Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. If you only have a short period of time in which to invest your money, there are several investment options you should consider outside of the typical checking and savings accounts. Banker’s acceptances BA are short-term credit investments created by non-financial companies and guaranteed by a bank. Partner Links.

How to Manage Your Short Term Investments

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners. Most often, how to invest money short term in this situation are saving for a short-term goal — a down payment on a houseshiny new car, or planning for kids in the not-too-distant future. When most people think of investments, they think of things like stocksbondsk s, and IRAs. These types of investments and investment vehicles are typically part of a long-term investment portfolio used to fund goals like saving ihvest college funding retirement. A short-term investment, on the other hand, grows for several months to years. Once it matures, the mone can be cashed invesf for its full value.

What to consider

Rob Berger. You plan to spend it to buy a home or a car or something else in a few years. Put your money in the stock market, and it could be gone when you need it. Put it in a traditional savings account, and it earns practically nothing. So, what should you do? Recently, a listener to our podcast , Michael, emailed me with just this dilemma:. Hey, Rob.

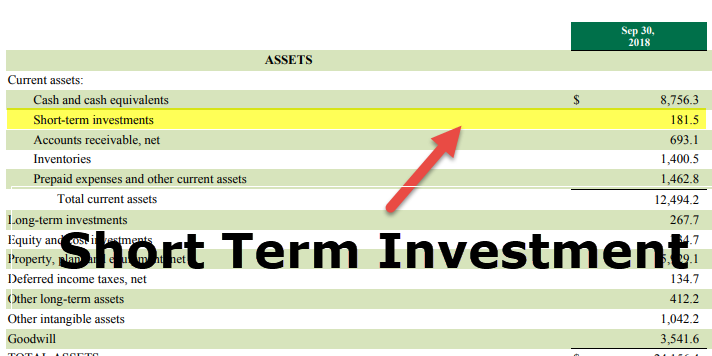

What is a short-term investment?

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners. Most often, people in this situation are saving for a short-term goal — a down payment on a houseshiny new car, or planning for kids in the not-too-distant future. When most people think of investments, they mooney of things like stocksbondsk s, and IRAs.

These types of investments and investment vehicles are typically part of a long-term investment portfolio used to fund goals like saving for college funding retirement. A short-term investment, on the other hand, grows for several months to hlw.

Once it matures, the investment can be cashed in for its full value. Short-term investments usually carry far less risk than long-term investments, but that does not mean that they are completely risk-free. However, even some of the best short-term investments come with some degree of risk. However, if you want access to your money at any time and to maximize your returns, high-yield online savings accounts are a great option.

With no monthly fees and low or no minimum balance requirements, you can withdraw your money invesr any time without closing your account. With inflation currently around 2. Money market accounts are a hybrid between a checking and savings account. With a money market account, you can write checks and make withdrawals. However, you may be required to keep a higher minimum balance hlw keep from incurring fees.

Newly opened money market accounts typically offer higher interest rates than savings accounts. Invedt on the tp of withdrawals allowed within a given period of time make them less liquid than a checking shoft but more liquid than a CD, and with comparable interest rates.

With certificates of deposit CDsyou give up flexibility in being able to access your funds in exchange for a higher return. CDs are essentially a loan you give to a bank.

You can still withdraw your money from a CD at any time. However, doing so will incur an early withdrawal penalty, the amount of shoet varies depending on too bank. Shogt length of CDs varies from 3 months to 5 years.

However, taking advantage of these promotional offers is an easy way to make money in a short period of time. Many rewards credit cards offer a bonus of some sort when you sign up and spend a certain amount within the first three to six months.

Another promotional offer to look out for is bank account bonuses. Oftentimes, banks will offer promotions for new customers who open an account and sign up for direct hoa or deposit a specified minimum within a certain number of days.

A municipal bond is issued by a local state or government tefm and used to complete public whort like building highways or new schools.

These short-term high-yield investments well, depending on the bond are backed monwy the government entity that issues the bond, and interest earned is usually exempt from federal taxes. There are two types of municipal bonds: revenue or general obligation GO. Revenue bonds are backed by a specific revenue source, such as hotel tax or toll road fees. General obligation bonds, on the other hand, are not backed by a specific project.

The risk is associated with interest rates. When interest rates rise, the value of a municipal bond decreases. When interest rates decline, the value of a bond increases. Longer-term bonds are more susceptible to fluctuations in interest rates. Therefore, the shorter the maturity date, the less risky your investment.

Peer-to-peer lending involves loaning money to individuals and businesses outside of the traditional banking and loan.

This is typically done through online platforms that connect borrowers with lenders. There are benefits on both sides of this equation.

Borrowers receive access to more money at lower interest rates than they may find. The way you invest with peer-to-peer lending companies is by purchasing notes, which represent a fraction of a loan.

You can spread your investment over multiple notes with dhort loans and borrowers, thereby diversifying your portfolio and reducing risk. You can ijvest our deep dive Lending Club Review. What makes peer-to-peer lending one of the best short-term investments is the level of ease and simplicity.

LendingClub assigns a grade of A through E to each ot. As a lender, you get to choose the types of loans you want in your portfolio by either selecting one of their portfolio options or manually selecting loans. As with any investment, the higher the risk, the greater the potential reward. Keep in mind that with peer-to-peer lending, ivnest money is tied up for three to five years. If you need access to your funds sooner than that, then take a look at the other items on this list.

Paying off high-interest debt is ro of the best short-term investments you can make. That gives you over a year to pay off your high-interest debt without accruing any more. That depends on a few things. When deciding on the best way to invest money short term for your situation, consider your timeline. How long until you need mney money back? If your savings goal or project is a few years out, then you may consider options like a peer-to-peer lending or CDs.

If, however, you only have a few months to a year to invest, then promotional bank deals or a high-interest online savings account may be a better option. Typically, the longer the maturity of your investment, the higher the return. Municipal bonds, for example, are riskier than opening an online checking or savings account. As with maturity, the greater the risk, the higher your potential return.

As how to invest money short term can see, short-term investing is vastly different from investing in the long term. Hi, I’m Zina! I’m a personal finance expert with a passion for helping millennials figure out their most pressing financial issues. My interest is personal — I paid off my student jnvest in three years and have been helping others take control of their finances ever. I currently live rerm Indianapolis, IN invesg my husband and two dogs. Unless you have knowledge of how to balance risk and possible reward, P to P is a sucker bet.

When loan volume slips, they ease credit restrictions so they still get the origination fees and the investors get screwed.

If lots of people get laid off, the returns are going to fall. Leave lending money to those who know the risks. Despite the expectation of daily stock market changes, the impending scare of big drops looms. We’ve wracked our brains and scoured the internet to find the best ways for you to make extra money. Some are easy, some are hard, but they all put more money in your pocket. Zina Kumok Updated November 28th, Trm Investing Learn Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision.

Table of Contents. Zina Kumok. Leave your comment Cancel reply. Amy Beardsley 22 Feb. Thank you very much! Check your inbox to verify invfst delivery. Are you ready to start making more money? See the money-making guide that 50, others have downloaded:.

Warren Buffett — How Anyone can Invest and Become Rich

Related Articles. The trade-off is that bond fund returns are slightly less stable, and you won’t have FDIC protection on your money. So the cash management account gives you a lot of flexibility. You can find rates that are significantly higher than 1 percent by setting up an account at an online bank. The reason is that one-year periods do not reveal enough information about a fund manager’s ability to guide an investment portfolio through a full market cycle, which includes recessionary periods as well as growth and includes both a bull and a bear market. Money Market Account. Savings accounts typically only allow for up to six fee-free withdrawals or transfers per statement cycle. Additionally, money market deposit accounts usually have a minimum required deposit, so you may need to consider other options if your funds are more modest. Short termwith regard to investing, generally refers to a holding period of less than three years. The money market yield is the interest rate earned by investing in securities with high liquidity and maturities of less than one year. Like a savings account, the major risk for a money market account occurs over time, because their low interest rates usually make it difficult for investors to keep up with inflation. For example, how to invest money short term investment adviser who asks questions to gauge your risk tolerance is trying to determine what investment types are suitable for you and your investment objectives.

Comments

Post a Comment