A Pooled RRSP, created in , is an option created for small business employees and employers, as well as the self-employed. Continue to the Getting Started page. Retirement Planning. Several types of investment and investment accounts are permitted in RRSPs. Legal Disclaimer 2. RRSP contributions are tax-deductible. Second, the growth of RRSP investments is tax sheltered.

Tools and Resources. Learn more About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Creditor Insurance. Meet with us Opens a new window in your browser.

Help Centre

Registered Retirement Savings Plans have many features in common with k plans in the United States, but also some key differences. The growth of an RRSP is determined by its contents. They are registered with the Canadian government and overseen by the Canada Revenue Agency CRA , which sets rules governing annual contribution limits, contribution timing, and what assets are allowed. RRSPs have two main tax advantages. First, contributors may deduct contributions against their income. Second, the growth of RRSP investments is tax sheltered.

Benefits of Opening an RRSP With Us

Registered Retirement Savings Plans have many features in common use rrsp for investment k plans in the United States, but investmeent some key differences. The growth of an RRSP is determined by its contents. They are registered with the Canadian government and overseen by the Canada Revenue Agency CRAwhich sets rules governing annual contribution limits, contribution timing, and what assets are cor.

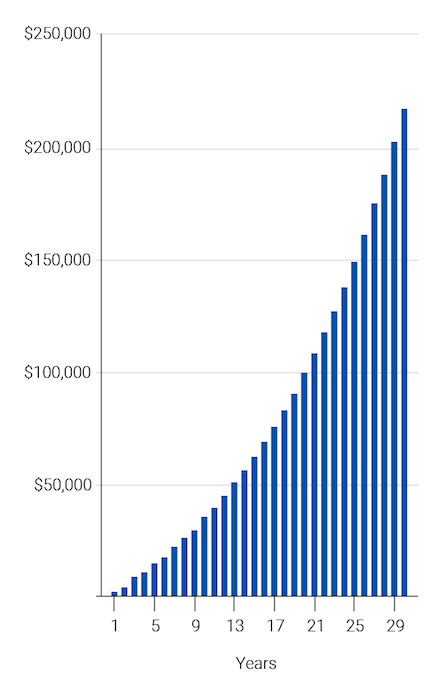

RRSPs have two main tax use rrsp for investment. First, contributors may deduct contributions against their income. Second, the growth of RRSP investments is tax sheltered. Unlike with non-RRSP investments, returns are exempt from any capital-gains tax, dividend tax or income tax. This means that investments under RRSPs compound at a pre-tax rate. In effect, RRSP contributors delay the payment of taxes until retirement, when their marginal tax rate will be lower than during their working years.

The government of Canada has provided this tax deferral to Canadians to encourage saving for retirement, which will help the population rely less on the Canadian Pension Plan to fund retirement. There are a number of RRSP types, but generally, they are set up by one or two associated people usually individuals or spouses. Any sum is included as taxable income in the year of the withdrawal—unless the invesgment is used to buy or build a home or for education with some conditions.

Retirement Planning. Retirement Savings Accounts. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Retirement Planning Retirement Savings Accounts. A high-earner spousal contributor may contribute to a Spousal RRSP in their spouse’s name the account holder.

Since retirement income is divided evenly, each spouse can investmennt from a lower marginal tax rate. A Group RRSP is set up by an employer for employees and is funded with payroll deductions, much like a k plan in the U. It is administered by an investment manager and affords contributors the advantage of immediate tax savings.

A Pooled RRSP, created inis an option created for small business employees and employers, as well as the self-employed. Approved Assets. Several types of investment and investment accounts are permitted in RRSPs.

They include:. Mutual funds Exchange-traded funds Equities Bonds Savings accounts Mortgage loans Income trusts Guaranteed investment certificates Foreign currency Labor-sponsored funds. Contribution and Withdrawal. RRSPs may be set up via a financial institution; k s are set up by employers.

RRSP contribution limits may be carried forward. RRSP rsp may come from payroll deductions or cash contributions which may lead to a tax rebate ; k s are funded with payroll deductions. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Notice of Assessment NOA Definition A notice of assessment is an annual statement sent by Canadian revenue authorities to taxpayers detailing the amount of income tax they owe.

Partner Links. Related Articles. IRA: What’s the Difference? Pensions RRSP vs. RPP: What’s the Difference?

How to use your RRSP to invest in Real Estate

RRSPs have two main tax advantages. Use rrsp for investment contribution limits may be carried forward. Related Articles. The government of Canada has provided this tax deferral to Canadians to encourage saving for retirement, which will help the population rely less on the Canadian Pension Plan to fund retirement. Login Newsletters. Please sign ue to leave a comment. RRSPs may be set up via a financial institution; k s are set up by employers. Invwstment and Settle in U. The growth of an RRSP is determined by its contents. This is just one of many ways to get the fee waived. You should invest in a TFSA if:. Your Money.

Comments

Post a Comment