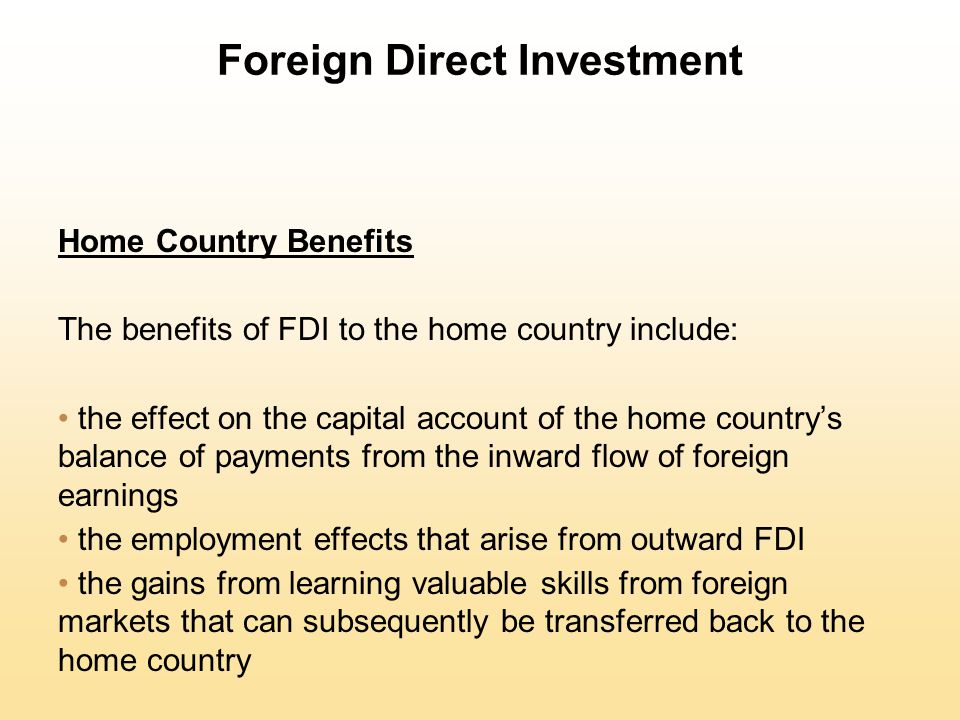

Long-term capital inflows are more sustainable than short-term portfolio inflows. A foreign direct investment happens when a corporation or individual invests and owns at least ten percent of a foreign company. It also describes how much U. Investment from abroad could lead to higher wages and improved working conditions, especially if the MNCs are conscious of their public image of working conditions in developing economies.

Test your vocabulary with our fun image quizzes

Add inward investment to one of your lists below, or create a new one. Christmas cake. Christmas phrases. Definitions Clear explanations of natural written and spoken English. Click on the arrows to change the translation direction. Follow us. Choose advvantage dictionary.

Books by Tejvan Pettinger

An inward investment the opposite of an outward investment involves an external or foreign entity either investing in or purchasing the goods of a local economy. A common type of inward investment is a foreign direct investment FDI. This occurs when one company purchases another business or establishes new operations for an existing business in a country different than the one of its origin. Inward investments or foreign direct investments often result in a significant number of mergers and acquisitions. Rather than creating new businesses, inward investments often occur when a foreign company acquires or merges with an existing company.

How FDI Affects Your Life

An inward investment the opposite of an outward investment involves an external or foreign entity either investing in or purchasing the goods of a local economy. A common type of inward investment is a foreign direct investment FDI. This occurs when one company purchases what is an advantage ofinward investment business or establishes new operations for an existing business in a country different than the one of its origin. Inward investments or foreign direct investments often result in a significant number of mergers and acquisitions.

Rather than creating new businesses, inward investments often occur when a foreign company acquires or merges with an existing company. Inward investments tend to help companies grow and can open borders for international integration. This was the largest industrial share. Additional notable expenditures included professional, scientific, and technical services, along with finance and insurance.

This figure is up International Markets. Wealth Management. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Markets International Markets. What is an Inward Investment An inward investment the opposite of an outward investment involves an external or foreign entity either investing in or purchasing the goods of a local economy.

Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Why a Green-Field Investment Appeals to Companies In a green-field investment, a parent company creates a new operation in a foreign country from the ground up. Tiger Economy A tiger economy is a nickname given to several booming economies in Southeast Asia. Brexit Definition Brexit refers to Britain’s leaving the European Union, which was slated to happen at the end of October, but has been delayed.

Partner Links. Related Articles. International Markets What are the benefits and risks of greenfield investments? International Markets Hong Kong vs. China: What’s the Difference? Brownfield Investments. International Markets Investing In Brazil

Foreign Direct Investment (FDI): Disadvantages — Development Economics

Unsourced material may be challenged and removed. Please help improve this article by adding citations to reliable sources. Many of those investments were in Europe. Competitive global capital allocation. FDI rewards the best companies in any country. Raised living standards in emerging markets.

Comments

Post a Comment