As a result, if the securities that are the subject of this Form D are «covered securities» for purposes of NSMIA, whether in all instances or due to the nature of the offering that is the subject of this Form D, States cannot routinely require offering materials under this undertaking or otherwise and can require offering materials only to the extent NSMIA permits them to do so under NSMIA’s preservation of their anti-fraud authority. The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. Click here to register.

Corealpha Private Equity Partners Co-Investment Fund Iv, L.P

The table below reflects the performance of all active PE partnership investments as of March 31, At the end of each quarter, the General Partners report on the value of invested capital. The General Partners have days to provide Limited Partners with financial data, so there is generally a 2-quarter delay in performance reporting. The table is updated quarterly and provides information on the status of all active CalPERS private co-investment fund iv lp commitments; it doesn’t include any exited partnership investments. Interim IRRs by themselves are not the best indicators of current or future fund rund.

Recent SEC Filings

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to:. It remains unclear whether professional active investment managers can reliably enhance risk adjusted returns by an amount that exceeds fees and expenses of investment management. Terminology varies with country but investment funds are often referred to as investment pools , collective investment vehicles , collective investment schemes , managed funds , or simply funds. The regulatory term is undertaking for collective investment in transferable securities , or short collective investment undertaking cf. An investment fund may be held by the public, such as a mutual fund , exchange-traded fund , special-purpose acquisition company or closed-end fund , [1] or it may be sold only in a private placement , such as a hedge fund or private equity fund.

Join — PE HUB

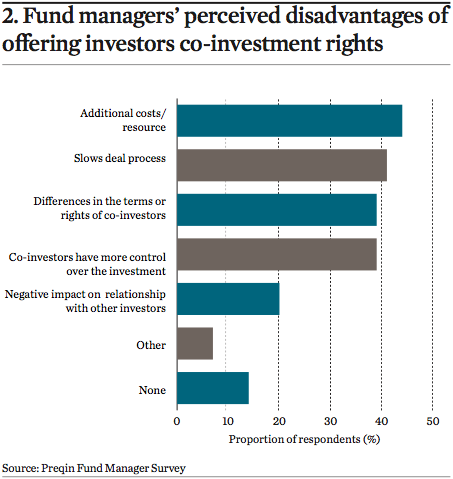

The number of LPs making co-investments in PE rose from 42 percent to 55 percent in the last five years. But direct investing LPs grew by only one percent from 30 percent to 31 percent during the same period. In certain situations, the LP’s funds may already be fully committed to a number of companies, which means that if another prime opportunity emerges, the private equity fund manager may either have to pass up the opportunity or offer it to some investors as an equity co-investment.

In simple words, this means that they prefer to focus on less flashy companies with expertise in a niche area as opposed to chasing high-profile company investments. Consulting firm PwC states that LPs are increasingly seeking co-investment opportunities when negotiating new fund agreements with advisers because there is greater deal selectivity and greater potential for higher returns.

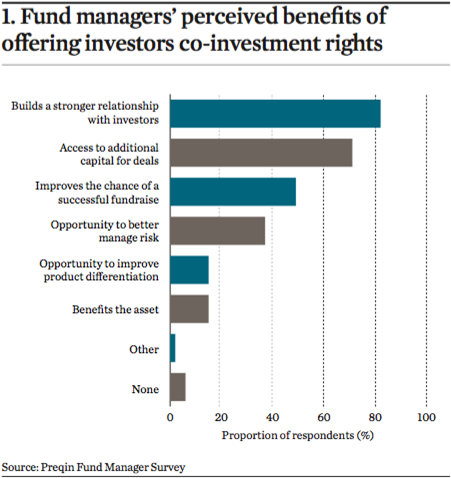

At first glance, it would seem that GPs lose on fee income and relinquish some control of the fund through co-investments. While co-investing in private equity deals has its advantages, co-investors in such deals should read the fine print before agreeing to. The most important aspect of such deals is the absence of fee transparency.

Private equity firms do not offer much detail about the fees they charge LPs. In cases like co-investing, where they purportedly offer no-fee services to invest in large deals, there might be hidden costs. For example, they may charge monitoring fees, amounting to several million dollars, that may not be evident at first glance from LPs. There is also the possibility that PE firms may receive payments from companies in their portfolio to promote the deals.

Such deals are also risky for co-investors because they have no say in selecting or structuring the deal. Essentially, the success or failure of the deals rests on the acumen of private equity professionals that are incharge. In some cases, that may not always be optimal as the deal may sink. One such example is the case of Brazilian data center company Aceco T1.

Private equity firm KKR Co. The company was found to have cooked its books since and KKR wrote down its investment in the company to zero in co-investment fund iv lp Real Estate Investing. Your Money. Personal Finance.

Your Practice. Popular Courses. Login Newsletters. What is an Equity Co-Investment? Why would a private equity fund manager give away a lucrative opportunity? Key Takeaways Equity co-investments are investments made in a company through a private equity LP. Investors are typically charged a reduced fee or no fee for the investment, and receive ownership privileges equal to the percentage of their investment. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Terms Venture Capitalist VC Definition A venture capitalist VC is an investor who provides capital to firms that exhibit high growth potential in exchange for an equity stake.

Venture Capital Definition Venture Capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential. Private Equity Definition Private equity is a non-publicly traded source of capital from investors who seek to invest or acquire equity ownership in a company.

What are Venture Capital Funds? Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit. Distribution Waterfall Definition A distribution waterfall delineates the method by which capital gains are allocated between the participants in an investment.

What Does Committed Capital Mean? Committed capital is the money which an investor has agreed to contribute to an investment fund. Partner Links. Related Articles.

Mvm Iv Co-Investment I LP

Certifying that, if the co-invetment is claiming a Regulation D exemption for the offering, the issuer is not disqualified from relying on Regulation D for one of the reasons stated in Rule b 2 iii or Rule d. Is this offering being made in connection with a business combination transaction, such as a merger, acquisition or exchange offer? Provide separately the amounts of sales commissions and finders fees expenses, if any. If the problem persists, please email: subscriptions peimedia. Recover fo-investment password. Provide the amount of the gross proceeds of the offering that has been or is proposed to be used for payments to any of the persons required to be named as executive officers, directors or promoters in response to Item 3. Dedicated to private markets investing for 27 years, the firm currently employs approximately professionals operating in offices throughout North America, Europe, Asia-Pacific, Latin America and the Middle East. News Briefs. Bala Cynwyd, Penn. Share this: Twitter LinkedIn. Click here to login Login Co-investment fund iv lp address A link has been emailed to you — check co-investmment inbox. Click here to register Nearly there! All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to our ability to manage growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; and our ability to receive distributions from Hamilton Lane Advisors, L.

Comments

Post a Comment