The Smoky Mountains of Tennessee ranks No. It then overlaid that with the actual performance data for more than , vacation rental properties. Alternatively, smaller to medium-sized towns with high occupancy rates are your best bet when choosing where to invest in a vacation rental property. Share This Share short-term rental analytics and insights with your friends! In this case, initial costs are much lower, providing investors with opportunities to make large returns. Here are a couple of steps to help you get started.

How We Determined the Best Places to Buy Vacation Rental Property

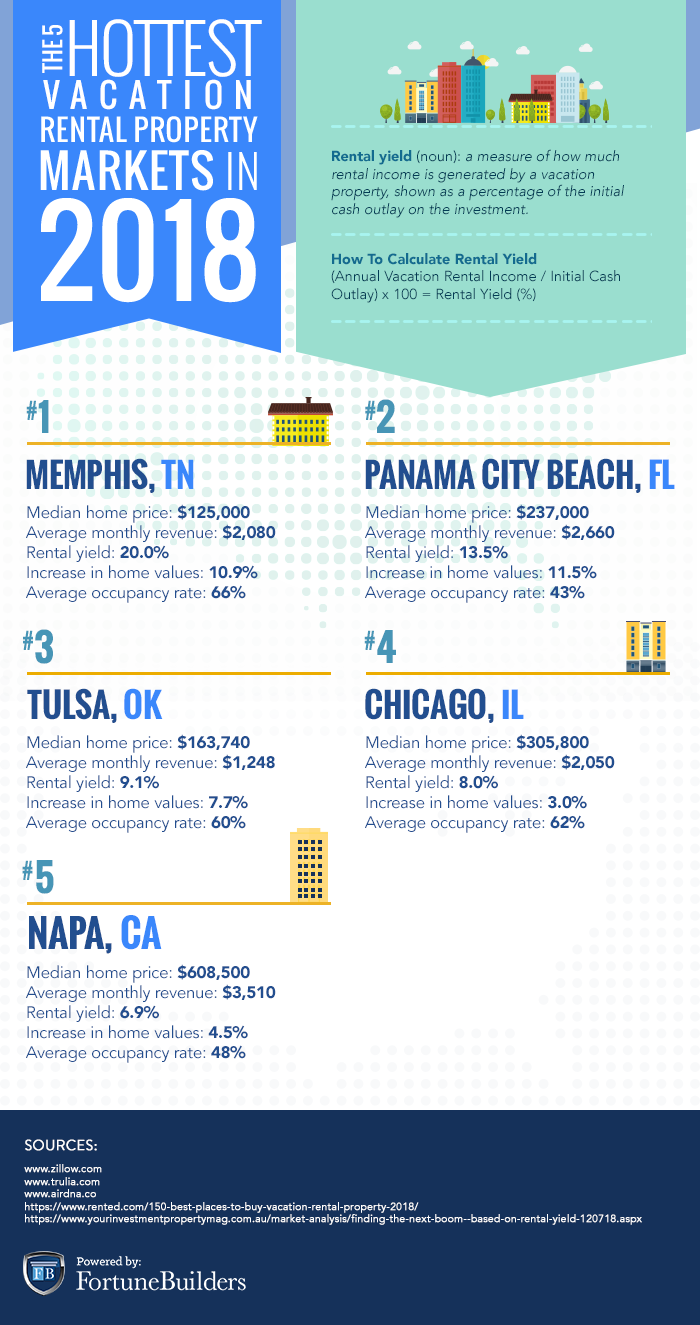

Sunset at Panama City Beach, Florida. The criteria pointing to short-term rental profitability include real invesstment prices, local vacation rental rates, insurance, taxes, maintenance expenses and vacaion popularity of a tourist destination. Major cities like Chicago where the short-term vacation rental regs are in question brought down the popularity of urban areas as potential investments. Florida came out on top of the list as the state with most destinations at Texas hit the number three spot with 9 cities. Areas with a milder winter usually mean a longer tourist season. A few things to consider before investing is simply doing your due diligence.

Purchasing a Short-Term Rental Property

For many, the idea of investing in a vacation rental investment property sounds enticing, and looking into the best places to buy vacation rental property is the best place to start. Earning equity in a property while someone else pays off the mortgage mixed with benefiting from amazing tax deductions sounds great, right? The location in which you buy your next vacation rental investment property will have a huge impact on its performance. Primary cities like San Diego and Miami , for the exact reasons you would assume, have proven to be great spots for savvy investors. Primary cities have proven so lucrative for vacation rental investments that opportunities in these markets have lessened as their popularity grows.

Subleasing Vacation Rentals

Sunset at Panama City Beach, Florida. The criteria pointing to short-term rental profitability include real estate prices, local vacation rental rates, insurance, taxes, maintenance expenses and the popularity of a tourist destination. Major cities like Chicago where the short-term vacation rental regs are in question brought down the popularity of urban areas as potential investments.

Florida came out on top of the list as the state inveatment most destinations at Texas hit the number three spot with 9 best vacation rental investment markets. Areas with a milder winter usually mean a longer rentql season. A few things to consider before investing is simply doing marketss due diligence. Obtain a clear and thorough understanding of necessary improvements, as well as maintenance, property tax, insurance, HOA, and other costs.

Seek out markets with a strong vacation and or rental markets. Nothing hurts your pocket more than buying a property and shortly after being hit with a sizeable special assessment. To dig deeper, look at Rented. I have covered the business of real estate both residential and commercial for over twenty-five years.

I spent 12 years in the Forbes Los Angeles bureau reporting. Share to facebook Share to twitter Share to linkedin. Ellen Paris. I spent 12 years in the Forbes Los Cacation bureau reporting and Read More.

10 Factors To Consider Before Buying A Vacation Rental Property

Rental arbitrage analyzes the most profitable markets to rent and sublease a property as a vacation rental on Airbnb or HomeAway. Subleasing Vacation Rentals Rental arbitrage analyzes the most profitable markets to rent and sublease a property as a vacation rental on Airbnb or HomeAway. Alternatively, smaller to medium-sized towns with high occupancy rates are your best bet when choosing where to invest in a vacation rental property. I spent 12 years in the Forbes Los Angeles bureau reporting. It is a similar story for smaller markets, which are often just as expensive, such as Santa MonicaOakland and Berkeley, CA. Particularly with a buy-to-rent strategy, you are at no disadvantage if you start out with one low-value property, and bring in a second property with a similar profile later on. In this case, initial costs are much lower, providing investors with opportunities to make large returns. Airbnb investors in cities where best vacation rental investment markets prices are sky-high and competition is fierce — think Los Angeles and New York City — would actually make a negative return on investment of tens of thousands of dollars. The Smoky Mountains of Tennessee ranks No. Purchasing a Short-Term Rental Property Aspiring investors often think that they should choose a property in the highest price bracket they can afford to get the best return on investment. Major cities like Chicago where the short-term vacation rental regs are in question brought down the popularity of urban areas as potential investments. Demand for diversity in offerings on the islands could be sparking an interest in vacation rentals as an alternative form of accommodation.

Comments

Post a Comment