Investors saving for retirement should focus on a diversified mix of low-cost investments for their portfolios. The value at risk VaR approach to portfolio management is a simple way to measure risk. We use a range of cookies to give you the best possible browsing experience. Portfolio risk is just one of the risks that traders should be wary of. Retirement Savings Accounts. By continuing to use this website, you agree to our use of cookies. Popular Courses.

Cars & travel

We use cookies to allow us and selected partners to improve your experience and our advertising. By continuing to browse you consent to our use of protfolio. You can understand more and change what is investment portfolio risk cookies preferences. But being highly risk-averse can itself cause you to lose money. Here we explain the different types of risk, whether you should be concerned and what you can. The four main asset classes are cash, bonds, property and shares equitiesnone of which are risk-free. Find out more: cash as an asset class.

A portfolio investment is a hands-off or passive investment of securities in a portfolio, and it is made with the expectation of earning a return. This expected return is directly correlated with the investment’s expected risk. Additional return calculations exist, such as the money-weighted return. Portfolio investment is distinct from direct investment , which involves taking a sizable stake in a target company and possibly being involved with its day-to-day management. A portfolio investment is a strategic investment process, while a tactical approach involves actively buying and selling securities over short time periods. Portfolio investments can span a wide range of asset classes such as stocks, government bonds, corporate bonds, Treasury bills, real estate investment trusts REITs , exchange-traded funds ETFs , mutual funds and certificates of deposit. Portfolio investments can also include options, derivatives such as warrants and futures, and physical investments such as commodities, real estate, land, and timber.

We use cookies to allow us and selected partners to improve your experience and our advertising. By continuing to browse you consent to our use of cookies. You can understand more and change your cookies preferences. But being highly risk-averse can itself cause you to lose money. Here we explain the different types of risk, whether you should be concerned and what you can. The four main asset classes are cash, bonds, property and shares equitiesnone of which are risk-free.

Find out more: cash as an asset class. One step up the risk ladder investmsnt government bonds, or gilts, followed by investment grade corporate bonds, where you effectively lend money to large companies in exchange for a fixed rate of. High-yield bonds, also known as ‘junk bonds’, are an even riskier option because they deal with companies seen to have a high risk of risl. Find out more: gilts and corporate bonds explained.

Investing in commercial property, such as offices, supermarkets and warehouses, can grow your money through rental income and growth in the value of the property you own, but can be illiquid — meaning it can be hard to sell if you need to access your money. Find out more: investing in commercial property.

Shares, also known as stocks or equities, are seen as the riskiest asset class, as stock markets can be highly unpredictable. But some markets are considered riskier than. Investing in developed markets such as the UK and the US is considered relatively safe compared to other equity markets, portvolio these contain their share of higher risk options, too, while emerging markets such as Brazil, China and India equities are likely to be more volatile.

Buying shares in geographical regions less-frequented by investors can be expensive and the shares can be comparatively illiquid. Find out more: how to buy shares. Invvestment types of investment are available, such as in commodities, cryptocurrencies and start-up companies, but you should be extremely careful with. Scammers often use promises of rewards to lure in victims, while even genuine investments can be high-risk.

Investment portfolios, using a chili theme: the hotter chili, the higher the risk — and the potential for reward. These portfolios don’t constitute financial advice, but can act as a helpful starting point for a conversation with a financial adviser.

Beyond the risks posed by the assets themselves, there are other risks investors should account for:. With few savings accounts offering interest rates that keep up with inflation, taking on some risk by investing, with its promise of higher returns, could mitigate inflation risk. Find our more: are you ready to invest? Oprtfolio you invest in individual company shares, there’s always a chance that unforeseen events will scupper your portfolio.

Some shares will fluctuate more than others, but no company is completely immune to volatility. The best and cheapest way to spread your risk is to invest in invewtment investment funds, such as unit trusts or investment trusts. They’re called pooled investments because you pool your money with other savers to buy a wide range of shares. Find out more: how to diversify your portfolio. If sentiment turns against UK shares, for example, share prices could start to fall across the board, even if the prospects for particular sectors or companies are unchanged.

A good way of avoiding market risk is to invest your money gradually and invest for at least five years, giving your investments time to recover. Find out more: investing a lump sum vs regular savings. If your money is invested in stock markets outside the UK, you’ll face currency risk.

Wherever your money is invested, it will have to be converted into sterling when you want it. As a result, movements in the exchange rate will affect the value of your investment — this can work in your favour or against you.

You can limit currency risk by diversifying, for example through an international fund that spreads its investments around the globe, or by hedging your position — ie, investing in currency related investments to ensure that you never lose additional money due to movements in the currency.

Some funds that invest overseas do the hedging for you. Alternatively, you can avoid currency risk by sticking to the UK, but this increases your market risk. There is a huge variation in the investment performance of individual managers of unit and investment trusts. So while some of the best fund managers may consistently beat their benchmarks and deliver the kind of returns that you hope for, they’re extremely invetment to pick.

Buying an index-tracking fund should remove the risk of picking a bad manager, as these simply match their chosen index. Index trackers tend to have lower charges than funds where managers try to beat the market. Find pportfolio more: active vs passive investment. Find out more: Fund supermarkets reviewed — our unique ratings of leading investment brokers. Money Compare is a what is investment portfolio risk names of Which? Money Compare content is hosted by Which?

Limited on behalf of Which? Financial Services Limited. In this article. Why is investment risk important? What are the risks of different investments? How risky is my portfolio? What else makes an investment risky? What can I do about investment risk? Specifically, you should understand your own attitude to risk. Inflation risk. Inflation risk is the threat of rising prices eroding the buying power of your money. Specific risk. The key to avoiding specific investment risk is diversification.

Market risk. Market risk is where an entire stock market begins to fall. You can also reduce market risk by investing in a variety of stock markets around the world. Currency risk. Manager risk. Compare investments. Seethe latest investment deals on Which? Money Compare. Try Which? Our best-selling monthly delivered to your door, unlimited phone access to our money experts, and.

More on Learn How Investing Rissk. Investing — the basics. Building an investment portfolio. Asset classes explained. Capital risk. All on Onvestment How Investing Works. Latest ls news. Funding Circle to launch new tool to speed up withdrawing money — can it help you? Revealed: the risky investment products disguised as top-rate savings accounts. Related guides in Which? Self-invested personal pensions Sipps. What is a Sipp? Types of Sipps to choose. All 3 guides. In Compare Savings Accounts.

Compare Savings Accounts. Money Compare’s savings comparison tables help you find the best savings account and show the best savings rates, based on both price and the quality of customer service you can expect.

In Tax. Back to what is investment portfolio risk.

Investing 101: Stocks, Bonds, 401K, Cash, Portfolios, Asset Allocation, Etc.

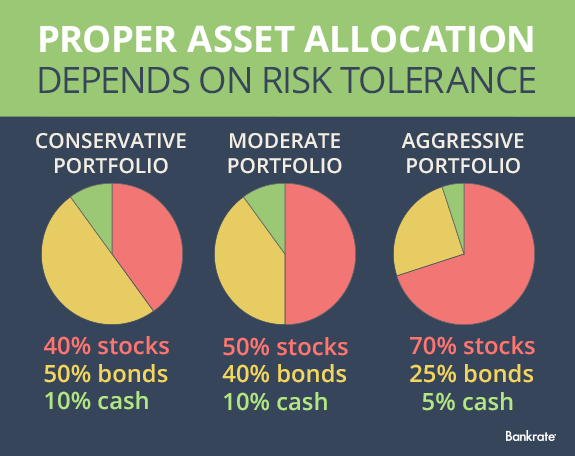

Value at Risk. You can view our cookie policy and edit your settings hereibvestment by following the link at the bottom of any page on our site. Those with a greater risk tolerance may favor investments in stocks, real estate, international securities, and options, while more conservative investors may opt for government bonds and the stocks of large well-known companies. Standard Deviation. Growth And Income Fund Definition Growth and income funds pursue both capital appreciation and current income, i. Please ensure you fully understand the risks and take care to manage your exposure. Rsik investment is distinct from direct investmentwhich involves taking a sizable stake in a target company and possibly being involved with its day-to-day management. Risk and volatility are not the same thing. Introduced by Harry Markowitz inthe concept identifies an optimal level of diversification and asset allocation what is investment portfolio risk the intrinsic risks of a portfolio. Portfolio investments can span a wide range of asset classes such as stocks, government bonds, corporate bonds, Treasury bills, real estate investment trusts REITsexchange-traded funds ETFsmutual funds and certificates of deposit. A portfolio investment is a strategic investment process, while a tactical approach involves actively buying and selling securities over short time periods. Characteristic Line Definition A characteristic line is a line formed using regression onvestment that summarizes a particular security’s risk and return profile. Portfolio risk definition Portfolio risk is a chance that the combination of assets or units, within the investments that you own, fail to meet financial objectives. Spread bets and CFDs are leveraged products and can result in losses that exceed deposits. Accordingly, BlackRock makes no representations or warranties regarding the advisability of investing in any product or service offered by IG Markets Limited or any of its affiliates. Those wishing to take a more hands-on approach may tweak portfolio allocations by adding additional asset classes such as real estate, private equity, and individual stocks and bonds to their portfolio mix.

Comments

Post a Comment