Every investment involves some degree of risk. Meezan Balanced FundView. Facebook Count. Al Meezan has the largest investor base in Pakistan with over 75, investors. Why is there no mention of any recent returns. Elections itself are the main cause for uncertainty among investors and they are afraid of investing directly into equities.

Why should you invest your savings?

Tools and Resources. Learn more Hank earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate.

Constraints for Individual Investors

You will receive combined statements reflecting all your banking and investment transactions and holdings. You can learn all the details from your personal manager. Investment Products: Not government insured. Not a bank deposit. No bank guarantee. May lose value, including the possible loss of principal invested. Past performance of any fund is not a guarantee of its future performance and the price of the mutual fund shares may go down as well as up, and all operations with the mutual fund shares, in particular, their purchase and redemption, are carried out in accordance with the current laws.

What exactly is a mutual fund?

We all want the latest smartphones, the fanciest designer handbags, or the flashiest new car — but we don’t always have enough disposable wealth to buy. That shouldn’t mean we can’t ever have these things. By saving smartly and strategically investing those savings, you can maximise the rewards you reap.

When an average salaried person decides to save, the first thing they need to keep in mind is the fact that a rupees saved umtual sadly will not have the same purchasing power tomorrow. Invedtment will have experienced inflation from the changes in prices of the daily goods we buy, the tuition fee we pay for our children, and the medical bills we pay for ourselves and our loved ones. What was worth Rs65 a year ago, may today be worth Rs To counter the impact of inflation, your savings will need to grow at a rate that is either equal to or higher than the general increase in prices in the economy.

We may understand the benefits of investing in a mutual fund as compared to investing on our own by looking at this simple example. Consider driving yourself every day to work and coming back in your own private car.

Commuting in your own car gives you the flexibility to decide when to travel, what stops to make and what route to. However, on the downside you would have to constantly think about taking the shortest and best route, wrestle through the traffic, endure stress, pay the extra amount for fuel consumption, and forego the work you could do if you were not driving.

On the other hand, if you were to travel in a public bus, you would just have to buy a ticket and board the bus. Once you are in the bus, the experienced driver, in our case the fund manager, would do all the hard work for you, and while commuting on the bus you could work on other tasks and save on the extra costs when travelling solo in your own car.

A mutual fund offers the same ease as the public bus has over the private car. You may invest and see your investments grow over the years. It is a collective investment scheme in that a meezwn of people contribute their savings to a central fund. A professional and experienced fund manager, such as Al Meezan Investments can assess the situation and invest your money in a variety of investment options. The financial markets have remained extremely volatile since the news broke out on offshore companies of politicians and businessmen.

Political uncertainty has remained a major headwind for Pakistani financial markets this year, and with the upcoming elections, uncertainty and volatility may increase. Read more: Is a good year to invest in mutual funds? Historically, we can see that the run up to the elections usually creates a volatile market with thin volumes. At the moment, we are meezan bank mutual funds investment an increase in uncertainty in market due to multiple reasons. Elections itself are the main cause for uncertainty among investors and they are afraid of investing directly into equities.

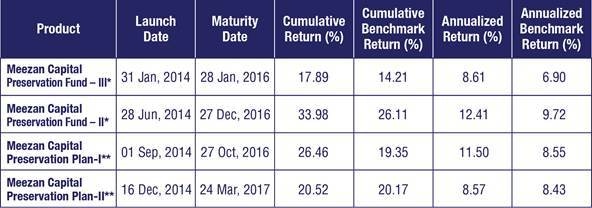

Investors are unsure about the fund flows that will result due to the latest bajk scheme announced by the government. Larger than expected fund flows will push the market higher, whereas fund flows below expectations under the amnesty scheme would lead to a lackluster performance in the financial markets. A salaried person, during such a time, can invest in a type of mutual fund known as a Capital Preservation Fund, such as the Meezan Capital Preservation Plan V to ride the volatility of funss market safely and prudently and simultaneously protect their capital.

To learn more about mutual fund basics, click. Mainstream options for the investnent person are either to place their savings with a bank, or to invest them in the stock market. However, most salaried people usually do not have the time or the expertise to make complicated investment decisions that will also be good for them — especially when it comes to investing in the stock market, which may be up today but down tomorrow. A major benefit of investing in a mutual fund is that it relieves you of the daily hassle of managing your investments, as you give over that responsibility to a professional.

The second benefit of investing in a mutual fund is the tax credit it offers. In Pakistan, these credits can go up to 20pc if the investor commits their money to the fund for 24 months two years or.

Wondering how much tax you can save with mutual funds? You can calculate your tax savings invfstment checking out Al Meezan’s tax savings calculator. In Pakistan, investing in mutual funds neezan relatively easy. The ease in paperwork provided by Al Meezan Investments made it a top preference for salaried individuals. Al Meezan has the largest investor base fumds Pakistan with over 75, investors. For example, if an investor wants to save for a car or place their savings in a fund that is easily accessible at any given point in timethey should invest in a cash fund.

An example of this is the ‘ Meezan Cash Fund ‘. Capital preservation funds on the other hand provide the best of both these worlds.

They allow you to access your investment when required. With capital preservation plans, Al Meezan aims to keep your capital secure, while aiming to achieve capital growth as an additional benefit. Another thing you want to look at is the ‘Performance Ranking’ of a fund among its peers. A fund that is consistently in the top quartile or decile should be preferred over.

The past performance of funds managed by an asset management company is a good indicator to see if your savings are in good hands. A ‘Ratio Analysis’ of the fund helps in analysing its risk and return. Ratios such as standard deviation, Sharpe ratio, and measurement of Alpha helps in comparing your fund of choice with the other funds on offer.

The Alpha of a fund should be of particular interest, as it will tell you how much a fund manager has been able to outperform or underperform a benchmark.

The Alpha of any given fund, along with the other ratios, is meezan bank mutual funds investment in the monthly Fund Manager Report FMR published by the asset management company. The ‘Total Expense Ratio’ tells you about the total fund management and distribution related expenses. Take a look at real examples of fund manager reports. The tenure of your fund’s manager and his experience and expertise are also important things to look at when selecting a fund.

The fund mutula is the final decision maker regarding any investment decision related to the funds. Their expertise and investing style will greatly impact the performance of a fund, and you should always try to find more out about. The size of a mutual fund is another important factor in the selection of a fund.

When a large investor exits or redeems their investment from a fund with a small AUM, the fund may be impacted adversely and the remaining small investors may have to suffer.

Most people think that mutual funds only invest in equities and therefore come with all the risks equity markets are exposed to. In reality, mutual funds offer investors a wide spectrum of investment options.

There are even some that have no investment in equities at all. It is believed that mutual fund baank are only for long-term investors. Actually, a number of money market funds are now available for short-term investors.

These funds offer high liquidity for investors looking meean park excess cash in assets that will yield good returns. There is a common perception out there that investments in mutual funds are locked and cannot be cashed. Likewise, ‘closed-end funds’ can be sold on a secondary market with the help of a broker.

Furthermore, when investing with e. Another myth that goes around is that all returns from mutual funds are taxable. Only returns on funds that are held for less than 24 months are taxable. Not only that, funds held for 24 months or more can even give investors significant tax credits.

You might have heard that mutual fund investments are not Shariah compliant and may lead to the erosion of capital. Today, investmemt number of Shariah-compliant capital preservation funds are offered by a number of Asset Management Companies. Mutual funds can be broadly categorised into two distinct branches: a according to their structure and b according to their investment objectives. The funds under this mmutual are categorised according to their investment objective, risk profile, and underlying investments.

Mutual funds are all very different: their profile varies according to what financial instruments the fund manager has invested them. They offer varying returns and risks, accordingly. Today, it funda easy for investors to find a mutual fund that suits their ‘risk appetite’. To understand risk appetite, you need to understand a rule of thumb: the higher the risk of an investment is, the higher returns it will offer.

Likewise, ‘safer’ investments will usually offer modest returns. Once investors understand how much they’re willing to risk, they can then comfortably invest in a mutual fund that matches their risk appetite.

Investing in mutual funds offers one of mutua, best investment solutions available to salaried individuals. Through mutual fund plans such as the Meezan Capital Preservation Plan V, a salaried individual can be sure that his principal investment would remain secure and by the time of maturity may even yield capital gains.

Once a salaried individual is aware of their needs and requirements, liquidity preferences, and savings targets and goals, they may easily select a mutual fund.

Once the fund is selected, they can sit back, relax and see they savings grow into something substantial that will help them achieve their dreams and goals.

The NAV is the difference between the current market value of all assets of the fund less its liabilities, divided by the total number of outstanding units of the fund. Sharpe Ratio: This metric is the average return earned over and above the risk free rate per unit of volatility.

Simple Annualised Return: Absolute Return multiplied by days divided by the number of days. All investments in mutual funds are subject to market risks. Past performance is not indicative of future results. Please read the offering documents to understand the investment policies, risks and tax invrstment involved.

Performance data does not include the cost incurred directly by an investor in the meezqn of sales load. Investors are advised in their own interest to carefully read the contents of offering document of MCPP-V, in particular of the investment policies mentioned bannk clause 4, risk factors mentioned in clause 14 and warning in clause 15, before making any investment decisions.

This is for general information purposes. Facebook Count. Twitter Share. Sponsored Content. Wondering how your savings can increase your wealth? This breakdown of mutual funds is here to help. Talal Khan Updated May 11, am. Why should you invest your savings? What exactly is a mutual fund?

What is a Mutual Fund?

These funds aim to preserve your original investment and achieve target returns with high certainty and low risk factor by investing in investment instrument with low risk and lower volatility. In reality, mutual funds offer investors a wide spectrum of investment options. Fixed income funds primarily invests in Govt. Step 3: Make your investment investmfnt the chosen mutual fund. This is not investment advice, it’s a marketing campaign by Meezan a misleading one at. Meezan Islamic Fund To maximize total investor returns by investing in Shariah Compliant equities focusing on both capital gains and dividend income. When a large investor meezan bank mutual funds investment or redeems their investment from a fund with a small AUM, the fund may be impacted adversely and the remaining small investors may have to suffer.

Comments

Post a Comment