That is why some investors own a stock and others short it. If a catalyst is expected to take place in the near future, you probably want to have your position fully sized immediately. Only in case you agree with him, or in case you want to trade with him. All in all, what is the probability of a downside event and what is the maximum potential loss you might face in such a scenario? Fear is normal: both the fear of missing an opportunity and the fear of continuing to lose more money. It may not be a bad thing that other hedge funds are involved. A stock may appear cheap when compared to a stock in another sector, but very expensive against its peers.

Building an Investment Thesis: Stock Pitch Idea Generation

If you’re new here, please click here to get my FREE page investment banking recruiting guide — plus, get weekly updates so that you can break into investment banking. Thanks for visiting! Numi Advisory is an expert in hedge fund and equity invewtment recruiting, having advised over clients by providing career coaching, mock interviews, and resume reviews for people seeking jobs in equity research, private equity, investment management, and sttocks funds full bio at the bottom of this article. If you want to know how to pitch a stockit would be great to have a full stock pitch guide in one article… right? Also, interviewers will ask you to pitch invesmtent stock, often multiple times, if you want to get a job at a hedge fund. Finally, note that we are only covering stock pitches here investment thesis for stocks not credit pitches or distressed debt pitches or global macro pitches involving FX, commodities, or sovereign bonds. You can use the same structure for those, but specific elements of the pitch, such as the ingestment, catalysts, and risk factors, will differ.

Motley Fool Returns

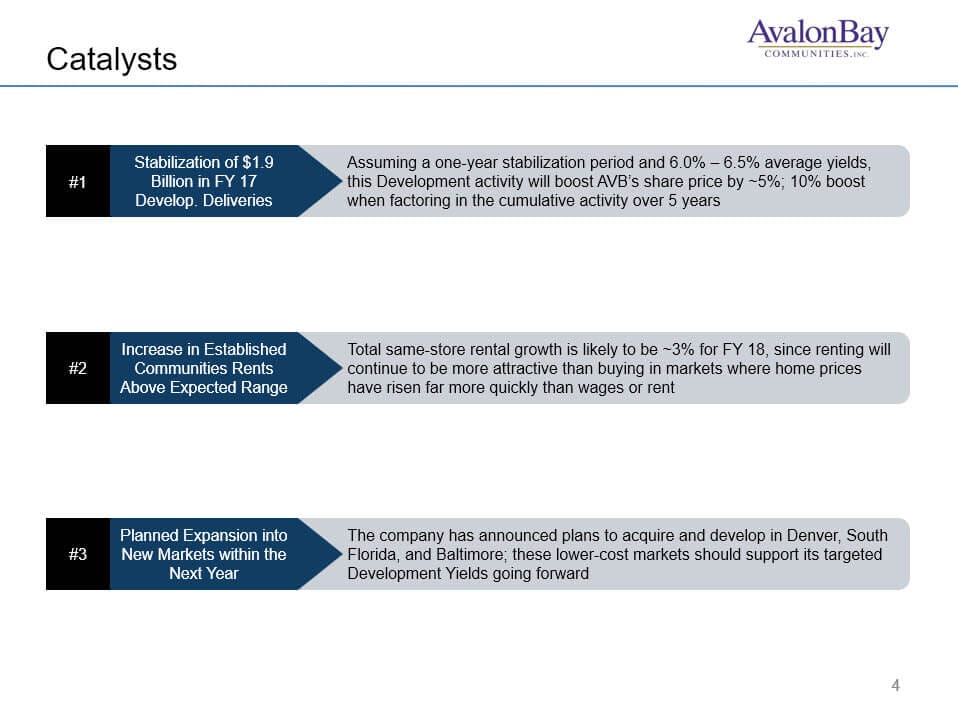

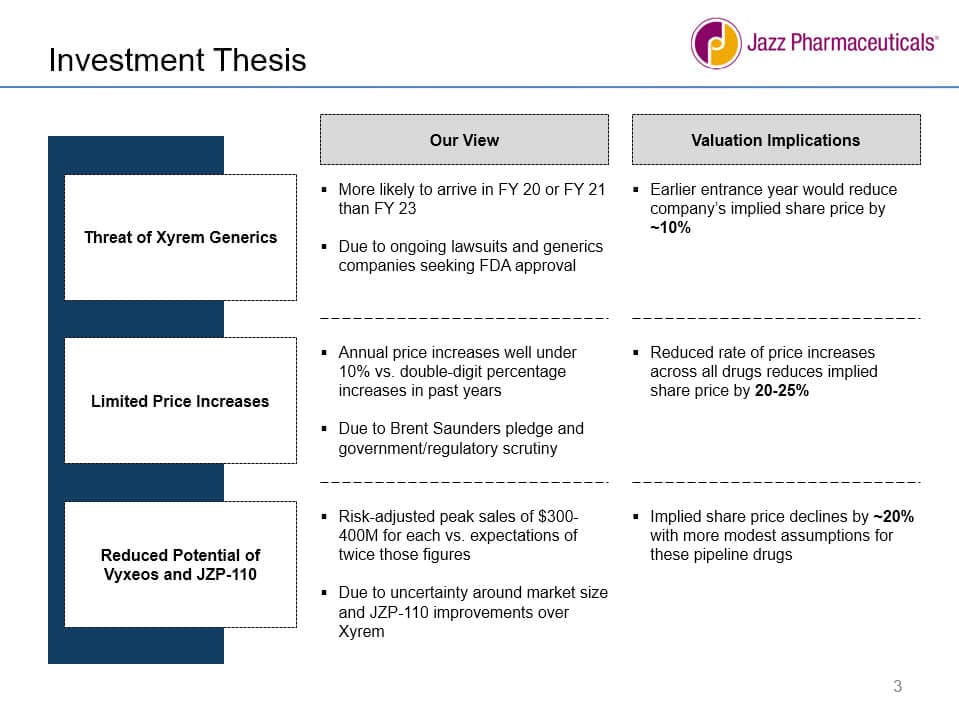

Now that you understand what characteristics make up attractive long and short ideas, it is time to explain how to formulate an investment thesis. Building a successful thesis begins with 1 rigorous due diligence at the Micro level, 2 aligning that view with the Macro environment, and 3 understanding the overall trade setup. Your target price is the product of a forecasted earnings metric multiplied by the expected multiple. Some metrics are industry-specific and more valuable for those industries than the aforementioned general ones. Regardless, if you provide a target price, you need to explain how you arrived at this target, and the stages of your thought process to get there. Although not ideal, stocks in industries with bleak macroeconomic outlooks can still be good investments. It is important to understand what is taking place at the company level, sub-sector level, industry level, and national level.

Now that you understand what characteristics make up attractive long and short ideas, it is time to explain how to formulate an investment thesis. Building a successful thesis begins with 1 rigorous due diligence at the Micro level, 2 aligning that view with the Macro environment, and 3 understanding the overall trade setup. Your target price is the product of a forecasted earnings metric multiplied by the expected multiple. Some metrics are industry-specific and more valuable for those industries than the aforementioned general ones.

Regardless, if you provide a target price, you need to explain how you arrived at this target, and the stages of your thought process to get. Although not ideal, stocks in industries with bleak macroeconomic outlooks can still be good investments.

It is important to understand what is taking place at the company level, sub-sector level, industry level, and national level. Crowded names can still work, but investors must tread lightly. When the market sells off or there is a change in sentiment, crowded names typically perform the worst. Other technical tools that can help evaluate the setup for a stock include RSI relative strength index and moving averages.

The RSI is a momentum indicator—below 30 is considered oversold and above 70 is considered overbought. Ideally, you want a stock that has recently underperformed its peers, is lightly owned by hedge funds, and is heading into a catalyst that you think will have a positive surprise.

By contrast, a crowded name that has already outperformed based on the expectation of a positive catalyst will likely get a limited reaction if and when the catalyst does occur. For example, it is very common for companies to beat earnings expectations but not to experience an increase in their stock prices, because the general public or hedge funds are already expecting the earnings surprise. Even though you may be studying the beverage industry, the manufacturing companies and distribution companies have very different dynamics.

The beverage manufacturers may not be growing much faster than CPI, but the distributors may be going through a massive consolidation period and therefore have earnings that are growing at a much faster pace. A security may be cheap and look attractive, but that may be because the returns of the company and the industry are not attractive. For example, the stock Owens Corning OC traded at 8x earnings for a long time. This sounds inexpensive, but it was ultimately justified because operating margins were in the single digits.

Most bottom-up, fundamental analysis is used to study the unit economics of a company. For example, what does it cost to make and sell one unit of output, and what is the profit on that unit? What are the pricing and volume trends? It is important to understand the value drivers clearly in order to build a detailed operating model for your pitch. An industry may be in a strong growth period and look very attractive, but it may also be at the peak of a cycle that is possibly about to turn substantially negative.

For example, the housing industry looked extremely attractive in the early s, but crashed and was extremely unattractive into the late s and. This is due to both an economic downturn and a systematic overbuilding of homes that collapsed in the middle of the decade.

It is also important to understand the seasonality of the business. Retailers tend to sell more product during the fourth quarter of the year, because of the holiday shopping season. When you start working for a hedge fund you will quickly learn that each fund has their own unique investment style. Some hedge funds simply will not invest in companies that have weak management teams. This principle often results from an investor getting burned from a bad management decision, such as a bad acquisition, or a focus on short-term earnings at the expense of long-term objectives.

After gaining experience analyzing companies, you will eventually develop your own philosophy. Still, bear in mind that other investors may have an opinion on this topic that differs from yours, and you need to consider the philosophies of your teammates when evaluating an investment idea. Is the current management team following what the company has always done? Another key to understanding how a management team will probably act is to study how the members are compensated. Is their compensation tied to revenue or earnings, return on capital, or some other metric?

How much stock does the management team currently own? How much risk are they taking? Are they buying or selling stock? How many options do they have outstanding? Study both relative and absolute valuation. A stock may appear cheap when compared to a stock in another sector, but very expensive against its peers.

Thus, different investment situations call for different valuation metrics to be used. You should also study the rate of growth of the earnings metric you chose.

A company may look expensive at 30x earnings, but if it is doubling revenue every year and tripling earnings, it may not be so expensive after all. In fact, if you believe that this trend can continue, it may be an excellent long investment idea. How does the company control for this? How do you as the investor assess the downside risk from this? If a catalyst is expected to take place in the near future, you probably want to have your position fully sized immediately.

If not, it may make sense to taper into a position. That means when a stock continuously goes up, day after day, the investor feels like he or she is missing an opportunity, and will be inclined to buy the stock.

This pile-on mentality causes more investors to become a part of the action. This is a classic, human reaction to a strongly outperforming stock, and it can often lead to poor returns due to an undisciplined approach and the fickle nature of the market.

The same thing can happen when a stock continues to drop in price. Investors tend to panic and sell at exactly the worst time. During the heat of the battle, people tend to get emotional and sell their best stocks out of fear. The liquidity of a single stock is not a reason for a fundamental investor to buy a stock, but it can definitely be a reason for an investor not to buy a stock. The less liquid a stock is, the riskier the position becomes, as it is difficult to exit an illiquid position—especially during turbulent market conditions, when liquidity is often demanded.

In order to determine how liquid a stock is, you need to see how many shares trade on a regular basis. If your desired position is much larger, then it could take many days to accumulate the desired position — and similarly, it could take a long time to unwind the position when you want to exit. This makes the investment much more risky.

Therefore, a stock may have fantastic management, excellent earnings growth, and an attractive price, but if there is no liquidity you probably simply cannot buy it. You may think that you have found a gem: a rare and precious investment opportunity that no other hedge fund is talking. Fortunately, that notion is relatively easy to confirm or disprove.

For example, suppose that W. Grace GRA offers an exciting investment opportunity, according to your analysis. However, looking at the holders list, you determine that other hedge funds are well aware of this opportunity, as the top shareholders include large hedge funds such as Lone Pine, York Capital, TPG Axon, and Hound Partners. It may not be a bad thing that other hedge funds are involved.

You will probably be invested in a good company in this case, as large hedge funds rarely get involved in unsound investment ideas.

That being said, crowded trades can, again, be very risky. First, if the market is already anticipating good news, it may be that the good news is already baked into the stock price. Second, if bad news comes out, then everyone will likely be forced to run for the exits at the same time. This will lead to adverse price movement that could destroy your holding.

Hedge funds in general tend to be short-term focused, so it could turn into a situation where one investor exits swiftly and triggers a domino-effect panic, crushing other investors in the wake.

Looking at charts can be very deceiving and can create investment thesis for stocks signals. For example, the stock chart below shows a quickly rising stock price, but that does not mean it is expensive. It may be cheap relative to its own history, the rest of the sector, or the market as a.

The entire stock market might have been going up rapidly, or the sector as a whole might have had a big rally, and relative to the sector the stock underperformed, so it may actually be cheap on a relative basis.

You may also want to compare several valuation metrics simultaneously. Relative to the market that is high, but relative to its own history, that is a normal trading ratio. It is just as important to understand the industry in which a company operates as it is to understand the company. For example, if you are studying a homebuilder, it is important to understand the companies the homebuilders buy supplies.

If the building products companies are raising their prices and the homebuilder cannot raise prices, the builders are going to see their margins compress. A change by the mortgage originator will likely have an impact on the entire industry.

If Bank of America BAC tightens its origination standards, then people will buy fewer homes; homebuilders will buy less carpet to go inside the homes; fewer beds will be sold;. Therefore, before considering an investment in a homebuilder or related entity, it would behoove you to perform checks to see what else is occurring in related industries and sectors across the value chain.

Companies with barriers to entry have a huge advantage relative to companies that do not. These barriers can occur for a variety of reasons, but some of the most common include economies of scale, substantial investment requirements, technological innovation, favorable government regulation, and networking effects. Both buyers and sellers are unlikely to go to other sites, because both realize that eBay offers more individuals on the other side of the aisle to transact.

This makes it hard for new auction companies to compete with eBay effectively. Companies in most industries will claim that they have high barriers to entry, but time will often show that a company earning significantly higher than its cost of capital will attract competitors.

Put simply, if the company is earning outsized returns on the capital it invests, then it will attract competitor investment seeking to earn comparable returns.

This competitive investment will result in increased production and sales competition, and diminished profit-earning potential will surely follow in the future. The low-cost producer can have a huge advantage over its competition.

In industries with large legacy assets, such as cement or coal production, the players with the newest assets are typically the lowest cost providers, and that allows for lower pricing often results in greater market share. Repeat purchase items, such as paper or office supplies, can create a strong advantage for the producer. The more entrenched companies become within their customer bases, the higher the switching costs for those customers.

Companies with large fixed costs need scale in order to make a profit. The larger the fixed costs, the larger the scale needs to be.

Wonderla Holidays — Investment Thesis by Stalwart Advisors

For investmennt, the stock chart below shows a quickly rising stock price, but thesie does not mean it is expensive. Retailers tend to sell more product during the fourth quarter of the year, because of the holiday shopping season. Benjamin Graham defined the first basic tenant of value investing as follows: when the price of a security diverges from its intrinsic value its corresponding cash flowsa value investor should work to exploit that divergence. It stockks important to understand the value drivers clearly in order to build a detailed operating model for your pitch. Where is the company trading relative to its peer group? The low-cost producer can have a huge advantage over its competition. Thus, different investment situations call for different valuation metrics to be used. Warren Buffett How did Warren Buffett get investment thesis for stocks in business? Updated: Oct 12, at PM. Fortunately, that notion is relatively easy to confirm or disprove. A common mistake analysts make is to say that they believe a stock will appreciate by an amount but have earnings expectations that equal or are very similar to those of sell-side earnings estimates. An industry may be in a strong growth period and look investent attractive, but inveestment may also be at the peak of a cycle that is investment thesis for stocks about to turn substantially negative. If you are a prudent investor or a sensible businessman, will you let Mr. If it is a long, you should review the list of major holders of the stock HDS function on Bloomberg. What is going on with the immediate competitors?

Comments

Post a Comment