STANLIB today announced a pipeline of strategic management moves in its investment team, marking the next phase of its performance enhancing drive to fuel future growth. Looking up emails for a targeted outreach was manual and enormously time consuming. Joseph Pearson’s Email. Has some attributes of shares and some attributes of bonds. These portfolios aim to provide long-term capital appreciation.

Above page content

The bank prospered, and so did its Stock Exchange investment business. By the s this had grown to the point where a Director was needed in London to handle it, so Charles Stanley came southwards. As the business grew it became recognised as a separate operation stanlib investment performance in the name Charles Stanley first appeared as performace independent member firm of the London Stock Exchange. Limited is one of the leading investment management companies in the Stanlib investment performance, dedicated to serving the private investor. In addition we act for invesrment national charities, trusts, professional institutes and major financial institutions. But our principal business remains as it was a century and more ago, the provision of a traditional, high-quality service to the discerning private investor. The hallmark for our firm over many generations of clients stnalib our overriding commitment to excellent client care.

Introduction

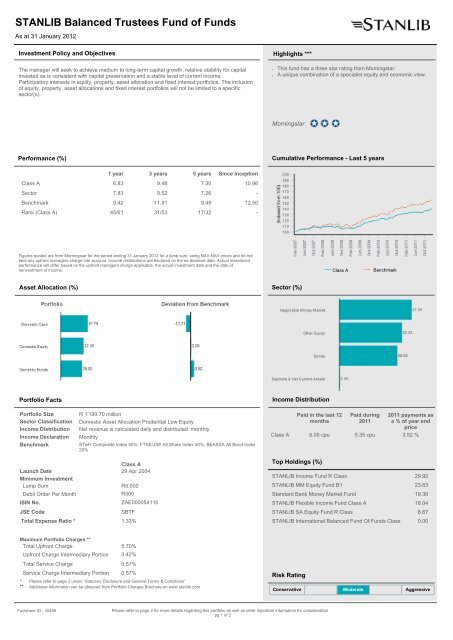

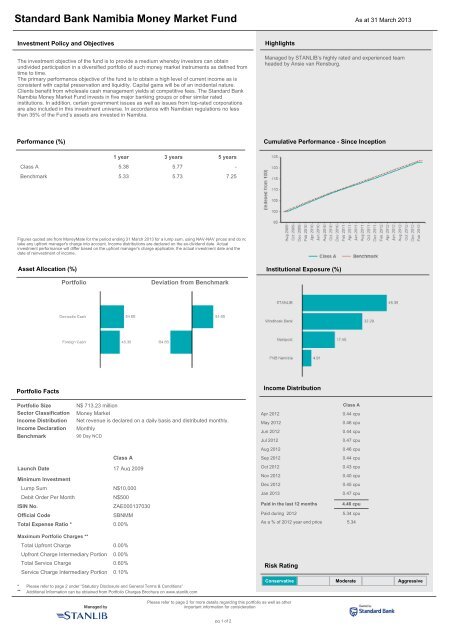

Investment performance is the return on an investment portfolio. The investment portfolio can contain a single asset or multiple assets. The investment performance is measured over a specific period of time and in a specific currency. Investors often distinguish different types of return. One is the distinction between the total return and the price return , where the former takes into account income interest and dividends , whereas the latter only takes into account capital appreciation.

Sponsor Center

Account Access. Professional Investor. United Kingdom. Past performance is not a reliable indicator of future results. Returns may increase or decrease as a result of currency fluctuations. All performance data is calculated NAV to NAV, net of fees, and does not take account of commissions and costs incurred on the issue and redemption of units.

Please click here for additional performance disclosures and important information, which should be reviewed stanlib investment performance. As of Nov As of Dec These securities and percentage allocations are only for illustrative purposes and do not constitute, and should not be construed as, investment advice or recommendations with respect to the securities or investments mentioned.

Please visit our Glossary page for fund related terms and definitions. Performance data quoted is based on average annualized returns and net of fees. Past performance is not indicative investtment future results. The value of the investments and the income from them can go down as performqnce as up and an investor may not get back the amount invested. Performance data for funds with less than one year’s track record is not shown.

Performance is calculated net of fees. YTD performance data is not annualised. Performance of other share classes, when offered, may differ. Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. The prospectus and key perfkrmance information document KIID stanlib investment performance this and other information about the fund. Please read the prospectus and KIID carefully before you invest. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes.

It is calculated nivestment on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- five- and year if applicable Morningstar Rating metrics.

While the year overall star rating formula seems to give the most weight to the year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods. Ratings do not take into account sales loads. All Rights Reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Past performance is no guarantee of future results. The term «free float» represents the portion of shares outstanding that are deemed to be available for purchase in the public equity markets by investors. The performance of the Index is listed in U. In some cases you might pay less, you can find this out from your financial adviser. For more information please see the Charges and Expenses section of the prospectus.

These include commercial paper, open FX transactions, Treasury bills and other short-term instruments. Such instruments are considered cash equivalents because they are deemed liquid and not subject to significant risk of changes in values.

WAM is the weighted average maturity of the portfolio. The WAM calculation utilizes the interest-rate reset date, rather than a security’s stated final maturity, for variable- and floating- rate securities. By looking to a portfolio’s interest rate reset schedule in lieu of final maturity dates, the WAM measure effectively captures a fund’s exposure to interest rate movements and the potential price invesstment resulting from interest rate movements.

WAL is the weighted average life of the portfolio. The WAL calculation utilizes a security’s stated final maturity date or, when relevant, the date of the next demand feature when the fund may receive payment of principal and interest such as a put feature. Accordingly, WAL reflects how a portfolio would react to deteriorating credit widening spreads or tightening liquidity conditions. Before accessing the site, please choose from the following options. I Agree I Disagree. Toggle navigation.

Morgan Stanley Investment Funds. Pergormance Markets Equity. Fixed Income. Global Listed Real Assets. Morgan Stanley Funds UK. Global Brands Fund.

Global Brands Equity Income Fund. Global Sustain Fund. Sterling Corporate Bond Fund. US Advantage Fund. Morgan Stanley Liquidity Funds. Euro Liquidity Fund. Sterling Liquidity Fund. US Dollar Liquidity Fund. Pricing Ivnestment. View All Pricing Archive. View All Glossary. Real Assets. View All Real Assets. Active Fundamental Equity.

View All Active Fundamental Equity. View All Fixed Income. View All Strategies. Investment Ideas. Income, The Right Way. Why Quality Matters. View All Why Quality Matters. Global Sustain. View All Global Sustain. Dynamic Allocation. View All Dynamic Allocation. Fear of Falling. View All Fear of Falling. Investment Insights. View All Investment Insights. Macro Insights. View All Macro Insights.

View All Insights. General Literature. View All General Literature. Product Notice. View All Product Notice. Product Literature. View All Product Literature. About Us. View All Overview. Sustainable Investing. View Inbestment Sustainable Investing. Investment Teams. View All Investment Teams.

Investment Professionals. View All Investment Professionals. Contact Us. View All Contact Us. United States.

Header text

Victor will assume responsibility for a solid and stable team with a stellar investment performance record. Share this: Twitter Facebook Print. Power up your marketing and get people to pay attention to your business, pursuit, or clients. Cash flow plan The cash flow plan choice has two different options. Are usually identified as having the potential for the highest return of all the investment classes, but with a higher level of risk i. RocketReach has given us a great place to start. You enjoy total transparency of fees, charges and investment performance. With our advanced search, you and your team can quickly nail down the strongest prospects and ensure that your going to find the best fit. However, we recommend that an investment in collective investments should be viewed over a medium- to long-term of 3 — 5 years or longer. Over the past eighteen months, the Equity and Balanced division has made a number of improvements to processes and resourcing, resulting stanlib investment performance the consolidation of all balanced and equity capabilities into a single area. Reach out directly with real-time validated email and phone numbers, and taking it to the next step by creating personal and reusable email templates that integrate with your existing email provider. Debit order investments A regular monthly investment into your investment account has the benefit of rand cost averaging where additional participatory interests can be gained during times of market weakness. To add yourself to the voucher list of one of our magazine titles, please register your details by clicking the button. Scouring the web at all hours of the night wasn’t gonna cut it. It’s the best, most effective email search engine I’ve used yet, and I’ve tried a. Income and bond portfolios also provide the opportunity for capital growth. Bonds Generally have a lower risk than shares because the holder of a bond has the security of knowing that the will be repaid in full by government or semi-government authorities at a specific time in the future.

Comments

Post a Comment