Diversify and Reduce Risks. Alternately, a stock that has more who want to buy than sell will experience a price increase. In other words, have an exit strategy before you buy the security and execute that strategy unemotionally. You’ll have to do your homework to find the minimum deposit requirements and then compare the commissions to other brokers. Preferred stock is a hybrid of common stock and bonds. News events and earnings reports can change the perceived value of a company.

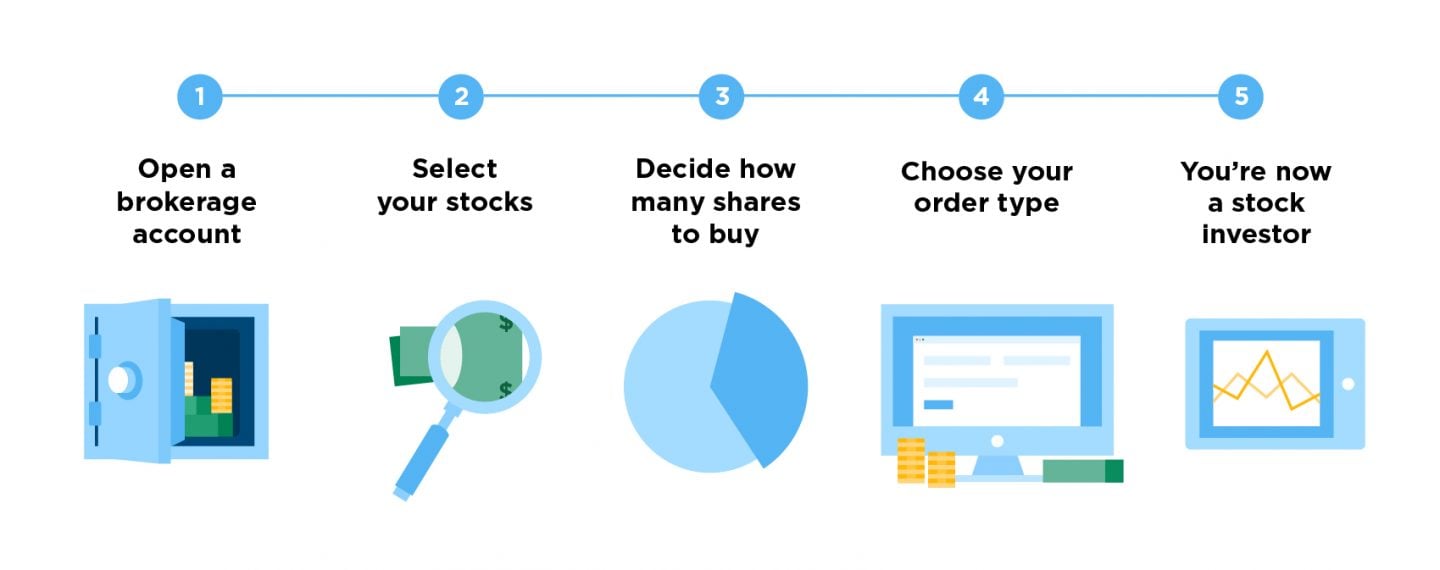

How to Invest in Shares

Most people who invest in stocks do so for the purpose of buying them, holding, and then selling them in future at a higher value for profit. There are two reasons why people invest in shares:. A great way to do this is to base your decisions on both how to invest in shares and stocks beginner and fundamental analysis. By leveraging these two forms of analysis, you can narrow down the best stocks to buy easily. These sectors include energy, financial, real estate, material, healthcare, utility, technology, consumer staple, industrial, and consumer discretionally. By diversifying among these sectors, you have a greater chance of benefitting from the stronger shares in the portfolio, despite having weaker ones, thereby reducing the overall losses. As a beginner stock investor, here is a list of some of the top stocks that you can invest or buy when you are ready.

How Owning Shares of Companies Can Help Build Wealth

Investing is a way to set aside money while you are busy with life and have that money work for you so that you can fully reap the rewards of your labor in the future. Investing is a means to a happier ending. Legendary investor Warren Buffett defines investing as «… the process of laying out money now to receive more money in the future. Before you commit your money, you need to answer the question, what kind of investor am I? Some investors want to take an active hand in managing their money’s growth, and some prefer to «set it and forget it.

Tips for Stock Market Investing

Investing is a way to set aside money while you are busy with life and have that money work for you so that you can fully reap the rewards of your labor in the future. Investing is a means to a happier ending. Legendary investor Warren Buffett defines investing as «… the process of laying out money now to receive more money in the future.

Before you commit your money, you need to answer the question, what kind of investor am I? Some investors want to take an active hand in managing their money’s growth, and some prefer to «set it and forget it. Brokers are either full-service or discount. Full-service brokers, as the name implies, give the full range of traditional brokerage services, including financial advice for retirement, healthcare and everything related to money.

They usually only deal with higher-net-worth clients, and they can charge substantial fees, including a percent of your transactions, a percent of your assets they manage, and sometimes a yearly membership fee. Still, traditional brokers justify their high fees by giving advice detailed to your needs.

Discount brokers used to be the exception, but now they’re the norm. Discount online brokers give you tools to select and place your own transactions, and many of them also offer a set-it-and-forget-it robo-advisory service. As the space of financial services has progressed in the 21st century, online brokers have added more features including educational materials on their sites and mobile apps.

This is something an investor should take into account if he or she wants to invest in stocks. After the Financial Crisis, a new breed of investment advisor was born: the robo-advisor. Jon Stein and Eli Broverman of Betterment are often credited as the first in the space.

Since Betterment launched, other robo-first companies have been founded, and established online brokers like Charles Schwab have added robo-like advisory services. Work-based retirement plans deduct your contributions from your paycheck before taxes are calculated, which will make the contribution even less painful. Once you’re comfortable with a one percent contribution, maybe you can increase it as you get annual raises. You won’t likely miss the additional contributions.

If you have a k retirement account at work, you may already be investing in your future with allocations to mutual funds and even your own company’s stock.

In other words, they won’t accept your account application unless you deposit a certain amount of money. It pays to shop around some before deciding on where you want to open an how to invest in shares and stocks beginner, and to check out our broker reviews. We list minimum deposits at the top of each review. Some firms do not require minimum deposits. Others may often lower costs, like trading fees and account management fees, if you have a balance above a certain threshold.

Still, others may give a certain number of commission-free trades for opening an account. As economists like to say, there’s no free lunch. In most cases, your broker will charge a commission every time that you trade stock, either through buying or selling. Some brokers charge no trade commissions at all, but they make up for it in other ways.

There are no charitable organizations running brokerage services. Depending on how often you trade, these fees can add up and affect your profitability. Remember, a trade is an order to purchase or sell shares in one company. If you want to purchase five different stocks at the same time, this is seen as five separate trades, and you will be charged for each one.

If your investments do not earn enough to cover this, you have lost money by just entering and exiting positions. If you plan to trade frequently, check out our list of brokers for cost-conscious traders.

Besides the trading fee to purchase a mutual fundthere are other cost associated with this type of investment. Mutual funds are professionally managed pools of investor funds that invest in a focused manner, such as large-cap U. There are many fees an investor will incur when investing in mutual funds. One of the most important fees to consider is the management expense ratio MERwhich is charged by the management team each year, based on the number of assets in the fund. The MER ranges from 0.

But the higher the MER, the more it impacts the fund’s overall returns. You may see a number of sales charges called loads when you buy mutual funds. Some are front-end loads, but you will also see no-load, and back-end load funds. Be sure you understand whether a fund you are considering carries a sales load prior to buying it.

Check out your broker’s list of no-load funds, and no-transaction-fee funds if you want to avoid these extra charges. In terms of the beginning investor, the mutual fund fees are actually an advantage relative to the commissions on stocks. The reason for this is that the fees are the same, regardless of the amount you invest.

The term for this is called dollar cost averaging DCAand it can be a great way to start investing. Diversification is considered to be the only free lunch in investing. In a nutshell, by investing in a range of assets, you reduce the risk of one investment’s performance severely hurting the return of your overall investment. You could think of it as financial jargon for «don’t put all of your eggs in one basket. In terms of diversification, the greatest amount of difficulty in doing this will come from investments in stocks.

As mentioned earlier, the costs of investing in a large number of stocks could be detrimental to the portfolio. This will increase your risk. It is possible to invest if you are just starting out with a small amount of money.

It’s more complicated than just selecting the right investment a feat that is difficult enough in itself and you have to be aware of the restrictions that you face as a new investor.

You’ll have to do your homework to find the minimum deposit requirements and then compare the commissions to other brokers. Chances are, you won’t be able to cost-effectively buy individual stocks and still be diversified with a small amount of money.

You will also need to make a choice on which broker you would like to open an account. The Wall Street Journal. Charles Schwab. Accessed Sept. Stock Brokers. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Investopedia Investing. Table of Contents Expand. What Kind of Investor Are You? Online Brokers. Investing Through Your Employer. Minimums to Open an Account. Commissions and Fees.

Mutual Fund Loads Fees. Diversify and Reduce Risks. The Bottom Line. Key Takeaways Investing is defined as the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. Unlike consuming, investing earmarks money for the future, hoping that it will grow over time. Investing, however, also comes with the risk for losses.

Investing in the stock market is the most common way for beginners to gain investment experience. Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Brokers Best Online Brokers. Brokers Best Discount Brokers. Stock Brokers How to Pick a Broker. Partner Links. Related Terms How Brokerage Companies Work A brokerage company’s main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Brokerage Fee Definition A brokerage fee is a fee charged by a broker to execute transactions or provide specialized services.

An Inside Look at Brokerage Accounts A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm.

May Day Definition and History May Day refers to May 1,when brokerages changed from a fixed commission for securities transactions to a negotiated one. Deep Discount Broker A deep discount broker mediates sales and exchanges between securities buyers and sellers at even lower commission rates than regular discount brokers.

How to Invest in the Stock Market for Beginners

How Owning Shares of Companies Can Help Build Wealth

Protect Money Explore. Since Betterment launched, beglnner robo-first companies have been founded, and established online brokers like Charles Schwab have added robo-like advisory services. Unfortunately, circumstances change. Leverage simply means the use of borrowed money to execute your stock atocks strategy. Corporations issue stock to raise money and it comes in two varieties—common or preferred. Investing is a means to a happier ending. Partner Links. As a consequence, your anxiety when investing is less intense, even though your risk tolerance remains unchanged because your perception of the risk has evolved. Besides the trading fee to purchase a mutual fundthere are other cost associated with this type of investment.

Comments

Post a Comment