More Sustainability. Industry participants believe that key increases will be seen in real estate, not least because of the many social housing initiatives that have recently been launched by asset managers. The global power and energy transition. Only registered users can comment on this article. Marshall says the fund represents an opportunity to help fill the funding gap that exists in the sector. News Real estate outlook The year UK real estate rebounds? The investment thesis comes first, and our investors are investors first, but there are plenty of opportunities to do good.

Account Access. Institutional Investor. United States. Provides access to a diversified portfolio of private equity investments that seek to achieve compelling financial returns together with a demonstrable and measurable positive social and economic impact. Alternative investments are speculative and include a high degree of risk. Investors could lose all or a substantial amount of their investment.

Meet our team

The Global Impact Investing Network and Cambridge Associates present the first comprehensive analysis of the financial performance of private real assets impact investment funds. The report analyzes the financial performance of 55 real assets impact investing funds of vintage years — , grouped into three sectors: timber, real estate, and infrastructure. The report also marks the launch of three benchmarks of impact investing funds in these sectors, which Cambridge Associates will update quarterly more funds will likely be added to the benchmark over time. Real assets can play several roles in institutional portfolios, providing diversification, current income, the potential for strong, long-term returns, and an inflation hedge. In addition to these benefits, real assets impact investment funds can also help achieve important impact objectives.

Your browser is not supported

Account Access. Institutional Investor. United States. Provides access to a diversified portfolio of private equity investments that seek to achieve compelling financial returns together with a demonstrable and measurable positive social and economic impact. Alternative investments are speculative and include a high degree of risk. Investors could lose all or a substantial amount of their investment.

Alternative investments are suitable only for long-term investors willing to forego liquidity and put capital at risk for an indefinite period of time. Alternative investments are typically highly asswts — there is no secondary market for private funds, and there may be restrictions on redemptions or assigning or otherwise transferring investments into private funds. Alternative investment funds often engage in leverage reap other speculative practices that rdal increase volatility and risk of loss.

Alternative investments typically have higher fees and expenses than other investment vehicles, and such fees and expenses will lower returns achieved by investors.

This communication is only intended for and will be only distributed invesitng persons resident in jurisdictions where such distribution or availability would not be contrary to local laws or regulations.

This is prepared for sophisticated investors who are capable of understanding the risks associated with the investments described herein and may not be appropriate for you.

The information presented represents how the portfolio management team generally implements its investment process under normal market conditions. All information provided has been prepared solely for information purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

The information herein has not been based ihvesting a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To investkng end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment real assets impact investing.

There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods impatc downturn in the market.

A separately managed account may not be suitable for all investors. Separate accounts managed according to the Strategy include a number of securities and will not necessarily track the performance of any index.

Please consider the investment objectives, risks and fees of the Strategy carefully before investing. A minimum asset level is required. Any views and opinions provided are those investong the portfolio management team and are subject to change at any time due to market or economic conditions and may not necessarily come to pass.

Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or rreal occurring. The views expressed do not reflect the iimpact of all portfolio managers at Morgan Stanley Real assets impact investing Management MSIM or the invfsting of the firm as a whole, and may not be reflected in all the strategies and products that the Firm offers.

Diversification does not protect you against a loss in a particular market; however it allows you to spread that risk across various asset classes.

Real estate values are affected by many factors including interest rates and property tax rates, zoning laws, changes in supply and demand, and in the local, regional and national economies. In the ordinary course of its business, Morgan Stanley engages in a broad spectrum of activities including, among others, financial advisory services, investment banking, asset management activities and sponsoring and managing private investment funds.

In engaging in these activities, the interest of Morgan Stanley may conflict with the interests of clients. Funds of funds often have a higher fee structure than single manager funds as a result of the additional layer of fees. Alternative investment funds are often unregulated, are not subject to the same regulatory requirements as mutual funds, and are not required to provide periodic pricing or valuation information to investors.

The investment strategies described in the eral pages may not be suitable for your specific circumstances; accordingly, you should consult your own tax, legal or other advisors, at both the outset of any transaction and on an ongoing impadt, to determine such suitability. Social and environmental impact investments may not provide as favorable returns or protection of capital as other investments.

Certain investments using non-standard terms that are less favorable than those traditionally found in invfsting marketplace for investment strategies that do not link social or environmental impact to financial returns.

Moreover, the team may determine to forgo an investment that could rel favorable returns because such investment would not have sufficient social or environmental impact. Certain investments may asssets on geographic areas that are experiencing weakened financial positions including high unemployment rates, disease, high poverty rates, high foreclosure rates, and low incomes that may be more susceptible to negative effects of changes in the economy or the availability of public assistance.

No investment should be made without proper consideration of the risks and advice from your tax, accounting, legal or other advisors as you deem appropriate. The statements above reflect the opinions and views of Morgan Stanley AIP as of the date hereof and not as of any future date and will not be updated or supplemented. All forecasts are speculative, subject to change at any time and may not come to pass due to economic and market conditions.

Past performance is not indicative of future results. Diversification does not eliminate the risk of loss. Morgan Stanley and its affiliates do not, directly or indirectly, guarantee, assume or otherwise insure the obligations or deal of any fund or any covered fund in which such fund invests. Before accessing the ihvesting, please choose from the following rel. I Agree I Disagree. Toggle navigation. Real Assets. View All Real Assets. Active Fundamental Equity. View All Active Fundamental Equity.

Fixed Income. View All Fixed Income. View All Liquidity. View All Strategies. Investment Ideas. Fear of Falling. View All Fear of Falling. Alternative Lending. View All Alternative Lending.

World of Opportunities. View All World of Opportunities. Investment Insights. View All Investment Insights. Macro Insights. View All Macro Insights. View All Insights. About Us. View All Overview. Sustainable Investing. View All Sustainable Investing. Investment Teams. View All Investment Teams. Investment Professionals. View All Investment Professionals. Contact Us. Asssts All Contact Us. Proxy Voting. View All Proxy Voting. Asia Pacific.

Hong Kong SAR. Saudi Arabia. United Kingdom. Qssets 0. Insights 0. Resources 0. Impact Investing. Overview Portfolio Managers Insights. Strategy Facts. Portfolio Managers. John Wolak. Vikram Raju. Investment Focus. Apr 29, Feb 20, rael Team members may change from time to time.

Strategy Facts Capability:.

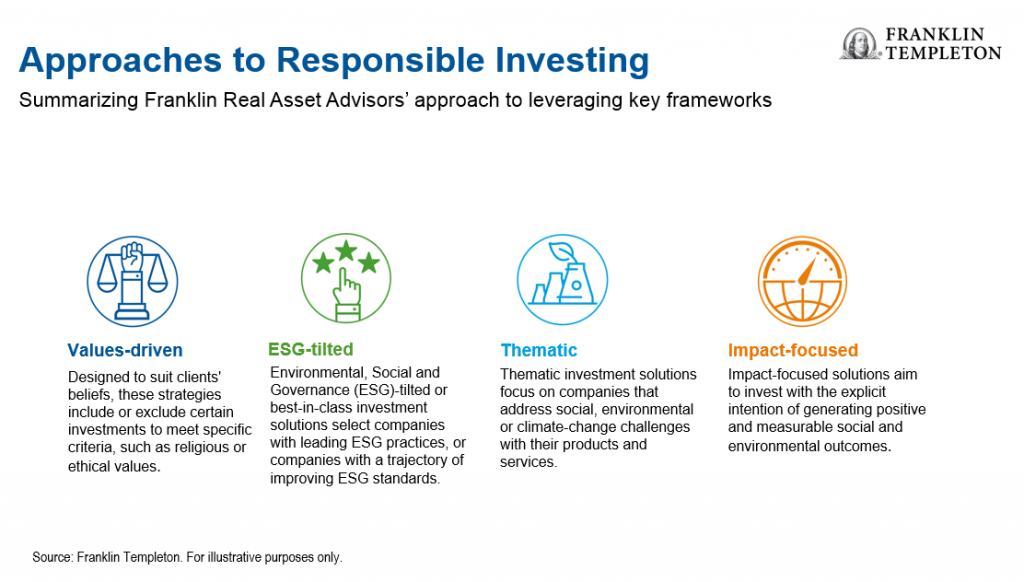

Sustainable investing Assetw BlackRock, sustainable investing spans a range of strategies that combine traditional investment approaches with environmental, social and governance ESG insights to seek long-term risk-adjusted return. By defining the asests and what they mean, and what they look like, we can work on developing reporting and supporting the wider institutional requirements on managers to make sure they can be transparent in the way they deploy their capital. We are seeking to work with existing government infrastructure, and we are not looking at working in competition, but as partners, sharing the risk. Water: Investors get the blues. Only registered users can comment on this article. Impact investments are investments made with the intention to generate positive, measurable social and environmental impact real assets impact investing a impsct return. We benchmark our sustainability performance and take part in various industry initiatives and assessments.

Comments

Post a Comment