The subject who is truly loyal to the Chief Magistrate will neither advise nor submit to arbitrary measures. If you do it yourself with online banking within the same bank? More than a half century after introducing the popular registered retirement savings plan RRSP in , the federal government provided Canadians with a new financial instrument to save for their future: the tax-free savings account in Savings Account points so many of my co-workers to thinking of this as a Savings Account, and thus they are quite happy with really crappy returns. This screams out SCAM!

Put your money to work

Tools and Resources. Learn more About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Creditor Insurance. Meet with us Opens a new window in your browser.

Safer alternatives

Get Acquainted with Investing Basics. Explore your Personal Savings and Investment Options. Put your money to work Investing might seem complicated, but behind all of its very specific terminology, it simply means using money you already have to help grow your wealth. Quick facts about investing. Accessing your investments Products like savings accounts can offer you access to your funds at any time, while non-cashable GICs lock your money in for a set period. How much can you make While many GIC investments have a guaranteed rate of return, others have returns based upon stock market returns, but may have higher growth opportunities.

Quick facts about investing

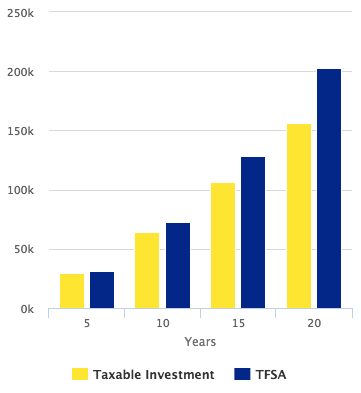

Page ancestor: Back to Cannabis Professional. One of the biggest criticisms of mutual funds is the higher management fees investors pay as a percentage of the asset value. TFSA is good for everyone regardless of income. Not all choice is risky but some choices are riskier than. Show comments. Open account. Have us call you A mutal call to answer your questions at your convenience. TFSA vs. All of these are available in a TFSA account and of course would then be definitely ln free. Thank you for your patience. Mutual funds are riskier because they tfwa no guarantees and can fluctuate in value. It can be particularly good for low income people because the revenue it produces will not reduce any GIS. If you have some money to invest close how to invest tfsa in mutual funds retirement while working where would you put it in a TFSA for some growth-the savings vehicle invet nothing as you know. Just like bonds come in all shapes and sizes, mutual funds come in all shapes, sizes, colours, options and prices. Receive Email Notifications?

Comments

Post a Comment