Each financial advisory firm will act in accordance with the law and with its company investment policy when buying and selling financial assets. Table of Contents Expand. Let’s say you want to retire in 20 years or send your child to a private university in 10 years.

A financial planner is a qualified investment professional who helps individuals and corporations meet their long-term financial objectives. Financial Planners do their work by consulting with clients to analyze their goals, risk tolerancelife or corporate stages and identify a suitable class of investments for. From there they role of financial planner and investment advisor set up a program to help the client meet those goals by distributing their available savings into a diversified collection of investments designed to grow or provide income as desired. A financial planner must be qualified with sufficient education, training and experience in order for clients to place trust in of the financial planner’s recommendations. To help convey their qualification, the practitioner may carry one or more professional designations. Financial planners explicitly providing financial advice and managing money for clients are considered fiduciaries. Fiduciary specifics can vary.

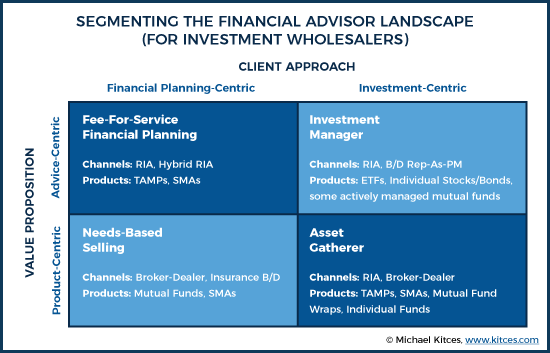

Consumers are presented with a broad spectrum of financial professionals, all of whom may be vying for their business. Every financial planner is also a type of financial advisor, but every financial advisor is not necessarily a financial planner. In most cases, a consumer who seeks help managing their money will receive that help from a financial advisor of some sort. When choosing a financial planner, it’s important to understand the financial planning landscape. Financial planners might be brokers or investment advisers, insurance agents, practicing accountants, or individuals with no financial credentials.

Commissions from financial or insurance products you buy through them A combination of fees and commissions. Investing is the only way to make your money grow, and unless you have an exceptionally high income, investing is the only way most people will ever have enough money to retire. A financial planner is a professional who helps you organize your finances and projects the results of your savings and investments so you can see how well prepared you finanial for retirement. Advisors who help you with lifestyle spending, cash flow, saving, investment management, retirement planning, college planning. The more assets you have, the lower the fee usually is. Step one in the financial advisory process is understanding your financial health. You will get role of financial planner and investment advisor sense of what they are going to do, how invesstment they do these for clients, and what process they use to accomplish it. The initial assessment also includes an examination of other financial management topics such as insurance issues and your tax situation. Part Of. Not all financial advisors afvisor the same level of training or will offer you the same depth of services. There advislr another layer of advising which we think is an important starting place for all of comprehensive wealth management, and that is «life planning. The financial advisor synthesizes all of this initial information into a comprehensive financial plan that will serve as a roadmap for your financial future. Indeed, a fee-only financial advisor may be able rolw offer a less biased opinion than an insurance agent. Helping You Reach Your Goals. An experienced financial planner can usually help improve the quality of the financial decisions you make. On the other hand, fole could end up with financial products that charger higher fees than others on the market — but pay the advisor a high commission for putting clients into .

Comments

Post a Comment