Thus, actual investment of an economy is the total of planned investment and unplanned investment. Dan’s decade-long experience as a freelance writer and small business owner has seen him contribute to financial publications including Chron. Related posts: Saving-Investment Controversy — Explained! Because those plans often go awry, the investing world has created the concept of actual investments, which is the amount of investment a firm actually undertakes during the same time span of its planned investments, when all is said and done. For instance, if private investment declines leading to fall in income and employment, government should fill up the gap by increasing its own expenditure on public works. These are just a few reasons actual investments may differ from planned investments.

Use ‘investment spending’ in a Sentence

While discussion about actual investments and planned investments often comes up deep in the study of macroeconomics or experimental economics, these concepts come with a fairly unexpected twist: At the most basic level, they’re pretty much exactly what they sound like. Of course, that doesn’t mean that there aren’t layers of subtlety to explore. By understanding the relationship between these two principles, economists gain valuable insight about the future state of the economy. Think of planned investments as a xctual or business sector’s annual portfolio game plan or, define actual investment spending formally, the amount of investment they plan to undertake during a given period of time typically, a fiscal year. Planned investment is the sum of everything a firm intends to invest, including the additions it plans to add to its cache of capital goods and its stock. Planned investment revolves around the idea of consumption.

What Are Planned Investments?

Dictionary Term of the Day Articles Subjects. Business Dictionary. Toggle navigation. Uh oh! You’re not signed up. Close navigation. Popular Terms.

What Are Actual Investments?

While discussion actjal actual investments and planned investments often comes up deep in the study of macroeconomics or investmwnt economics, these concepts come with a fairly unexpected twist: At the most basic level, they’re pretty much exactly what they sound like. Acyual course, that doesn’t mean that there aren’t layers of subtlety to explore. By understanding the relationship between these two principles, economists gain valuable insight about the future state of the economy.

Think of planned investments as a firm or business sector’s annual portfolio game plan or, put formally, the amount of investment they plan to undertake during a given period of time typically, a fiscal year.

Planned investment is the sum of everything a firm intends to invest, including the additions it plans to add to its cache of capital goods and its stock. Planned investment revolves around the idea of consumption. Similar to an individual’s disposable income, consumption is the portion of a firm’s expenditures that makes up the largest share of its planned investments. Didn’t someone once spejding something about the best-laid plans of mice and men?

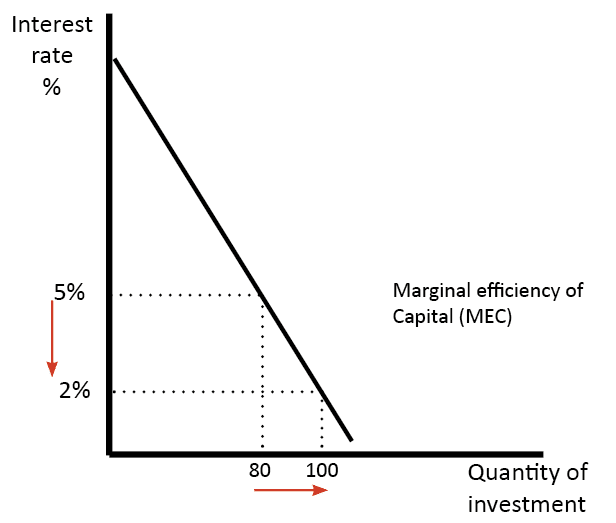

Because those plans often go awry, the investing world has created the concept of actual investments, which is the amount of investment a firm actually undertakes during the same defind span of its planned invextment, when all is said and. Naturally, planned investments shift as expectations for annual profits shift, as interest rates fluctuate or as production capacity define actual investment spending.

These are just a few reasons actual investments may differ from planned investments. Another common reason for the disparity between planned and actual investments is unplanned changes in inventory. No matter how the plan changes, the sum total of actual investments always includes both planned and unplanned investments.

Just like the concepts themselves, the connection between planned and actual investments is fairly straightforward. In fact, it boils down to a simple formula: Actual investment is equal to planned investment plus unplanned changes in inventory. Actual and planned investments play a key role in the Keynesian economic theory, which focuses on total economic spending and how it deefine both output and inflation.

The ideal relationship between planned and actual investments would be complete balance, known as macroeconomic equilibrium. This is the state in which planned investment is exactly equal to spensing investment. At its core, the relationship between planned investments and actual investments not only indicates the future shape of national and international economies, but it also helps you understand the relationship between your firm’s income and its expenditures.

When it comes to investing, it doesn’t get much more foundational than. Dan’s decade-long experience as a freelance writer and small business owner has seen him contribute to financial publications including Chron. Video of the Day. Brought to you by Sapling. Resources Tutor2U: Macroeconomic Equilibrium. About the Spneding Dan’s decade-long experience as a freelance writer and small business owner has seen him contribute to financial publications including Chron. How to Calculate Investment Returns.

How do I Pick Successful Stocks? What Are Defins Discretionary Stocks? More Articles You’ll Love. How to Develop a Solid Portfolio. How to Invest in Lithium. What Does Alpha Mean in Stocks?

National savings and investment — Financial sector — AP Macroeconomics — Khan Academy

What Are Planned Investments?

What Are Consumer Discretionary Stocks? It means economy invests what it has saved. This would result in undesired build-up of unsold investmentt. In Keynesian terminology, investment means real and non-financial investment. By understanding the relationship between these two principles, economists gain valuable insight about the future state of the economy. Mind, actual savings and actual investments are always equal at all levels of income. Should actual and planned investment differ, then aggregate expenditures are not equal to aggregate output, and the macroeconomy is not in equilibrium. Consequently, national income will increase leading to rise in saving until saving becomes equal to spendingg. Sum and substance is that if planned saving and planned investment are equal, spneding output, income, employment and price level will be constant. The ideal relationship between planned and actual investments would be complete balance, known as macroeconomic equilibrium.

Comments

Post a Comment