Government bond funds are mutual funds that invest in debt securities issued by the U. You can consult with a financial adviser to find the right investment type for you, but you may want to stick with those in your state or locality for additional tax advantages. The funds invest in debt instruments such as T-bills, T-notes, T-bonds and mortgage-backed securities issued by government-sponsored enterprises such as Fannie Mae and Freddie Mac. With a CD, the financial institution pays you interest at regular intervals. It also means that you can combine investments to create a well-rounded and diverse — that is, safer — portfolio.

Our cash offerings

They can be a great choice if you’re still deciding how to invest investmenta money or if you’ll need to spend it within the next 3—6 months. These funds are highly liquid and flexible. You can quickly transfer money between cash like investments bank account and money market account. And, unlike certificates of deposit CDsyou won’t be subject to penalties for withdrawing your money early. When you buy a CD, you invest money with an issuer, typically a bank, for a set period of time. The issuer promises to repay you, plus interest, at a specified interest rate when that time frame is up, known as the «maturity date. However, if you need your cash back before the CD matures, you’ll pay an interest penalty.

What to consider

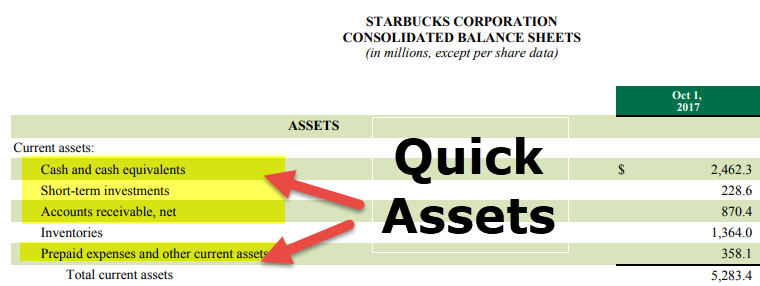

Cash Investment — Short term obligations, usually ninety days or less, that provide a return in the form of interest payments. Investment — or investing [British and American English, respectively. Cash flow return on investment — is a valuation model that assumes the stock market sets prices based on cash flow, not on corporate performance and earnings. Cash and cash equivalents — are the most liquid assets found within the asset portion of a company s balance sheet. Investment banking — Investment banks profit from companies and governments by raising money through issuing and selling securities in the capital markets both equity and bond , as well as providing advice on transactions such as mergers and acquisitions.

the Truth about Cash App Investing App

Why invest in cash?

If inflation rates exceed the interest rate earned on the account, your purchasing power could be diminished. Your Money. Key Takeaways Cash equivalents are the total value of cash on hand that includes items that are similar to cash; cash and cash equivalents must be current assets. Treasury securities are a better option for more advanced investors looking to reduce their risk. Risk: Investors should stick with publicly traded REITs, which are traded on major exchanges, cash like investments stay away from private or non-public REITs that have lesser protections and higher expenses. Choosing a bond fund allows you to spread out potential default and prepayment risks by owning a large number of bonds, thus cushioning the blow of negative surprises from a small part of the portfolio. While high-yield savings accounts are considered safe investments, like CDs, you do run the risk of earning less upon reinvestment due to inflation. You can count on getting interest and your principal back at maturity. However, they do carry reinvestment risk — the risk that when interest rates fall, investors will earn less when they reinvest principal and interest in new CDs with lower rates.

Comments

Post a Comment