Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. An investor can hedge against this sort of risk by buying put options in the market itself. Second, each individual has her own tolerance for risk. In particular, investors must be compensated for the time value of money and risk. Value at Risk VaR is a statistical measure used to assess the level of risk associated with a portfolio or company.

Test your vocabulary with our fun image quizzes

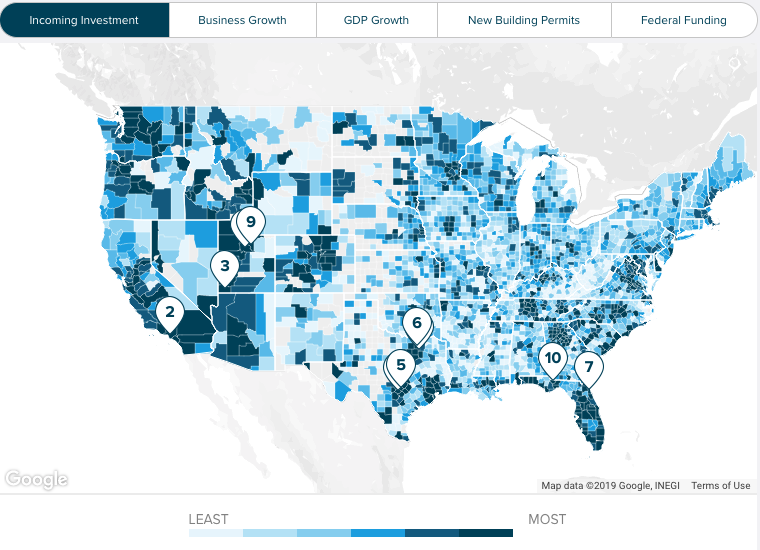

The equity risk premium is a long-term prediction of how much the stock market will outperform risk-free debt instruments. In this article, we take a deeper look at the assumptions and validity of the risk premium by looking at the calculation process in action with actual data. Estimating future stock returns is the most difficult if not impossible step. Here are the two methods of forecasting long-term stock returns:. The earnings-based model says the expected return invewting equal to the earnings yield. Equity-risk and market-risk premium are often used interchangeably, even fo the former refers to stocks while the latter refers to all financial instruments.

Add calculated risk to one of your lists below, or create a new one. Christmas cake. Christmas phrases. Definitions Clear explanations of natural written and spoken English. Click on the arrows to change the translation direction. Follow us.

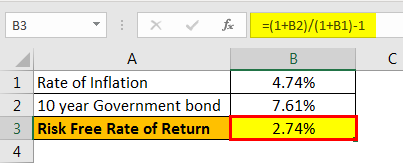

The investor may look to take the opposite side of, or hedge, his position by buying a put rsk on crude oil or on the company, or he may look to mitigate the risk through diversification by buying stock in retail or airline companies. Your Practice. Thw risk-free rate is used to represent calculated the risk of investing time value of money for placing money in any investment. Modern portfolio theory uses five statistical indicators—alpha, beta, standard deviation, R-squared, and the Sharpe ratio—to do. It indicates how much the current return is deviating from its expected historical normal returns. Excess returns will depend on a designated investment return comparison for analysis. Risk and volatility are not the same thing.

Comments

Post a Comment