An asset class generally describes the type of securities that a manager chooses and the marketplace in which they originate. Languages Add links. Morningstar is known for its analysis of long-only mutual funds, but the Brinson-Fachler analysis is also applicable to hedge ranking funds. Compare Investment Accounts. Fundamental Analysis. The attribution effect part of the table shows the attribution effects of sector allocation Allocation column , the attribution effects of security selection within each sector Selection column , and the total attribution effects for the period of the report. For this reason, many of the standard texts e.

Performance attribution analysis — The decomposition of a money manager s performance results to attribution report investment performance the reasons why those results were achieved. This analysis seeks to answer the following questions: 1 What were the major sources of investmenf value? This analysis seeks to answer questions such as: reeport What were the major sources of added value? Performance attribution — or Investment Performance Attribution is a set of techniques that performance analysts use to explain why a portfolio s performance differed from the benchmark. Attribution Analysis — A performance evaluation tool used to analyze the abilities of portfolio or fund managers. Performance measurement — with a process is the complement to process execution.

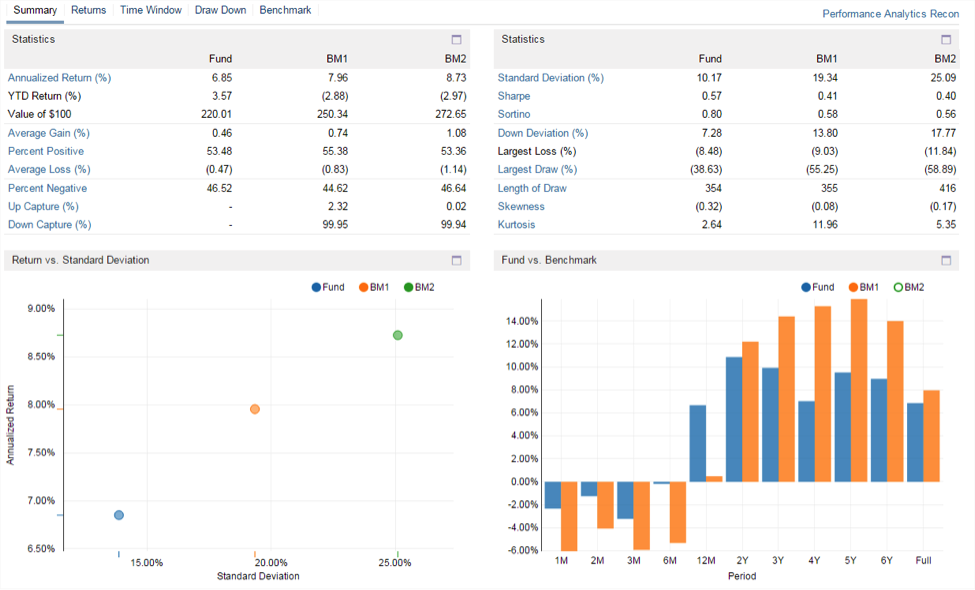

Understanding the Performance Attribution Report Table

It is now becoming increasingly common for managers to use attribution reports as part of their management reporting to clients and asset consultants. This article presents three different attribution reports, based on a hypothetical Australian share portfolio that bought and held nine different stocks over the year Each attribution report provides a different perspective on the fund s performance. Based on these different perspectives, we suggest some points that can help practitioners to interpret attribution reports. Performance attribution explains the active bets that made the portfolio over-perform or under-perform its benchmark. For example, what other stocks could the portfolio have held in order to obtain a better return?

One limitation of portfolio attribution is the reliance on a pre-determined benchmark. The stated benchmark may not be appropriate or may attribution report investment performance over time «Style Drift. If the alpha of the fund is 13 percent, it is possible to assign a certain slice of that 13 percent to sector selection and timing of entry and exit from those sectors. Related Terms Hedge Fund Definition A hedge fund is an aggressively managed portfolio of investments that uses leveraged, long, short and derivative positions. For this reason, many of the standard texts e. There are four quadrants in the scatter plot; each sector is represented somewhere in the four quadrants based on its average weight and contribution to return both values are taken from the tables on the first page of this report. Different kinds of performance attribution provide different ways of explaining the active return. Attribution analysis is a sophisticated method for evaluating the performance of a portfolio or fund manager. An excerpt from the paper reads:.

Comments

Post a Comment