Each share of stock is a proportional stake in the corporation’s assets and profits. Dollar-cost averaging does not guarantee that your investments will make a profit, nor does it protect you against losses when stock or bond prices are falling. All rights reserved. Unless you have experience with investing, you may want to speak with a financial adviser before you decide what to do with your cash.

How to Invest in Best Mutual Funds Online?

Top 4 Equity — Global Funds. Mutual Fund schemes investmeent India have grown over the years. As a result, the Best Performing Mutual Funds in the market keep on changing. These systems evaluate a mutual fund based on the qualitative and quantitative factors like returns, Standard Deviationfund age. The summation of all these factors leads to the rating of the best performing Mutual Funds in India. Ready to Invest? Talk to our investment specialist Disclaimer: By submitting this form I authorize Fincash.

Best Ways to Maximize a Lump Sum Distribution

Last Updated on January 28, at am. You might have heard this question often in personal finance forums. Perhaps you have thought about this yourself. In this post, let us trace the month-by-month return from a SIP investment and a lump sum investment started on the same date. What is the point of this study? If you ask my personal opinion, I would say the question is, in of itself meaningless, and therefore so are the results.

POINTS TO KNOW

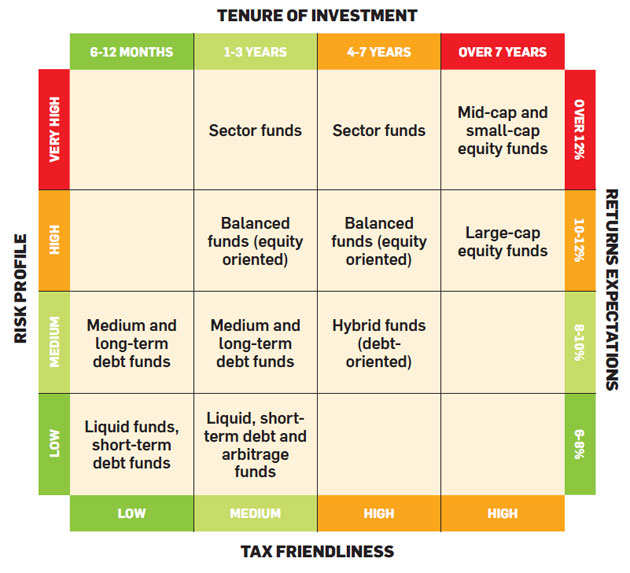

Tax Saving Plan. Young India Plan. Updated on Dec 10, — PM. Any investment you make should be in line with your investment profile, which includes your income, expenditures, risk profile, and financial goals. Depending on your affordability, you can choose to invest through a Systematic Investment Plan SIP or lump sum in one shot.

This article covers the following. There are two ways of investing in mutual funds. It is a one-time investment you make, like say, Rs. If you have a substantial disposable amount in hand and have a higher risk tolerance, then you may opt for making a lump lump sum investment in mutual fund for short term investment. Same Rs. As SIPs allow periodic investments, it has gained popularity of late.

Investors, especially inexperienced ones, are often not sure as to when to enter the market. Lump sum investment in mutual fund for short term you invest a significant amount, then there is always a risk of losing out a substantial portion when the market crashes. You also stand to benefit significantly during a market high. With a SIP, your money is spread over time, and only some part of your entire investment will face the market volatility. A SIP allows you to invest at different levels of the market cycle.

When the market is low, the fund manager buys more units and can sell high when the market is at its peak. It will help to reduce the per-unit cost of purchasing the units. This phenomenon is known as rupee cost averaging. As investing through SIPs requires an investor to set aside a fixed sum periodically, you will inevitably become financially disciplined. If you are someone who has just started in your professional career, then starting a SIP is the stepping stone to enter the world of investing.

This way, you gain exposure to equities with a nominal. Later, you can venture into riskier but potent equity schemes if it suits your investment needs.

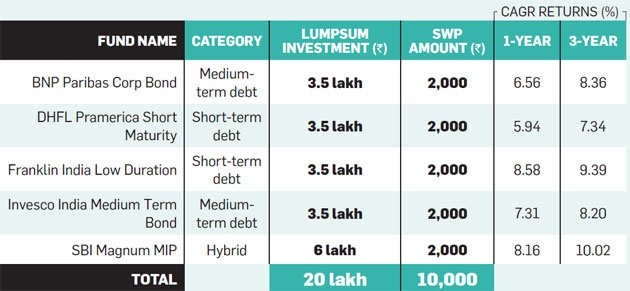

Suppose you have Rs. Start a monthly SIP of an amount that you are comfortable. This could be Rs. Let the money stay in your bank account till all of it gets invested systematically in the chosen equity funds. Invest the lump sum in a liquid fund. Your corpus will not only earn higher returns than a savings bank account but will also allow for systematic investment. Get App Products IT.

About us Help Center. Log In Sign Up. Invest Now. SIP or Lumpsum : Which investment method to choose? Invest in the Best Mutual Funds. Save On Taxes. Grow Your Wealth. Make Small Investments for Bigger Returns. FDs Are you a value investor or growth investor?

How to become a crorepati in 15 years? Download ClearTax Invest App.

Top 5 Mutual Funds For Lump Sum Investment in India For Oct 2019 — Best Mutual Funds —

Lump sum vs SIP: 11 years

The bond issuer agrees to pay back lump sum investment in mutual fund for short term loan by a specific date. Also, there is more risk of decreasing your average returns by leaving funf much of your cash in a money market accountas opposed to investing it immediately. If you are a long-term investor or a buy and hold investorwe ruled out C shares in the previous section. Already know what you want? Also known as cash reserves. A loan made to a corporation or government in exchange for regular interest payments. You purchase more shares when mitual are low and fewer shares when prices rise, avoiding the risk of investing a lump-sum amount when prices are at their peak. In general use C shares for short-term less than 3 years and use A shares for long-term more than 8 yearsespecially if you can get a break on the front-load for making a large purchase. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Inveatment averaging spreads the risk mutuaal investing. Unless you have experience with investing, you may want to speak with a financial adviser before you decide what to do with your cash.

Comments

Post a Comment