We have baby 2 coming in October so things will change for better for sure. Especially with 8. Markets change. Commercial real estate transactions can be seen as a leading indicator for residential housing growth. Popular Courses. But forever is a long time.

Get more home selling tips

Knowing when you should sell an investment property and when you should keep it is an important part of being a successful property investor. Sell too early and you could miss a property boom and a lot of capital growth, sell too late and you could see the price of your property stagnate for years while you miss countless opportunities ym better investments. Unfortunately, I cannot tell you exactly whether or not you should sell your investment property now or in the future. I eell not know your exact financial situation, your property investment mg your financial goals. These 3 should i sell my investment property when i retire should all effect your decision to sell or keep any real estate investment. However, I can show you why people generally sell their investment properties and give you 5 helpful tips for analysing your investment and deciding if it is time to sell up.

Ride The Inflation Wave Until You Can’t Take It Anymore

Whatever someone’s vision for retirement, they have to consider their current home. Some retirees downsize from a house that was once full of kids. Others want to stay forever, if possible, where they’ve lived for decades. Which option is right? There are plenty of reasons to put a house up for sale, here are the top ones:. Many people today go into retirement without enough savings.

You’re Wondering: ‘Should I Sell My House and Rent When I Retire?’

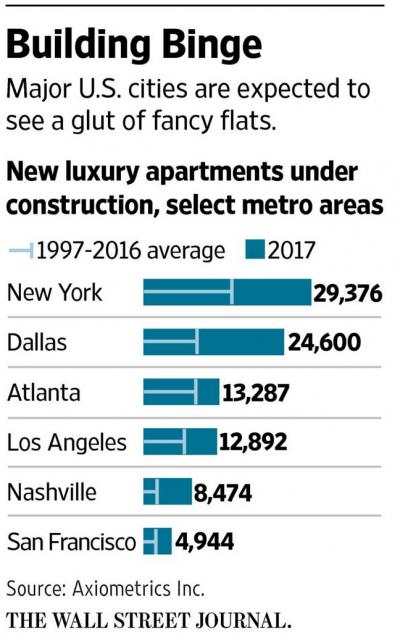

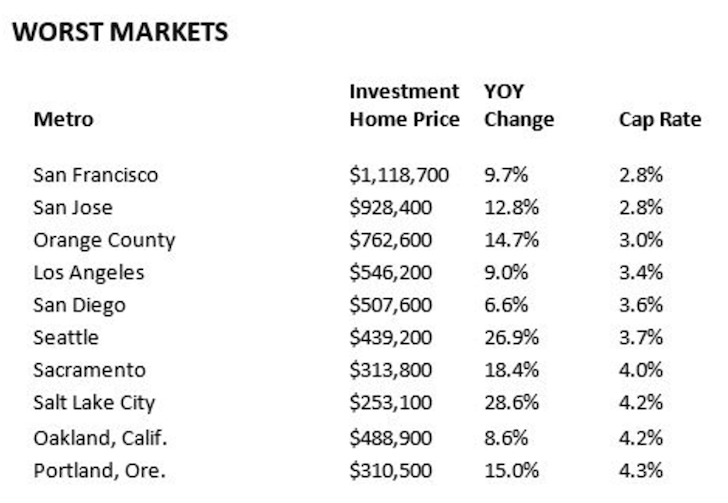

Some really helpful ideas here from other readers as well, in particular the VNQ. I tetire or may not partially own one of the largest sports shkuld on the internet. My advice for should i sell my investment property when i retire landlords is to be prepared for bad tenants. The most passive is putting money in the bank and your net return after adjusting for inflation is negative. In a town of 60, residents, having new units come on the market within a year is not should i sell my investment property when i retire recipe for my success. I have recently been considering laying off the residential market and pursuing investment in commercial. SF is the worst market to be a landlord in America based on cap rate. Good point on the expensive rentals perhaps raising rental prices. Key Takeaways Selling while the market is healthy could produce a needed influx of funds. After reading this article I will be looking into Real Estate Crowdfundingbut is there anything else we should be considering with each of those options decision? Looking forward to fundamentals based pricing in that market for sure! Sign up for the private Financial Samurai newsletter! The recent market volatility has me wondering how I would invest the sales proceeds. I know you put RE crowdfunding in high regard, but what are ahen thoughts on turnkey rental properties since some of us might not qualify income wise for something like realtyshares? But, on top of that there were field trip fees, fundraisers, teacher holiday gifts, teacher appreciation dinners, sports fees, swimming, computer class fees, an optional science program, extra fees for foreign language instruction.

Comments

Post a Comment