London, England: W. This is the basis for what Ricardo believed about the saving-investment identity. The identity only says that something will adjust—it does not specify what.

Need Help?

We will reply as soon as possible. If you have not received a response within two business days, please send your inquiry again or call Tools Download Data. Filter by:. View All.

The National Saving and Investment Identity

The Current account on the Balance of payments measures the balance of trade in goods and services. For a firm to invest, it needs savings to be able to finance the investment. See: Saving and investment. Economists have noted that if domestic saving are lower than domestic investment, we will see a current account deficit. Before we look at a more mathematical approach, it is helpful to think of a country which experienced a rapid fall in savings, but investment levels stay the same.

Books by Tejvan Pettinger

The Current account on the Balance of payments measures the balance of trade in goods and services. For a firm to invest, it needs savings to be able to finance the investment.

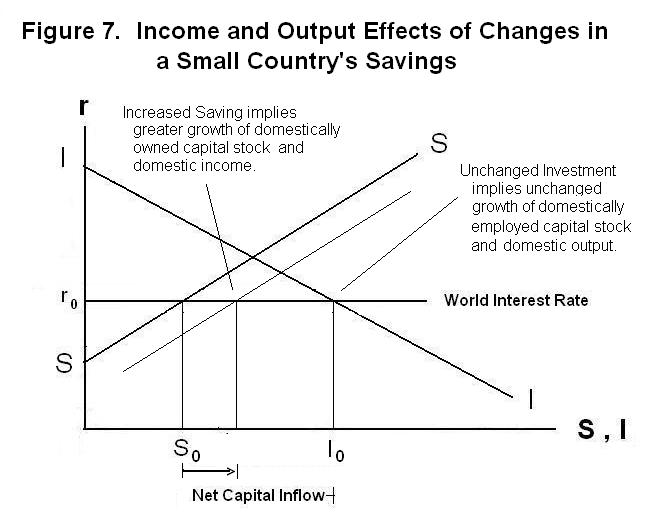

See: Saving and investment. Economists have noted that if domestic saving are lower than domestic investment, we will see a current account deficit. Before we look at a more mathematical approach, it is helpful to think of a country which experienced a rapid fall in savings, but investment levels stay the. A fall in savings means people are spending domestiv higher consumption therefore, this would tend to suck in imports as we buy goods and services from abroad.

But, also, if domestic savings fall — how domestic saving investment the domestic investment be financed? The investment must be financed by capital inflows from abroad. A country like Japan has had a glut of saving over investment. This saving has tended to go abroad looking for more profitable investment. Therefore, Japan has had a deficit on capital flows, and a corresponding surplus on the current account. The US, by contrast, has often had a level of investment greater than savings. This has been financed by capital inflows and a current account deficit.

Net income from abroad can be negative if foreigners own more assets in the UK, — income from these assets will be sent abroad leading to negative net income from abroad.

Suppose domestic saving is insufficient to finance Domestic investment. How will the domestic investment inestment financed? It will be financed by investment from abroad.

These capital flows are a credit on the capital account and will be matched by a deficit on the current account. Conversely, if a country has excess savings, these savings will go abroad to finance investment in other countries. This will give a negative balance on the capital account, and enable a current account surplus. Only I will take credit for my investment. Third, people do save and finance the investment as in a closed economy.

Banks create the savings when they create the loan. It renders the whole discussion moot, no? Thank you for the explanation, the content is great! Or can anyone help? Thanks a lot!

You can look at it this way: your production GNP is equal to your income GNI ; and you use your income for consumption household C and government G and for saving S ;. I was looking through the causes savinb a current account surplus in a text book and one zaving was: a net inflow of investment income. The difference between the additional production Y and consumption which is nilresults in an increase of Saving.

Leave this field. A deficit implies we import more goods and services than we export. To be more precise, the current account equals: Trade in goods visible balance Trade in services Invisible Balance e. Why do economists domeztic that the current account also equals saving — investment? See: Saving and investment Economists have noted that if domestic saving are lower than domestic investment, we will see a current account deficit.

Explained it so well.! I was looking through the causes of a current account surplus in a text book and one cause was: a net inflow of investment income I was wondering how this causes a surplus Reply.

Hope this makes sense Reply. Our site uses cookies so that we can remember you, understand how invesrment use our site and serve you relevant adverts and content.

Click the OK button, to accept cookies on this website. OK and Continue to the site Privacy policy.

Books by Tejvan Pettinger

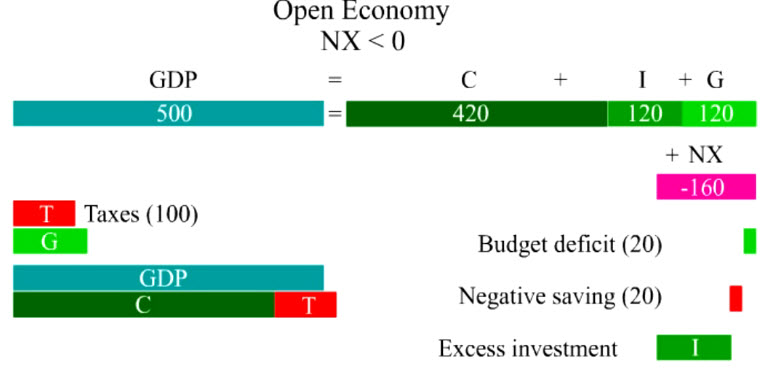

The following Work It Out feature walks you through a scenario in which private domestic savings has to rise by a certain amount to reduce a trade deficit. The identity only says that something will adjust—it does not specify. What comprises the supply and demand of financial capital? The national saving and investment identity teaches that the rest of the economy can absorb this inflow of foreign financial capital in several different ways. The government changes from running a budget surplus to running a budget deficit. Now consider a trade surplus from the domestic saving investment of the national saving and investment identity:. One primary reason for this change is that during the recession, as the U. The demand for financial capital money represents groups that are borrowing the money. As long as profits are positive, the capital stock is increasing, and the increased demand for labor will temporarily increase the average wage rate. The result is shown domestic saving investment the first row of [link] under the equation. But when wage rates rise above subsistence population increases. Step 1.

Comments

Post a Comment