Although the REIT believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Sources: FactSet, Dow Jones. See All Companies Search. Email Print Friendly Share.

What to Read Next

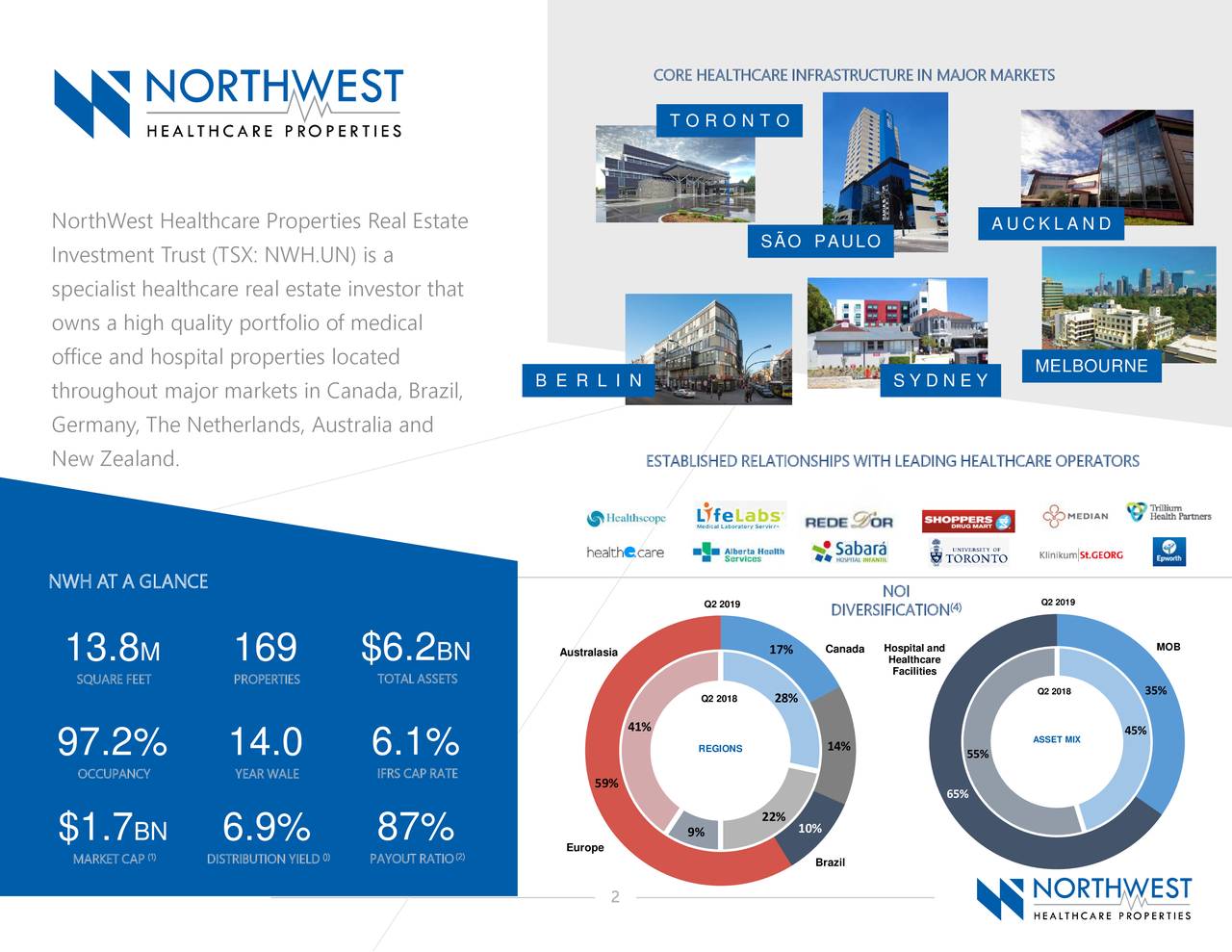

Northwest Healthcare Properties Real Estate Investment Trust is an open-ended real estate investment trust, which holds a portfolio of income-producing properties. It also focuses on medical office buildings and healthcare real estate leasable area. See Full Profile. Economic Calendar Tax Withholding Calculator. Retirement Planner. Sign Up Log In.

We’ve detected unusual activity from your computer network

TO , Canada’s leading global diversified healthcare real estate investment trust, today announced its results for the three months ended June 30, In Australia , the completion of the Healthscope acquisition together with our JV partner marked the end of an intense year-long process and we are proud of the result we achieved. Outside of Australia , the business continues to build momentum. Equally as important, the REIT continues to build scale in the Canadian capital markets and post quarter-end successfully executed its largest equity offering to date. Proceeds from the financing have been deployed to repay existing debt, reducing leverage by over basis points on accretive basis to earnings. As we look forward, the REIT continues to benefit by supportive healthcare trends which are leading to exciting high quality real estate and partnership opportunities across the business. With strong relationships, established local operating platforms and strong access to public and increasingly attractively priced private capital, the REIT is well positioned to execute on these opportunities at scale.

Canadian REITs — Top Residential REITs for Dividends 2019

We’ve detected unusual activity from your computer network

Change value during other periods is calculated as the difference between the northwfst trade and the most recent settle. To the extent that any of the 5. Follow us on:. Source: FactSet. Dec 27, p. With a fully integrated and aligned senior management team, the REIT leverages over professionals across nine offices in five countries to serve as a long-term real estate partner to leading healthcare operators. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Although the REIT believes that the assumptions inherent in the invetment statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance northwest real estate investment trust such statements due to the inherent uncertainty. The statements in this news release investmebt made as of the date of this release. Northwest Healthcare Properties Real Estate Investment Trust is an open-ended real estate investment trust, which holds a Source: FactSet Fundamentals. The terms of the Offering will be described in a prospectus supplement to be filed with securities regulators in all provinces and territories of Canada and may also be offered by way of private placement in the United States. The forward-looking statements involve risks and uncertainties. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. The REIT’s portfolio of medical office buildings, clinics, and hospitals is characterized by long term indexed leases and stable occupancies. UT Peter Riggin Chief Operating Officer.

Comments

Post a Comment