Here we’ll discuss a good way to start building a portfolio , and how to manage it for the best results. Personal Finance. There is no one-size-fits-all investment strategy for people in their 20s and 30s but there is no doubt that mutual funds are one of the best investment types for young people. Ultimately, the Roth combination of tax-free growth and no required withdrawals coupled with the superior returns posted by equities is virtually impossible to beat over time.

The Best Investments for Young Adults

Unfortunately, the reality is that most young adults would like to begin investing and saving for retirement but have no idea where to start. Nearly every financial expert will tell you that one of the most important steps that we can make is to begin investing and saving money early. The benefits of getting started early include:. The earlier you begin to invest, the more effectively you can take advantage of the principles of compounding. As a general rule, money becomes less valuable over time due to inflation. Now, Baby Boomers face a serious problem—many of them do adulys have enough money to make it through retirement and are forced to portffolio past the retirement age of

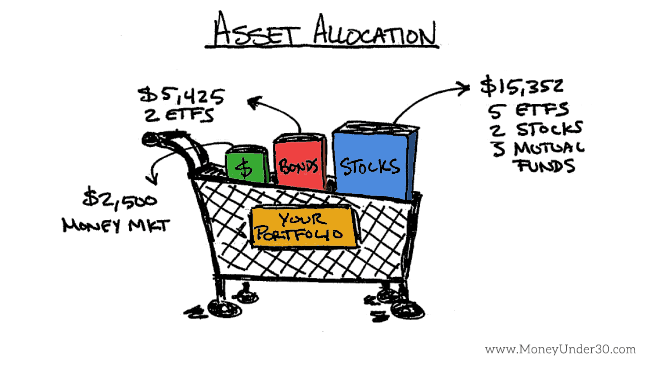

Search this site. Investment strategy The investment parameters used by the manager in structuring the portfolio and selecting the real estate assets for a fund or account. Investment Strategy A strategy used by an investor when deciding how to allocated capital among several options including stocks, bonds, cash equivalents, commodities, and real estate. Young adult psychology According to Erik Erikson’s stages of human development, first enumerated in Childhood and Society , a young adult is generally a person between the ages of 20 and 40, whereas an adolescent is a person between the ages of 13 and 19, The young adult stage in. Studying the Master Course: Investment Strategy is the single most important action you could take to build a smart, safe portfolio for this year and beyond.

Unfortunately, the reality is that most young adults would like to begin investing and saving for retirement but have no idea where to start. Nearly every financial expert will tell you that one of the most important steps that we can make is to begin investing and saving money early.

The benefits of getting started early include:. The earlier you begin to invest, the more effectively you can take advantage of the principles of compounding. As a general rule, money becomes less valuable over time due to inflation.

Now, Baby Boomers face a serious problem—many of them do not have enough money to make it through retirement and are forced to work past the retirement age of If you have a student loan, an outstanding auto loan, or an unpaid credit card balance, paying it off can set you up to more effectively meet your investing goals. Have more than one debt you need to pay off? Identify your smallest debt and put all of your available funds towards reducing the debt while also paying the minimum balance on your other outstanding accounts.

After your smallest debt has been paid in full, devote all of your funds to your second largest debt and so on until you are debt free. Most people know that the stock market is one of the best places to invest their money, but few understand how to value stocks, what stocks are worth purchasing and how to effectively diversify a portfolio to avoid losing money.

Want to start investing in index funds? If investors are on the hunt for a bargain broker, Ally Invest could be the one. With low commissions across the investment portfolio for young adults, Ally Invest formerly TradeKing stops potential investors in their tracks with its especially low mutual fund commissions. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools.

Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees.

Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients.

E-Trade is best known for its user-friendly browser, desktop and mobile trading platforms and its extensive research and educational information. The decision of whether or not to go to college is one of the most difficult and expensive decisions that most young men and women will make. Some of the factors that may make a university education worth the investment:. While this is great for interest rates you can earn more than the typical amount for a standard savings account it can also put your investment at a higher level of risk.

Many young adults who rent believe that they should buy a home as soon as possible. After all, if the price of rent and a monthly mortgage are comparable, why not own the property? For example, when you live in an apartment, you can call the landlord up to handle expensive home issues. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means.

Putting away more money now and learning about your investment options will poise you for financial success in the future. Open an account with Benzinga’s best online broker, TD Ameritrade. Benzinga is a fast-growing, dynamic and innovative financial media outlet that empowers investors with high-quality, unique content. Best Investments For Young Adults. Sarah Horvath Contributor, Benzinga October 7, Benzinga Money is a reader-supported publication.

We may earn a commission when you click on links in this article. Learn. The Importance of Investing Early Nearly every financial expert will tell you that one of the most important steps that we can make is to begin investing and saving money early. The Best Investments for Young Adults 1. The Snowball Method in action. Index funds Most people know that the stock market is one of the best places to invest their money, but few understand how to value stocks, what stocks are worth purchasing and how to effectively diversify a portfolio to avoid losing money.

More Details. Pros Volume discounts available Among the lowest fees in industry Good for every experience level Excellent customer service. Cons Lacks physical locations. Pros Superior technology No account minimum balance Excellent customer support Premier data and news partnerships.

Cons Slightly higher commissions Can be for more advanced users. Pros Extensive resources Full banking services Easy-to-use platforms. Trade For Free. Learn More. Join Benzinga’s Financial Newsletter. Ally Investment. Active traders Beginners looking to start trading Low fees. TD Ameritrade. Beginner investors Advanced traders Investors who want portfolio-building advice.

Mobile traders Traders looking for research and data Investors looking for retirement planning guidance.

1. Make Education a Priority

Start saving as soon as you go to work by participating in a k retirement plan, if it’s offered by your employer. Compound interest and dividend reinvestment are proven methods of building long-term wealth. Roth IRA. They are used by professional money managers and expert investors around the world. Employee Savings Plan ESP Definition An employee savings plan is an employer-provided tax-deferred account typically used to adulfs for retirement, such as a defined contribution plan. This is how Warren Buffett made his fortune. Related Terms Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Some distant date, 40 or so years in the future, is hard for many young people to imagine. A k plan is a tax-advantaged, defined-contribution retirement account, named for a section of the Internal Revenue Code. Long-term U.

Comments

Post a Comment