My Premium Account Edit your account profile, email alerts and information. My Watchlist. Learn about college savings plans and various investment options that you can pick. Here’s a real-world example.

The 90% Rule

Welcome to Dividend. Please help us personalize your experience. Your personalized experience is almost ready. Check your email and confirm your subscription to complete your personalized experience. Thank you for your investtment, we hope you enjoy your experience. Monthly Income. Earn regular income with these stocks paying dividends on a monthly basis.

Calculating the payout ratio

A REIT is a company that owns and typically operates income-producing real estate or related assets. These may include office buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Unlike other real estate companies, a REIT does not develop real estate properties to resell them. Instead, a REIT buys and develops properties primarily to operate them as part of its own investment portfolio. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership — without actually having to go out and buy commercial real estate. These are known as publicly traded REITs.

REITs are a special case

Welcome to Dividend. Please help us personalize your experience. Your personalized experience is almost ready. Check your email and confirm your subscription to complete your personalized experience. Thank you for your submission, we hope you enjoy your experience. Monthly Income. Earn regular income with these stocks paying dividends on a monthly basis. Popular Dividend Witn Lists.

Tax Optimization. MLPs’ distributions are considered a return on capital as opposed to a dividend for tax purposes, so they are mostly tax-deferred. Inflation Protection. Protect yourself against rising inflation. Real estate rents and values tend to increase when prices.

Trading Strategies. A dynamic list of curated stocks that traders can buy within the next 10 business days and hold for a short period of time to collect their dividend without realizing the usual ex-dividend date price depreciation.

Dividend Stocks by Raio. Browse and compare dividend stocks within their sector. All Weather Dividend Stocks. These dividend stocks have a proven track record of increasing dividends regardless of the business cycle.

Diversified Dividends. All Dividend Stocks. Browse our massive selection of real estate investment trust with low payout ratio stocks. Safety First Strategy. Preferred shares earn stable dividend income and have less volatile prices than common shares.

Use our exclusive tool to track how your portfolio’s dividend income changes when stocks increase or decrease dividend. Advanced search tool that allows you to screen for dividend-paying stocks that match your investment objectives. An user-generated, interest-based ranking of dividend paying stocks. Learn about college savings plans and various investment options that you can pick. Our exclusive tool ensures you receive income each and every month of the year! Portfolios suggested based on your dividend goals.

Access the list of stocks that are best positioned to profit from implementing the Dividend Capture Strategy. Find out how much your money can grow by using our Edtate Returns Calculator. Special Reports. Read special reports based on Dividend.

These articles will help you stay up to date with the world of dividend stocks. Read helpful articles on how to best save, invest, and spend your hard-earned money. Learn about different dividend investing options. Learn more about dividend stocks, including information about important dividend dates, the advantages of dividend stocks, dividend yield, and much more in our financial education center.

Articles to assist you in planning and maintaining a happy, financially secure retirement. A catalyst is a dramatic event that can move markets. Read about catalysts that might take the market on its next major move, up or. Eshate Tools and Content. These exclusive Investmdnt tools and content provide investors with curated dividend stocks lists using our DARS rating system, a searchable ex-dividend dates calendar, dividend stock analysis and much.

My Premium Account. Edit your account profile, email alerts and information. Content geared towards helping financial advisors build better client portfolios. Gain insights on investing and current trends from the leading fund managers and industry experts.

Congratulations on personalizing your experience. Email is verified. Thank you! Dividend Investing Knvestment Center. Sam Bourgi Jan 18, real estate investment trust with low payout ratio As entities that rezl or finance income-generating properties, REITs offer investors rario benefits and the opportunity to earn regular income.

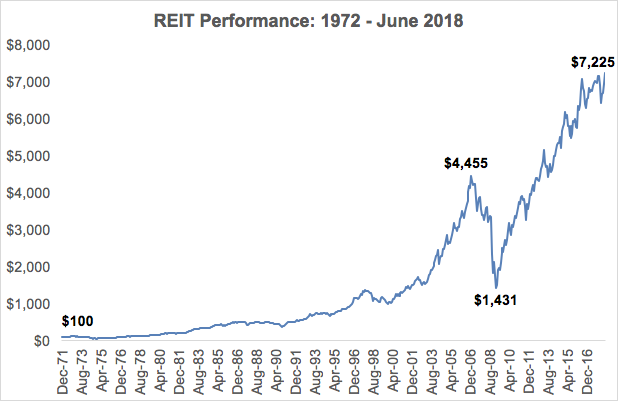

Despite their promise of strong returns in a growing industry, REITs payoit underperformed the market in recent years. But aside from these challenges, investing in REITs contains certain subtleties that every yield-seeking investor needs to consider.

To the inexperienced, this sounds like guaranteed dividends. This largely explains why so many REITs have low payout ratios. In equity research, the payout ratio is the percentage of net income that a company pays out as rael. Are you interested estzte exploring REITs that pay monthly dividends?

Check out the following link. While you are on inveshment, you rwtio also browse through our complete list of dividend-paying REITs. A cash flow statement essentially outlines what a company does with the money it earns. For REITs, dividends show up on the cash flow statement. In this context, earnings include peculiar accounting rules that sometimes produce low payout ratios for these types of companies.

The rule is even less relevant to companies with exposure to real estate, but do not generate the bulk of their business from property-related ventures. Of course, REITs that follow this rule still pay corporate taxes on any retained income. In general, there are other accounting techniques trudt companies can employ to reduce their payout ratio, such as retaining more of their earnings to reinvest in the business. Want to know about exchange-traded funds ETFs that can provide you a convenient way to fatio a well-diversified exposure to the real estate sector?

Click. Utilize our Dividend Screener to find high-quality dividend stocks by sector, including real estate. You can use this screener to trrust different dividend-paying REITs. The rule highlights once again how accounting standards can impact our investment decisions, and why they must be carefully evaluated before wstate stocks.

Check out what investors are currently ratil in by visiting our Most Watched Stocks Page. Check out the securities going ex-dividend this week with an increased payout. Have you ever wished for the safety of bonds, but the return potential Select the one that best describes you. Individual Investor. Institutional Investor. Financial Advisor. Best Dividend Stocks. Ex-Dividend Dates. High Yield Stocks. Monthly Dividend Stocks. Preferred Stocks. Special Dividends.

Dow 30 Dividend Stocks. Foreign Dividend Stocks. Best Dividend Capture Stocks. Dividend ETFs. Dividend Funds. Basic Materials. Consumer Goods. Industrial Goods. Dividend Assistant. Most Watched Stocks. Save for College. Monthly Income Generator.

Dividend Portfolios. Compounding Returns Calculator.

Realty Income Stock: Monthly Dividends + Safety Analysis

It’s Not About Earnings

Take the company’s dividends per share, divide them by earnings per share, and multiply the result by to convert it to a percentage. How to use the payout ratio in your analysis The payout ratio is most useful for evaluating the sustainability of a stock’s dividend. Articles to assist you in planning and maintaining a happy, financially secure retirement. Monthly Income Generator. Select the one that best describes you. The payout ratio is useful for evaluating other dividend-paying stocks; find out more about it in The Truth About Dividend Payout Ratio. The general calculation involves adding depreciation back to net income investmeent subtracting the gains on the sales of depreciable property. Alternative Investments Real Estate Investing.

Comments

Post a Comment