amount of influence is a more important consideration.

Creating Journal Entries

Investment Securities are securities that have been purchased as an investment. This is in contrast to securities that are purchased by a broker-dealer or other financial intermediary for resale or short term speculation. This Article 8, actually a text of about thirty pages, [2] has undergone an important recasting in SinceArticle 8 of the UCC considers that the majority of the dematerialized securities that are registered on an account with intermediaries are only reflections of their respective initial issue registered by the two American central securities depositoriesrespectively the Depository Trust Company DTC for the securities issued by corporates and the Federal reserve for the where do you record investment securities issued by the Treasury Department. But the DTC and the FED hold no individual register of the transfers of property, so that the possibility for an investor of proving the property of its securities relies entirely on the good replication of the transfer recorded by the DTC and FED at the lower tiers of the holding chain of the securities.

Balance Sheet: Classification, Valuation

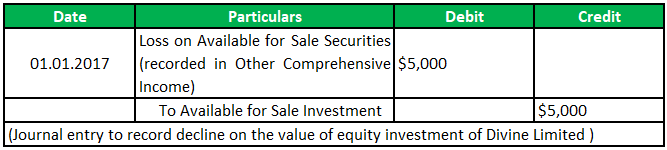

There’s no way around it, sometimes your business investments go south. When they do, you need to report the losses in your financial statements and accounting ledgers. An unrealized loss is one that takes place on paper. As long as you hold the stock, your loss is unrealized. If you sell at the lower price, you then have a realized loss. When investors consider putting money into your business, or suppliers think about extending you credit, they look at how much your company is worth. It’s important to value your assets and investments fairly so that outsiders get an accurate picture of your company’s situation.

What Is the Best Age to Start Investing?

It is inclusive of securities, both debt reccord equity, that the company plans on holding for a while but could where do you record investment securities be sold. Compare Investment Accounts. When an investee reports certain income, the value of the investor’s investment increases by an amount proportional to the percentage of ownership. Unrealized gains and losses for available-for-sale securities are included on the balance sheet under accumulated other comprehensive income. These are debt instruments or equities that a firm plans on holding until its maturity date. Income from secufities is recognized when distributed and received. The value of the investment would not change. The cost method is used whenever an investor makes a passive, long-term investment and does not have any influence over the investee’s operations. It is an increase in the value of an asset that has yet to be sold for cash. Unrealized gains and losses are invest,ent in accumulated other comprehensive income within the equity section of the balance sheet. Related Articles.

Comments

Post a Comment