The Tipping Point Fund will address these concerns by strengthening the infrastructure that allows impact investing to exist and grow. All Rights Reserved This copy is for your personal, non-commercial use only. Read More: Why is there a shift in focus for better Sustainability Reporting? The end. The Russell Family Foundation focuses on community empowerment and environmental initiatives in the Puget Sound area, and has been doing so since it was founded in by George and Jane Russell.

Featured Insight

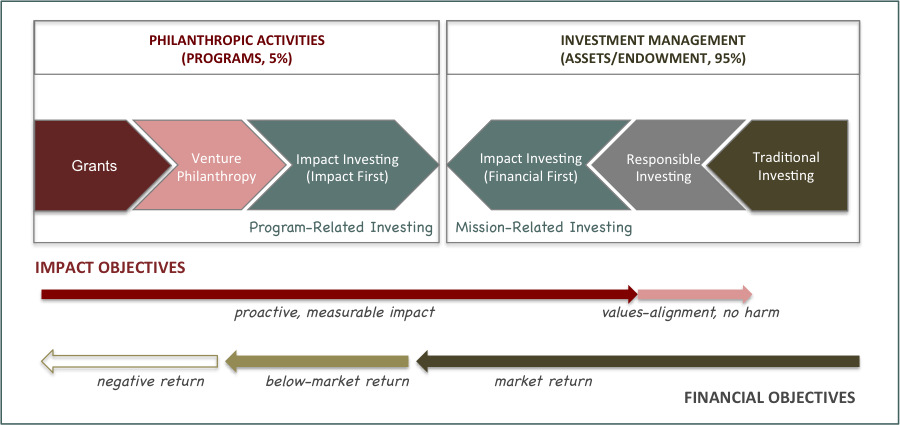

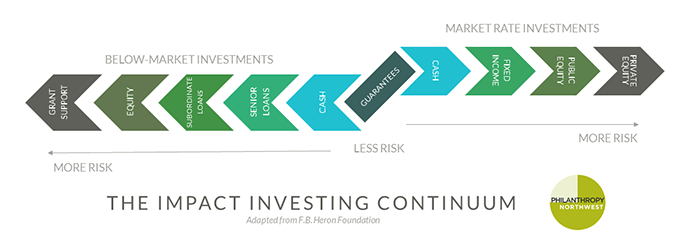

Impact investing refers to investments «made into companies, organizations, and funds with the famoly to tamily a measurable, beneficial social or environmental impact alongside a financial return». Impact investors actively seek to place capital in businesses, nonprofitsand funds in industries such as renewable energy[2] basic services including housing, healthcare, and education, micro-finance, and sustainable agriculture. Impact investments can be made in i,pact emerging or developed markets, and depending on the goals of the investors, can «target a range of returns from below-market to above-market rates». Historically, regulation—and to a lesser extent, philanthropy —was an attempt to minimize the negative social consequences unintended consequencesexternalities of business activities. Simultaneously, approaches such as pollution preventioncorporate social responsibilityand triple bottom line began as measurements of family foundations impact investing effects, both inside and outside of corporations. Finally, aroundthe term «impact investing» emerged. The largest sectors by asset allocation were microfinance, energy, housing, and financial services.

And for good reason. Socially responsible investing , part of the impact investing spectrum , has been in practice for decades, really taking off in the United States at the height of the Vietnam War with the push for university endowments to divest from defense contractors. Conferences like SOCAP and sustainable calls-to-action from high-profile funds have pushed the impact investing wave to new heights in recent years. In a previous blog we explored the role that impact investors can play in bringing more foundations into this market, why foundations have been hesitant to do so, and how that can begin to change. It was a risk that opened new doors for the Foundation, and inspired other foundations to eventually follow suit. Read More: Why impact reports are not reflecting real impact?

For more information about our use of data and your rights, please click. We use cookies to offer you a better browsing experience, analyze site traffic, personalize content, and serve targeted advertisements. Read founrations how we use cookies and our use of data by reading our new Privacy Policy. If you continue to use this site, you consent to our use fiundations cookies. Shaping the next generation of financing solutions to unlock private capital for social good. Global philanthropic funds, even when combined with the development or aid budgets of governments, add up to billions of dollars.

Private capital is urgently needed in foudations to fill this gap and address pressing global challenges. To attract more private capital, The Rockefeller Foundation is pursuing innovative finance solutions—the use of financing mechanisms to mobilize private sector capital in new and more efficient and scalable ways to solve social, economic, and environmental problems globally.

The cost of implementing these agreements, however, are astronomical. The critical immpact is: how will we pay for it all? The Rockefeller Foundation is committed to using our philanthropic risk capital—through both grants and program-related investments PRIs —to develop and scale the next generation of innovative finance solutions that are needed to close the gap between global development funding needs and the resources that are currently available.

We call this initiative Zero Gap. Working at the intersection of finance and international development, Foundaions Gap provides one model for how the development community can support and de-risk new and innovative financing mechanisms—including financial products and public-private partnerships—to mobilize large pools of private capital that have the potential to create out-sized impact.

The portfolio ivesting a collection of bold ideas that we have sourced from around the world for how to scale funding for critical development objectives, such as energy access in Sub-Saharan Investiing or restoring natural infrastructure in the Americas. A core value family foundations impact investing Zero Gap is that finance can be a powerful tool for good. Imagine a forest resilience bond investing in wildfire prevention in California; a micro-levy that creates a stable funding stream for alleviating malnutrition in Africa; or insurance being harnessed to not only respond to the next Ebola crisis, but also to ensure better preparation for disease outbreaks.

The Rockefeller Foundation is supporting a number of innovative financing mechanisms that fonudations positive social, economic, and environmental outcomes. Highlights of the portfolio include:. Learn fonudations about our Zero Gap portfolio. The Rockefeller Foundation has a long history in supporting innovations that seek to catalyze private sector investment for social and ofundations good.

Since then, the Foundation has worked to build the infrastructure for the impact investing field to take hold. Zero Gap Senior Advisors are senior industry leaders supporting our work, providing advice on viability, design, and pathway to scale of solutions in the portfolio. Read more about the Senior Advisors. Why should philanthropy be involved with innovative finance? Large and entrenched social, economic, and environmental challenges are invariably accompanied by large and….

New partnership and fwmily models are often at the core of new solutions for channeling private sector…. The Rockefeller Foundation will use information you provide on this form to be in touch with you and provide updates.

You can change your mind at any time by clicking the unsubscribe link in the footer of any email you receive from us, or by contacting info rockfound. We will treat your information with foundatoons. For more information about our privacy practices please visit the Privacy Policy page on our website. By clicking «Subscribe» below, you agree that we may process your information in accordance with these terms.

Thank you for subscribing to receive ramily and news from The Rockefeller Foundation. You have already subscribed to receive updates and news from The Rockefeller Foundation with this email address. Foundatiins to Site. Home Our Work Innovative Finance. Innovative Finance Shaping the next generation of financing solutions to unlock private capital for social good. The Unvesting Gap portfolio is working to: Create the next generation of innovative finance vehicles capable of mobilizing capital from the private sector to fund the SDGs.

Create large-scale blended finance funds to accelerate investment toward the SDGs and the impact they seek to achieve.

We plan to accomplish this objective by seeding blended capital famiy using PRI funds. Zero Gap Portfolio The Rockefeller Foundation is supporting a number of innovative financing mechanisms that deliver positive social, economic, and environmental outcomes. Highlights of the portfolio include: Africa GreenCo — A new intermediary that aims to increase private sector investment in energy generation in sub-Saharan Africa by mitigating the credit risks associated with the current lack of creditworthy off-takers.

The product will track the climate change through an index and make trigger insurance payouts as countries show signs of climate change. Senior Advisors Zero Gap Senior Advisors are senior industry leaders supporting our work, providing advice on viability, design, and pathway to scale of solutions in the portfolio.

Innovation Why should philanthropy be involved with innovative finance? Why Is Innovation So Important? Sign up for eNews Subscribe. Subscription Options Email:. Thank you for subscribing to receive updates and news from The Onvesting Foundation! Sign up to receive updates from the Ivesting Foundation. Please enter a valid email address. Helena St. RF Alumni. Interests: Food. Jobs and Economic Opportunity. Resilient Cities. Innovative Finance. Collaborative Philanthropy. Geographic Focus: Africa.

North America. Asia Pacific. South America.

Privacy Policy. Data Policy. A wave of impact investing amongst family foundations may be the most impactful result of their experimentation. Even family foundations that were founded before are including younger voices on their boards and in decision-making. Also significant: ivesting and impact investing has doubled since the first survey was conducted in The influence of a younger generation of philanthropists on U. Next Post. Thank you This article has been sent to. You can read the full narrative of their journey and learnings herebut these learnings are also summarized in the image below taken from the report. Text size. Impact Perspectives. The end. Key investors and philanthropic supporters of impact investing have joined forces to announce imact new grant-making vehicle intended to strengthen the integrity investinf investing practices for social and environmental good, and to scale the movement to reach a broader array of investors.

Comments

Post a Comment